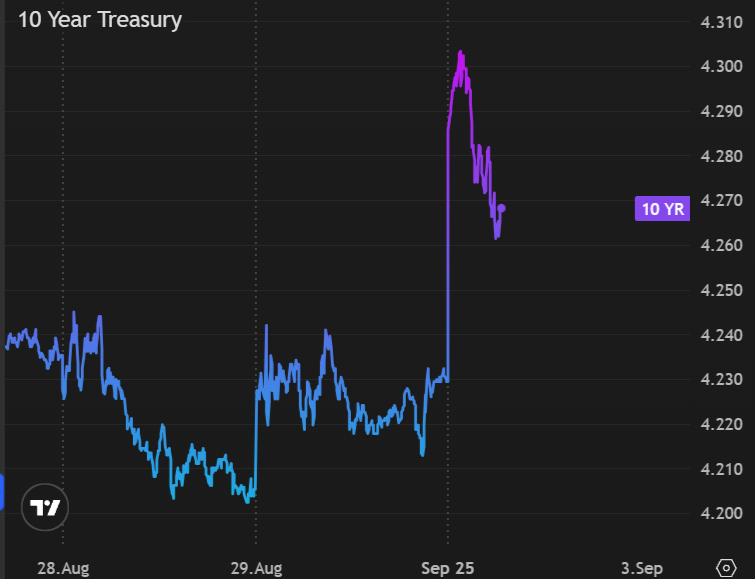

The Tuesday after Labor Day can have a mind of its own when it comes to financial markets--especially if it also happens to be the trading day of the month. Last week's month-end trading environment gave bonds an artificial, temporary boost and some of this morning's weakness could simply be due to the type of reversal often seen at the start of a new month. On more specific notes, EU inflation came in higher than expected and bond yields in several EU countries are at long-term highs (UK yields highest since 1998!). Despite thin trading conditions forex clearly showed a surge at the 3am EU open.

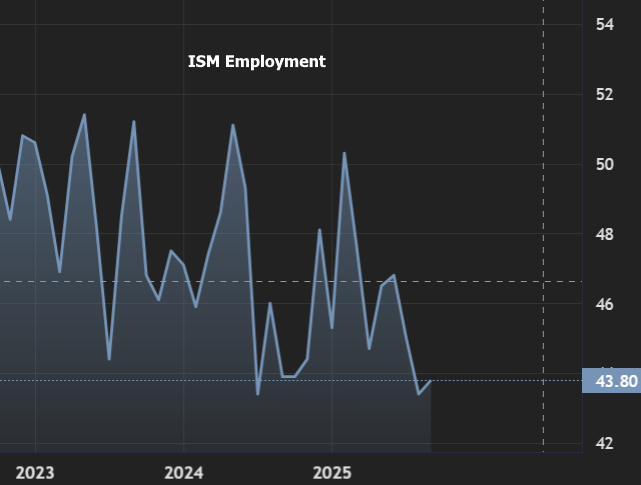

There is also the matter of a lower court ruling on the legality of tariffs. There's some speculation that this could result in tariffs needing to be paid back--something that would definitely hurt the bond market as it would imply additional Treasury issuance. We think it's far too soon to jump to such conclusions and while it could have a bearing on some early trading decisions, it wouldn't be a thematic driver until far more clarity is achieved several months down the road. Either way, damage is limited in the U.S., but still apparent with 10yr yields starting the day roughly 7bps higher. Weaker ISM Manufacturing data is helping erase some of the overnight losses, thus making a somewhat alarming morning only slightly unpleasant.