Inflation data has hit screens. The Consumer Price Index was UNCHANGED in February (+0.0018)...this is cooler than consensus forecasts which called for a 0.1% gain. The CORE CPI print, which strips out food and energy, rose 0.1% in February---on the screws. Year over year, the consumer price index is up 2.1%, slightly below economist expectations for a read of +2.3%. Ex-food and energy, consumer price levels were up 1.3% YoY.

GASOLINE was a big contributor to weakness...don't expect that category to be so helpful next month---gas prices have been on the rise lately. Housing prices were all unchanged. Overall, another round of tame inflation data.

Jobless Claims data was also released.

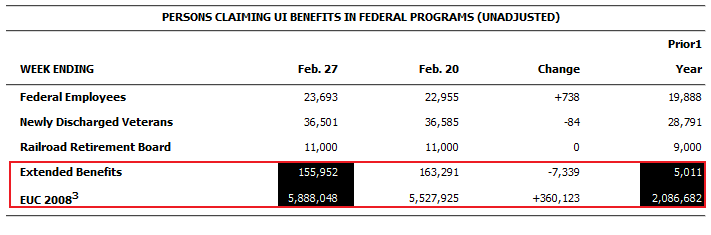

New claims fell by 5,000 to 457,000 in the week ending March 13. This is slightly worse than consensus forecasts which called for 455,000 new jobless claims. The four week moving average of new unemployment benefit claims fell to 471,250 from 475,500 in the previous week. Continued Claims rose to 4.579 million from 4.567 million in the previous week (revised higher from 4.558 million). This was worse than estimates for 4.54 million.

Emergency/Extended Benefits rose by 352,784 to 6.044 million. Compare that to 2,091,693 one year ago. THIS IS A RECORD HIGH.

The BLS noted no seasonal distortions in the data...like bad weather.

Here is a recap:

Below is a table of individual states with an increase or decrease of more than 1,000 new claims (unadjusted). Notice what industry is listed repeatedly: CONSTRUCTION

PLAIN AND SIMPLE: Inflation data was dovish, supportive of exceptionally low Federal Reserve interest rate policy for an "extended period". Jobless claims were worse than expected and still stubbornly high. A lack of job creation is evident via the growing use of emergency unemployment benefits (at a record high).

This all seems bond bullish and stock bearish right?

Well..the 10 yr note yield initially fell a few bps in an attempt to take out the overnight yield low, but that test failed and positive progress was quickly capped by profit taking. The 10 year note is now -0-02 at 99-26 yielding 3.649%....still holding onto yesterday's gains.

The FN4.5 played follow the leader with its benchmark big brother. After an initial knee jerk move higher in price, positive progress reversed course and we are now sitting at the lows of the day. The FN 4.5 is currently -0-01 at 101-02 yielding 4.377%. The secondary market current coupon is 4.327%. The current coupon yield is 67.8bps over the 10 year TSY note yield and 65bps over the 10 yr swap.

Prices have broken out of the originator friendly trend channel but 101-02 should act as support into this downtrade.

Contrary to how one might expect the market to react to two sets of bearish data, stocks are not losing their luster (portfolio managers are chasing index returns thanks to gains in large cap stocks). The S&P is basically unchanged at 1166. The DXY (dollar index) is +0.49%. Oil prices are attempting a rebound rally after an overnight retracement..

In regard to rates...while we have given back a portion of recent improvements, there is a layer of support under the market. Now we wait and watch for buying at the lows....

REPRICES FOR THE WORSE AT 101-00. REPRICES FOR THE BETTER AT I AM NOT SURE YET.

NEXT EVENT: LEADING INDICATORS AND PHILLY FED AT 10AM