Overseas markets are in sell-off mode with England’s FTSE 100 falling 2.08% and Germany’s DAX dropping 1.64%.

The biggest data news overnight was a weaker-than-anticipated reading for the China’s manufacturing PMI, which came in at 53.9 in May, down from 55.7 in April.

“Markets are concerned that tightening measures in China will slow growth in the economy that is critical for commodity prices and cyclical sector sectors of the equity market, and this number certainly doesn’t help already fragile sentiment,” said economists at BMO Capital Markets.

Two hours before the opening bell, Dow futures are down 115 points to 10,011 and S&P 500 futures are off 14.20 points to 1,074.30.

Commodity prices are mostly under pressure, with WTI crude oil down $0.29 to $74.20 per barrel. By contrast, Spot Gold is up $3.90 to $1,220.10, benefitting from a flight to safety.

Also, the euro is down 1.43 cents against the dollar at $1.2162.

More broadly, the U.S. dollar index is up 75 basis points to 87.34 ― its highest level since March 2009.

Key Events This Week:

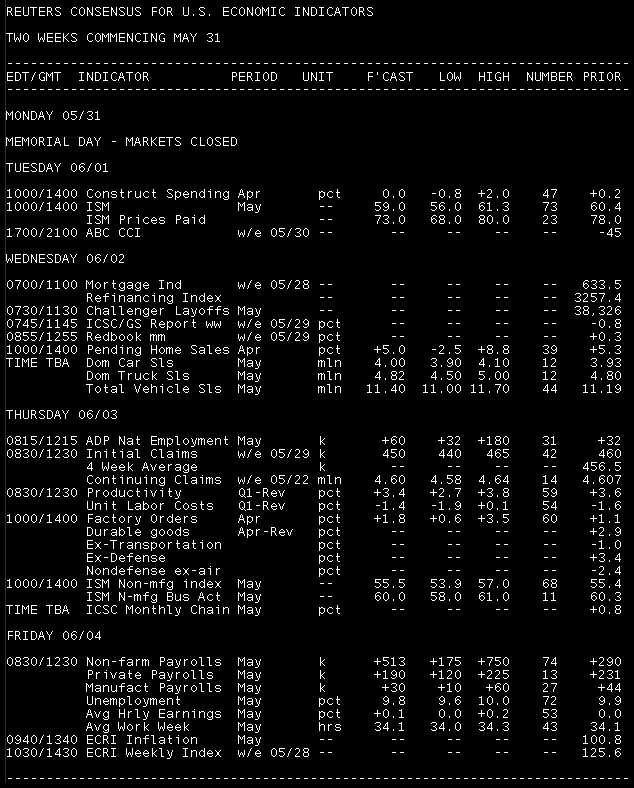

Tuesday:

10:00 ― The ISM Manufacturing Index hit a six-year high of 60.4 in April, marking the ninth straight month of expansion. In May, the index is set to continue at robust levels, but the consensus is for a slight moderation to 59.5. Predictions for the loss of momentum are based on regional indexes, particularly with the Empire State survey seeing a sharp drop early in the month, but the broader picture is still one of steady growth.

“The employment sub-index, which hit a three-year high in April, is expected to show manufacturers are still hiring, and will be watched closely for any clues on Friday’s payroll report,” said economists at BMO Capital Markets. “Export orders, which are sitting near a two-decade high, could see some downward pressure in the face of the recent rally in the U.S. dollar.”

Economists at BBVA added: The ISM may fall back to 59.9 from 60.4, but the level will still remain above the historical average of 52.0. A positive surprise in this index would be a good sign that business spending is firming in 2Q10 and strengthen the Fed’s view of sustainability in the recovery.”

10:00 ― Continued weakness is the anticipated theme for April’s Construction Spending report. The index is expected to be flat overall, following a 0.2% uptick in March and a dramatic 2.1% fall in February. The market will be looking at the survey’s details: non-residential and multi-family construction has been pulling the numbers down, while single-family construction could remain robust.

“The construction industry is still stuck in recession, but an upturn in building activity of single homes may show some improvement in April,” said economists at Nomura. “Spending on single-home construction in the private sector gained for a tenth straight month in March. However, non-residential construction has been shrinking due to excess stock of commercial properties and budget cuts by state and local governments. On a net basis, construction spending is likely to rise slightly in April.”

Treasury Auctions:

- 3-Month Bills

- 6-Month Bills

Wednesday:

10:00 ― The Pending Home Sales Index rose 5.3% in March and 8.3% in February. The strength will likely extend into April as the last-minute homebuyers jumped into the market before the government tax-credit expired at the end of the month. The bigger question is how sales hold up the following month.

