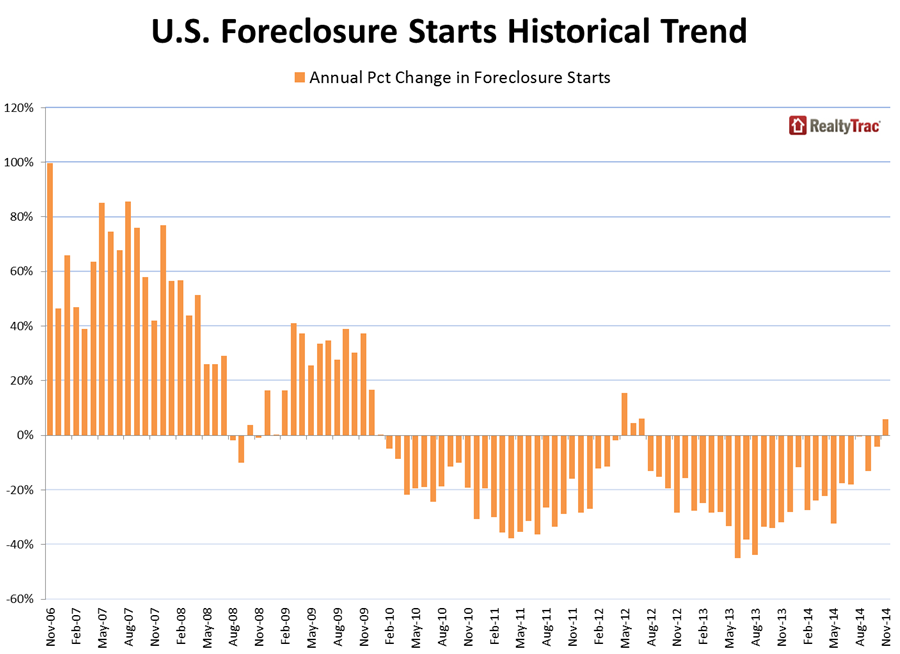

While overall foreclosure activity overall continued its now years-long decline from housing crisis peaks there was a significant year-over-year increase in foreclosure starts. RealtyTrac says in its November U.S. Foreclosure Market Report that 55,906 properties started the foreclosure process during the month, a decrease of 1 percent from October but a 6 percent increase from a year ago. This was the first such increase after 27 consecutive months of year-over-year declines.

