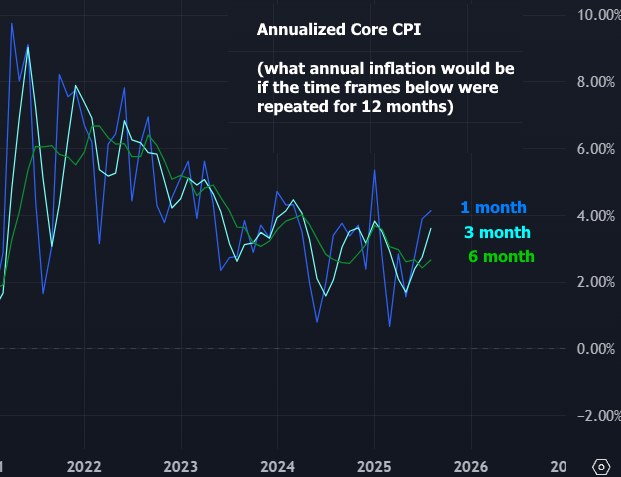

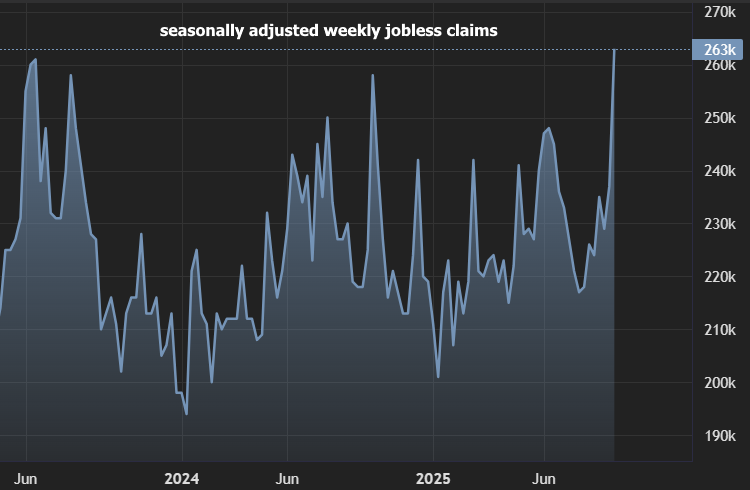

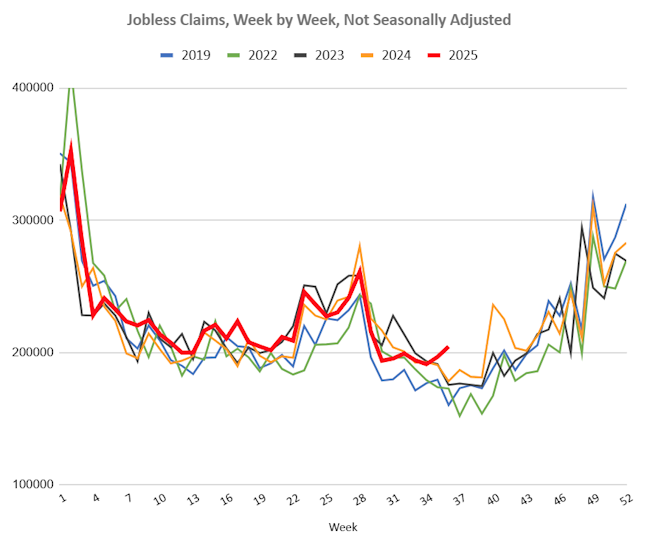

It's an interesting morning for economic data and the bond market's reaction. At face value, CPI was mostly in line with forecasts, but unrounded numbers were a bit hot (i.e. core monthly CPI was 0.346%, almost high enough to make for a 0.4 vs 0.3 reading). Additionally, monthly headline inflation was 0.4 vs 0.3. These numbers, in and of themselves, wouldn't seem to suggest a bond rally. At the same moment, Jobless Claims printed at 263k vs a 235k forecast--the highest reading since 2021. The initial conclusion is that there is enough labor market concern to offset still-elevated inflation, but a drop in supercore inflation (excludes food/energy/housing) may be the bigger factor. Last month's supercore, per Bloomberg, was 0.481. This month, it fell to 0.330. This basically means inflation is standing aside and allowing the Fed to focus on the weaker labor market--a conclusion that's far more informed by the last jobs report than today's jobless claims.