Treasury Auctions:

- 4-Week Bills

- 52-Week Bills

Thursday:

7:30 ― Dennis Lockhart, president of the Atlanta Fed, speaks to the economic outlook at the Atlanta Technical College Business & Industry breakfast.

8:15 ― The ADP Employment Report tries to be the number one tool in predicting changes in the nonfarm payrolls employment report, but during the recession it has not been too helpful. Economists at TD Securities noted last month that the survey has been off “by a whopping 100k,” on average, for the past five months. Still, the broader trend tends to be on track with payrolls and economists sometimes revise their payroll estimates based on its results. No predictions are available for the May survey, but in April the index suggested 32k private jobs were created in April.

8:30 ― After months of watching Initial Jobless Claims steadily fall, the index then stalled from March to May, with weekly claims ranging from 442k to 480k. The four-week average is currently 457k, suggesting little or no growth in the labor markets, where in March it was 448k. For the final week of May, economists hope to see a 450k level, but there are no guarantees.

“Although the business sector has started to create new jobs on a net basis, initial claims have remained in the range of 440k-480k since February,” said economists at Nomura. “We expect the erratic but gradual downward trend in claims to continue.”

8:30 ― Revisions to the first-quarter Productivity & Costs report are expected to pull down productivity from +3.6% to +3.4%, while unit labor costs are anticipated to change from -1.6% to -1.3%. The changes should be in line with GDP revisions which downgraded growth by two-tenths to 3.0%, but whatever the exact numbers, the trend is broadly the same ― productivity has been rebounding while labor costs continue to be slashed.

10:00 ― The ISM Non-Manufacturing Index has been at a four-year high of 55.4 for the past two months, and in May the index should expand even more at a predicted 55.9 level. The index, which covers the financial, construction, and services industries, has been lagging its manufacturing cousin index, but its recent levels have been suggestive of broad and steady growth in the economy.

Economists at BMO Capital Markets expect markets to focus on the report’s employment numbers.

“The employment sub-index will likely climb above 50 for the first time since December 2007 ― not coincidentally the start of the recession ― playing catch-up with private-service-sector payrolls which have already been growing for four months,” they wrote.

Meantime, economists at IHS Global Insight said that freight activity has been speeding up while order volumes overall are climbing.

11:00 ― Treasury announces the terms of next week's 3 year, 10 year, and 30 year auctions.

1:15 ― Thomas Hoenig, president of the Kansas City Fed, speaks to the Bartlesville (Oklahoma) Chamber of Commerce.

Friday:

8:30 ― The month’s most important data report, the Nonfarm Payrolls Employment Situation report, is expected to bring good news to financial markets with more than half a million jobs created in May. This will be the fifth straight month of jobs growth in the economy, in part due to Census hiring, which created hundreds of thousands of new jobs. In April the survey reported that 290k jobs were created in the month ― the most in four years ― while 230k jobs were created in March. For May, a poll among economists points to 540k new jobs, with predictions ranging from 225k to 635k.

“We are assuming 330,000 temporary Census hires by the federal government, 20,000 jobs lost in state and local government, and 170,000 added in the private sector,” said economists at IHS Global Insight. “The private sector figure is the one to watch. A gain of 170,000 jobs would be less than the 231,000 jobs added in April, but still enough to preserve the gradual upward trend in the labor market.”

Despite such robust growth, the unemployment rate should fall just one-tenth to 9.8%, in part because as more people get jobs, more begin to look for work, causing the pool of ‘unemployed’ to remain stubbornly high.

“The labor market is expected to gain momentum in May as job creation accelerates in the private sector and the Census adds additional temporary jobs,” said economists at BBVA. “Nevertheless, the unemployment rate is expected to remain at 9.9% due to an influx of new labor market participants as formerly discouraged workers resume their job search. Consumers have been reacting well to the payroll data, so a positive surprise in this report could significantly boost consumer confidence and consumer spending.”

Lastly, Ian Shepherdson from HFE said the survey is unpredictable.

“We’re guessing payrolls will jump by about 500k as hiring for the Census accelerates, but just about anything could happen. Private payrolls should rise about 150k, and we expect April’s 231k private number to be revised down.”

9:30 ― Dennis Lockhart, president of the Atlanta Fed, speaks on the economic outlook and banking to the Alabama Bankers Association annual convention in Braselton, Georgia.