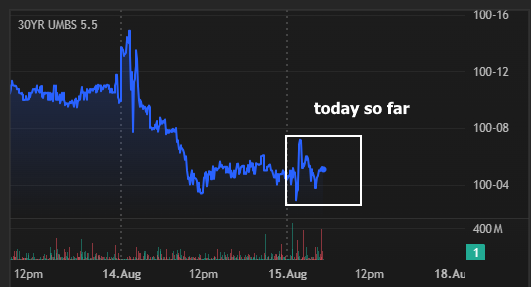

Friday morning's highlight is the Retail Sales report which came in at a respectable 0.5 vs 0.5 headline. Core retail sales (excluding autos/gas/building materials) was even more respectable as it not only beat the forecast by 0.1, but was also revised 0.3 higher last month. If the bond market were so inclined, this data provides plenty of cover for a little sell-off. But while there's been a modicum of weakness in response, it's effectively an unchanged day so far--especially for MBS.

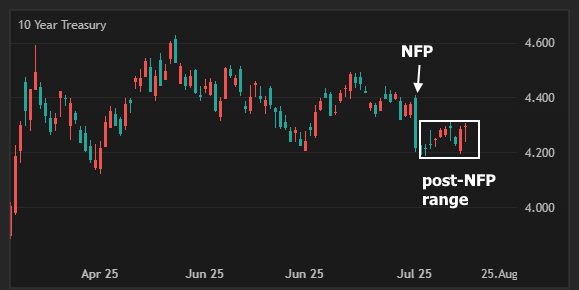

10yr yields are about 1bp higher, but still in the post-NFP range.