I have done this once before and got great feedback. Let me know if you found this recap useful.

The Federal Open Market Committee (FOMC) met for a one day meeting on Tuesday. The FOMC is the branch of the Federal Reserve that dictates domestic monetary policy. The FOMC statement held no surprises, only a few alterations were made to the text of the release. The Board reiterated that economic conditions warranted exceptionally low rates for an "extended period". There were two changes made that relate to housing. First, the Fed inserted a few words that imply there is good reason to be concerned about the health of housing, stating: "Housing starts have been flat at depressed levels". Secondly, the verbiage referring to the MBS Purchase Program, which is scheduled to run out of funding at the end of March, added what may be a door to re-open the program in some capacity down the road. READ MORE

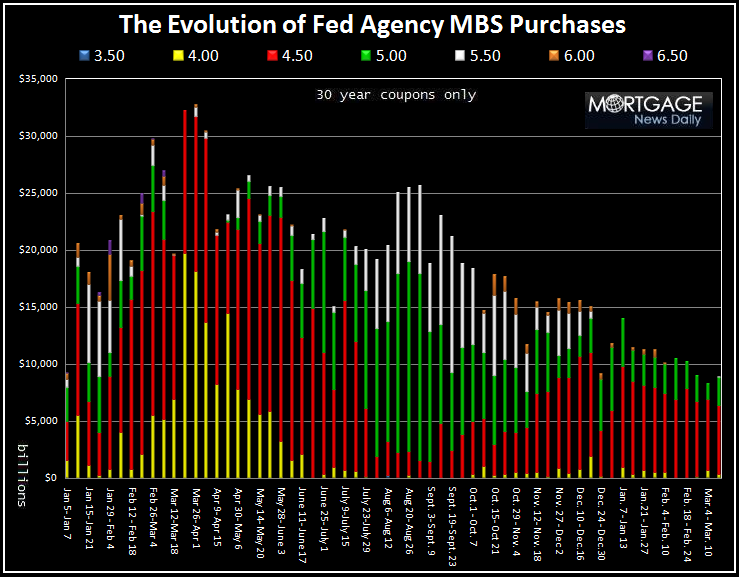

Speaking of the Federal Reserve's agency MBS program, with 10 days left in the program, there is now only $14.1 billion in funding remaining. A total of $1.236 trillion has been spent by the Fed in the agency MBS market, or 98.9 percent of the allocated $1.25 trillion. I do not expect an extension of the MBS program on April 1. If anything, the Fed will let the market function on its own and react if necessary. READ MORE

In that same regard, bearish bond market/housing related comments from influential financial analyst Meredith Whitney made waves in the market this week. In an CNBC interview, she correctly called attention to the fact that the macroeconomic recovery is largely dependent on the health of housing. She expressed concerns that housing will take another dip as shadow inventory has distorted equilibrium supply and demand...which I cannot argue with but happen to think it is in most bank's best interests to offer REO in a slow and steady manner. Whitney went on to state that both Treasuries and mortgage-backed securities are due "material corrections" when the Fed exit's the MBS purchase program. READ MORE.

I posted a very clear explanation as to why we do not think rates will skyrocket when the Fed exits the TBA MBS market. I know its a bit long, but I believe it covers all necessary bases and provides a firm foundation to formulate your own opinion. IT'S A MUST READ

Last Friday the Treasury and HUD released their monthly HAMP update. We learned, at the end of February, 168,708 homeowners had graduated from the HAMP trial modification program and have been granted permanent loan modifications. This works out to a 12.4 percent conversion rate, a modest improvement from January when the permanent modification conversion rate was 9.2 percent. 57.4 percent of these permanent loan mods were made to borrowers who are out of work or underemployed. READ MORE

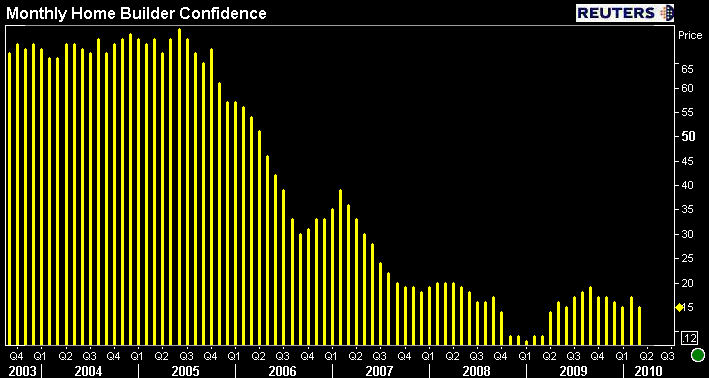

The National Association of Home Builders released their monthly Housing Market Index (Home Builder Confidence). The NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” In March, home builder confidence fell 2 points to a read of 15, returning the index to where it sat in January. From the chart below, it is obvious that builder confidence has failed to maintain the momentum generated by the expiration of the home buyer tax credit. The index sits near a record low. READ MORE

