I was reminded that 70% of the US economy is propelled by consumers, all consumers. Last night, after giving a speech to some UC Berkeley econ students, I was in a book store and the gal in front of me asked the clerk, "Do you have a book on 'Karmageddon'? Its like, when everybody is sending off all these really bad vibes, right? And then, like, the Earth explodes and it's like, a serious bummer." Berkeley is eternal.

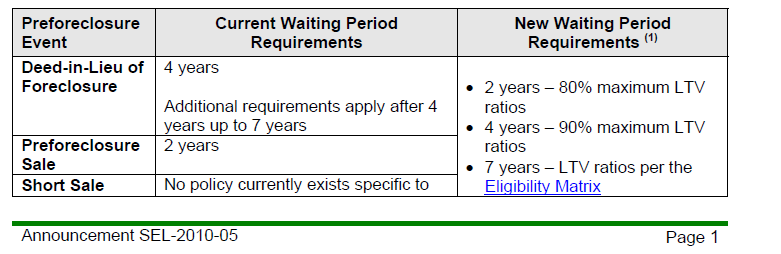

In what many view as big news, Fannie Mae adjusted its underwriting criteria for borrowers who have experienced a "preforeclosure event". This term encompasses preforeclosure sales, short sales, or deeds-in-lieu of foreclosure. Starting in July, Fannie has changed the waiting period after the event and based it on the LTV for the transaction and any extenuating circumstances. In addition, Fannie Mae is updating the requirements for determining that borrowers have re-established their credit after a significant derogatory credit event. Basically borrowers have less time to wait if the LTV is low.

HERE IS THE BULLETIN. Below is a table of the changes.

In an interesting move, HUD Secretary Shaun Donovan announced that Ginnie Mae plans to allow lenders to securitize single loans starting in July. What does that mean? Well, for one, it would allow smaller lenders to access Ginnie Mae and the FHA directly, and therefore receive its guarantee for securitized loans on single loans. Selling loans to large lenders has been an efficient strategy for smaller lenders, but the approach prevents them from servicing those mortgages and getting the best possible return when the loans are subsequently sold to investors. The process of securitizing loans sounds good, but it has its own set of complications - it will be interesting to hear if this program becomes popular.

The Federal Reserve released its Beige Book economic report and provided us with some anecdotal information on the state of the US economy. Overall economic activity increased in nearly all parts of the country, with many districts reporting increased activity in residential housing markets, but commercial real estate is still weak. Any drive through downtown "Anywhere, USA" shows a large number of "For Sale", "For Rent" and "For Lease" signs. The increase in the residential sector spanned across almost every district except St. Louis, where it was mixed, and San Francisco, where it was flat. However, there is concern in many districts - notably, Philadelphia, Cleveland and Kansas City - where sales are feared to be impacted by the impending expiration of the first-time homebuyer tax credit. Home prices were stable across most districts, with decreases experienced in the New York and Atlanta districts. In addition, the New York, Kansas City, Dallas and San Francisco districts noted sluggish sales for high-end homes. In new residential construction, activity increased slightly in New York, Atlanta, St. Louis, Minneapolis and Dallas, but remained weak in Cleveland, Chicago and San Francisco.

CitiMortgage weighed in on some GFE and HUD-1 updates (yes, that dreaded abbreviation "RESPA"). The company reminded clients, as other investors have, that every loan sold to it "comes with your representation and warranty as to compliance with RESPA regulations and any other federal, state or local law, rule or regulation governing the origination of consumer residential mortgages. Every Correspondent is responsible for its own compliance." That being said, during the pre-purchase review process, CitiMortgage will compare the fees and terms on the Final GFE to the fees and terms on the comparison tables of the Final HUD-1 to make sure they match exactly. If the HUD-1 needs correction, Citi will suspend the purchase until extensive corrective steps are taken. Citi's bulletin goes on to list criteria that lenders should probably already know, and although probably all of them are on the "Frequently Asked Questions" site its clients are best advised to view Citi's bulletin for exact details.

RealtyTrac, whose press releases never seem to bring good news lately, reported that 1st quarter foreclosure action on 932,000 properties was up 16% from a year ago and was up 7% from last quarter. Nevada residents can continue to chant "We're #1, we're #1" with the 13th straight month of leading the nation in its foreclosure rate: 1 in every 33 housing units in the state was subject to a foreclosure filing. Arizona was #2, Florida #3, and ten states accounted for 70% of the overall activity. California had 216,000 properties subject to a foreclosure notice and accounted for 23% of the nation's total. Yipes!

PHH Mortgage apparently sees a need (or desire) by smaller companies to service loans, and therefore has rolled out subservicing to small and midsized institutions, such as community banks, credit unions and mortgage investors. Its press release makes a point of stating that the platform can accommodate "the servicing of any single-family residential mortgage portfolio acquired from the Federal Deposit Insurance Corp. (FDIC) under a loss-sharing agreement" - truly a sign of the times.

So after hitting their highest levels in quite some time, 10-yr yields sank back down to their lowest levels since March after the CPI proved to be tame (and when was the last time inflation wasn't tame?) and Retail Sales were as expected. The bond market, however, in a blatant attempt to be spooked at anything, sold off after the text of Federal Reserve Chairman Ben Bernanke's testimony before a congressional committee didn't repeat that "interest rates will remain low for an extended period". Mr. Bernanke noted a modest recovery in the U.S. economy, which sounds pretty obvious, although weak construction spending and high unemployment are major hurdles, and at some point in the perhaps-not-so-distant-future the Fed will be selling its MBS holdings. In fact, Richmond Fed Lacker said the U.S. economy will probably expand at a moderate pace for the rest of this year as spending by consumers and businesses picks up.

The Greek situation is becoming more complicated. Greek bonds are back to the lows in pricing, high in rates, in spite of the billions worth of backing they received. The 10-year Greek bond versus German bund spread widened to 426 basis points on Thursday, which roughly the same as the old spread between prime and subprime borrowers here in the US five years ago.

This morning, and today, we're looking at a fair amount of news. Initial Jobless Claims came out at 484,000, up from 460,000. There were 4.64 million continuing claims, and the four-week moving average rose by 7,500 to 457,750. And the April Empire Manufacturing data rose slightly. Regarding mortgages, for the second consecutive day yesterday mortgages closed the day at their worst levels of the session. Equities finishing at the highs, a late surge of originator supply, hedge fund selling, and minimal buying interest have impacted spreads. Traders reported that buyers did not step into the market on material weakness in mortgage spreads. This morning the yield on the 10-yr is at 3.88% and mortgage prices are worse by about .125.

A group of 40-year-old buddies discuss and discuss where they should meet for dinner. Finally it is agreed upon that they should meet at the Gasthof zum Lowen restaurant because the waitress's there have low cut blouses and nice "chests".

10 years later, at 50 years of age, the group meets again and once again they discuss and discuss where they should meet. Finally it is agreed that they should meet at the Gasthof zum Lowen because the food there is very good and the wine selection is good also.

10 years later at 60 years of age, the group meets again and once again they discuss and discuss where they should meet. Finally it is agreed that they should meet at the Gasthof zum Lowen because they can eat there in peace and quiet and the restaurant is smoke free.

10 years later, at 70 years of age, the group meets again and once again they discuss and discuss where they should meet. Finally it is agreed that they should meet at the Gasthof zum Lowen because the restaurant is wheel chair accessible and they even have an elevator.

10 years later, at 80 years of age, the group meets again and once again they discuss and discuss where they should meet. Finally it is agreed that they should meet at the Gasthof zum Lowen because that would be a great idea since they have never been there before.