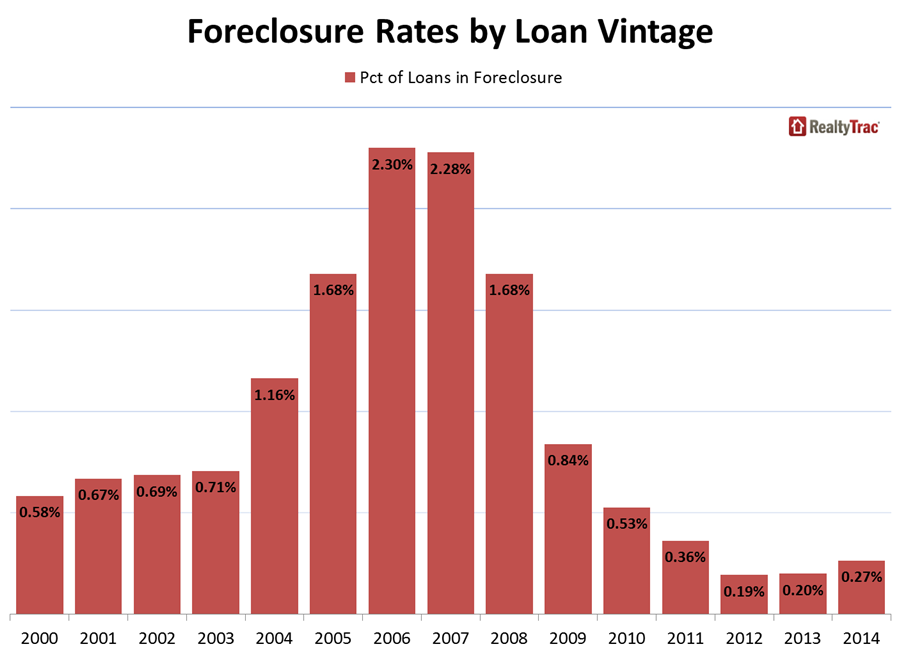

RealtyTrac also said that the 2012 vintage of mortgages is not performing as well as some of its predecessors. The company however did not link this to the recent increase in early stage defaults.

The increase in foreclosure starts was not an isolated one. Starts were up in 30 states with the greatest increases in New Jersey (+256 percent), Nevada (+138 percent), and Massachusetts (+137 percent).

Scheduled auctions, which in some states are identified as foreclosure starts, also rose in November compared to one year earlier although they declined by 16 percent from October's figure which had been the highest in 18 months. There were 50,102 properties scheduled for the first time for foreclosure in November, a year-over-year increase of 5 percent. Thirty states shared in the increase with Kentucky (+163 percent), Tennessee (+159 percent) and North Carolina (+157 percent) heading the list.

Despite the increases in starts and scheduled auctions, overall foreclosure filings were down 9 percent from October and 1 percent from a year earlier. A total of 112,498 properties or one in every 1,170 U.S. housing unit was the subject of a filing during the month.

The dip in total filings was due to a 10 percent reduction in bank repossessions or completed foreclosures compared to October. A total of 25,249 properties were taken into bank inventories or REO, down 17 percent from November 2013. It was the 24th consecutive month in which completed foreclosures were lower on a year-over-year basis

There were increases in completed foreclosures in 15 states, most notably Maryland (+93 percent), North Carolina (+66 percent), New York (up 64 percent), Kentucky (+56 percent), and New Jersey (+54 percent).

"The housing market is struggling to find the new normal when it comes to a tolerable level of foreclosure activity in this post-Great Recession economy," said Daren Blomquist, vice president at RealtyTrac. "Finding that new normal requires striking a balance between too much loan risk, which would result in another housing meltdown, and too little risk, which could result in a stunted recovery.

"Foreclosure rates on 2014-originated loans are actually higher than 2013-originated loans nationwide and in many markets, indicating that lenders are open to a slightly higher level of risk than we've seen over the past five years of extremely tight lending standards," Blomquist continued. "But it's unlikely that lenders will dial up that risk level too quickly going forward given that many are still dealing with working through a lengthy and messy foreclosure process on risky loans from the last loose lending spree."

Florida retained its position as the number one state for foreclosure activity for the 13th out of the last 14 months. Despite a dip of 4 percent in overall activity compared to October and a 15 percent decrease year-over-year, the state's foreclosure activity was at a rate of one in every 463 housing units.

New Jersey jumped from 9th position among the states to number 2 in foreclosure activity with a filing on one in every 478 housing units. Foreclosure activity in the state has increased 196 percent since last November and has increased year-over-year for 11 of the last 12 months. Atlantic City may be largely responsible for the state's foreclosure explosion. The city had the highest foreclosure rate among larger metro areas with filings on one in every 289 housing units in November and has seen completed foreclosures soar 264 percent in the last year.

An increase of 93 percent in activity over the last year put Maryland in third place among states with one in every 581 housing units affected by a filing. The other states in the top five were Delaware, up 24 percent from the previous month with a rate of 1 in 693 units and Utah where REO activity jumped 83 percent in a single month, boosting the state from 12th in overall activity to number 5. One in 750 units had a filing during the month.

Four Florida metropolitan areas followed Atlantic City in their level of activity. Miami dropped from first position to second after filings decreased 22 percent on an annual basis. Jacksonville, Palm Bay-Melbourne-Titusville, and Orlando rounded out the top five.