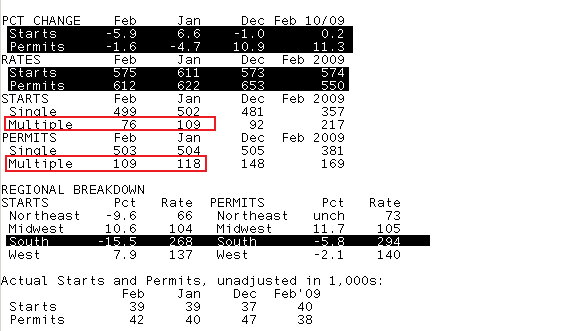

The U.S. Census Bureau and HUD reported that Housing Starts fell 5.9 percent in February while Building Permits declined at an annualized rate of 1.6 percent. The majority of weakness in both housing starts and building permits was noted in multi-family housing, not the larger single-family series. Regionally, only the West saw month over month improvements in housing starts, while the Mid-West reported an uptick in permits. Many economists expect the combination of warm weather and the soon to expire home buyer tax credit to contribute to a rise in building activity over the next 45 days. READ MORE

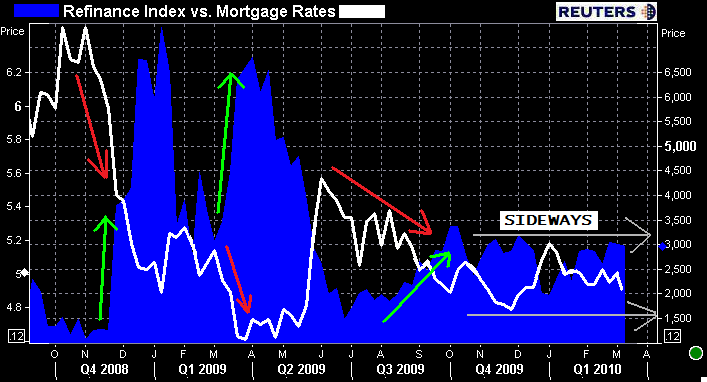

Mortgage applications were marginally lower but essentially unchanged in the week ending March 12, 2010. The Market Composite Index, a measure of mortgage loan application volume, decreased 1.9 percent. The Refinance Index fell 1.7 percent and the Purchase Index inched 2.3 percent lower. Regardless of low rates, loan demand continues to stagnate. I asked if this concerned you and got mixed answers, with originators who write loans in major metro areas providing optimistic outlooks while others reiterated how tough this industry is to operate in at the moment. The correlation between low rates and strong loan demand has clearly faded though. Purchases will drive business in the year ahead (we hope) READ MORE.

Just one day shy of the second anniversary of the Bear Stearns collapse, Senator Christopher J. Dodd (D-CT), chairman of the Senate Banking Committee, released his long awaited proposal to overhaul the nation's financial regulations. The changes, viewed by many as the most sweeping since the Depression, are apparently backed by the Obama administration. The bill, named Restoring American Financial Stability, establishes a Consumer Financial Protection Bureau, creates a Financial Stability Oversight Council, and the Office of Financial Research. Of particular note, the legislation requires firms (bank and non-bank) who sell securitized products like mortgage-backed securities, to retain at least 5 percent of credit risk to ensure the underlying loans are of high quality. READ THE RECAP and THE REACTION

Interest Rates

The Treasury announced the terms of next week's debt auction. This was the most influential event of the week in the bond market. Treasury will sell $118 billion in coupon supply next week. $44 billion 2yr notes on Tuesday. $42 billion 5s on Wednesday, and $32 billion 7s on Thursday. The short end of the yield curve suffered the most from this announcement. This make sense because the majority of auction supply is concentrated toward shorter maturity Treasury coupons. READ MORE

The 3.625% coupon bearing 10 year Treasury note is ending the week basically where it began. Yields fell over the course of the week but failed to maintain positive progress.

The same story can be told for current coupon mortgage-backed secutities as the "rate sheet influential" Fannie Mae 4.5 MBS coupon is ending the week where it started. The secondary market current coupon, essentially the MBS yield lenders use to derive par mortgage rates after servicing and guarantee fees, went out at 4.355%. (Add about 50bps for best 30 year fixed mortgage rates).

The same thing cannot be said for consumer borrowing costs. Mortgage rates are higher today compared to last Friday, albeit only 0.125%. READ VIC'S COMMENTARY

Other Relevant Economic

Data, Events, Stories, and Perspective

- Fannie Mae Cut Their New Home Sales and Origination Outlooks Again.

READ MORE

- GMAC Hired Goldman Sachs to Start the Process of Selling RESCAP. READ

MORE

- Foriegn Demand for U.S. Treasuries is Still Strong. This Helps Mortgage Rates Remain Low. READ MORE

- Raising Capital to Help Grow Your Mortgage Operation. READ MORE

- Producer Level Inflation was Muted in February. Gasoline Prices Led the Way Lower. READ MORE

- Consumer Level Inflation was Tame in February. Gasoline Prices Dip. READ MORE

- The FHLB of San Francisco Sued Nine MBS Securities Dealers. READ MORE

- Rumors Circulated that the Fed was Planning On Hiking the Discount Rate Again. READ MORE

- Fannie Mae Published More Details on Delinquency Buyouts.Appeasing Prepay Risk Fears for Super Premium MBS Coupons. READ MORE

- The FDIC Sold $1.3 billion in Non-Agency MBS. Demand was Robust. Cash Flows are Backed by the FDIC. READ MORE

- What is Right About the Mortgage Industry. READ MORE

- Rob shared several lender updates and bulletins on Pipeline Press

- Discussing the Attributes of Successful Mortgage Operation Leadership. READ MORE

- The Cost of Labor in the Mortgage Market. READ MORE

- Shortening the Short Sale Timeline: Broker Price Opinions. READ MORE

Have a great weekend. Good luck with your brackets.