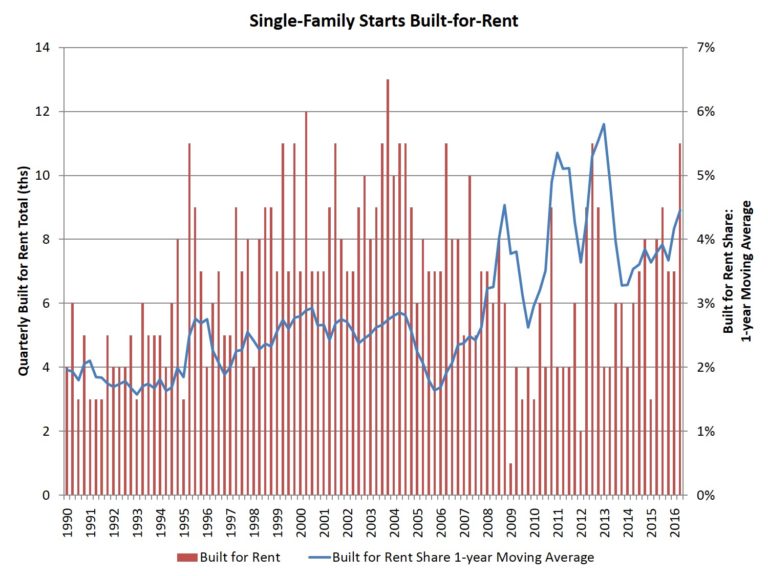

While the numbers remain small, the National Association of Home Builders (NAHB) notes there is a slowly increasing trend of single-family homes being built specifically as rentals. Robert Dietz, chief economist and senior vice president for NAHB says that, while the small numbers mean care must be taken when identifying trends, there were solid gains in the built-for-rent market over the last year.

The Census Bureau's Quarterly Starts and Completions by Purpose and Design as analyzed by NAHB puts the one-year moving average market share of this construction at 4.5 percent of total housing starts as of the second quarter of 2016. This is higher than the historic share of 2.8 percent but down from 5.8 percent at the beginning of 2013.

The percentages translate to 34,000 housing starts in this category for the four quarters ending with the first quarter of 2016 compared to 26,000 for the four prior quarters. This class of construction does not include homes that are sold to another party to be rented, only those home specifically built and held for that purpose.

As an example of this trend, one major homebuilder, Lennar, has completed a single-family rental community in Sparks, Nevada and says it may build one or two more.

At the same time, there has also been a trend toward purchasing newly constructed homes on the part of institutional investors. Starwood-Waypoint purchased 16,000 single-family properties in the rush that followed the housing crash but only 200 were new construction. Recently the REIT's CEO Doug Brien told CNBC that builders are "the next frontier for institutional builders." He says builders are even starting to offer institutional buyers bulk discounts. Lennar says it is also moving in this directions, buying up the first or the last 10 percent of single family developments and turning them into rentals.