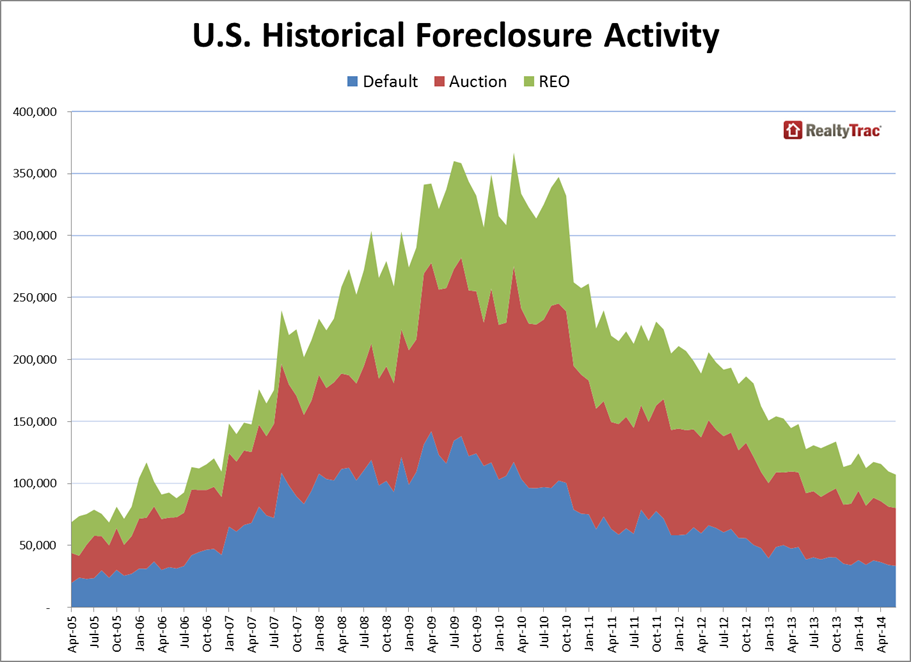

It has been a long eight years, but foreclosure activity appears to have returned to levels last seen before the housing downturn was born in 2006. RealtyTrac said today that the 2 percent decrease in the various types of foreclosure filings in June brought overall activity down to the lowest it has been since July of that year. The company released its Midyear Foreclosure Market Report which contains data on both June foreclosure filings and those that occurred during the first half of 2014.

June filings, including default notices, scheduled auctions, and bank repossessions or completed foreclosures, were filed on a total of 107,194 properties, down 2 percent from May and 16 percent from June 2013. For the first half of the year there were 613,874 filings, a decrease of 19 percent from the last half of 2013 and 23 percent from the first six months of that year. Filings at mid-year equate to one filing for every 214 housing units in the U.S.

"Nationwide foreclosure activity in June reached an important milestone, dropping to levels not seen since before the housing price bubble burst in August 2006," said Daren Blomquist, vice president at RealtyTrac. "Over the next six to nine months nationwide foreclosure numbers should start to flat line at consistently historically normal levels.

Ten states also were at the lowest level of foreclosure activity in June since the housing bubble burst in August 2006. These include Texas, Georgia, Colorado, Tennessee, Arizona and Nevada. Activity was down during the first half of the year compared to the first six months of 2013 in all but nine states. Among those with the larger increases were New Jersey which was up 54 percent, Maryland (+18 percent), Iowa (+10 percent), and Massachusetts and Connecticut, each with 4 percent increases.

Overall foreclosure rates during the first half of the year were highest in Florida with one filing for every 74 housing units, Maryland with one in 107, Illinois, one in 123; New Jersey, one in 134; and Nevada, one in 138.

There were 47,243 first-time foreclosure starts in June, down 4 percent from May and 18 percent from a year earlier and the lowest number since November 2005. Foreclosure starts for the first six months numbered 315,895. At the current pace foreclosure starts will probably exceed 630,000 by the end of the year compared to a finally tally of 747,728 for all of 2013.

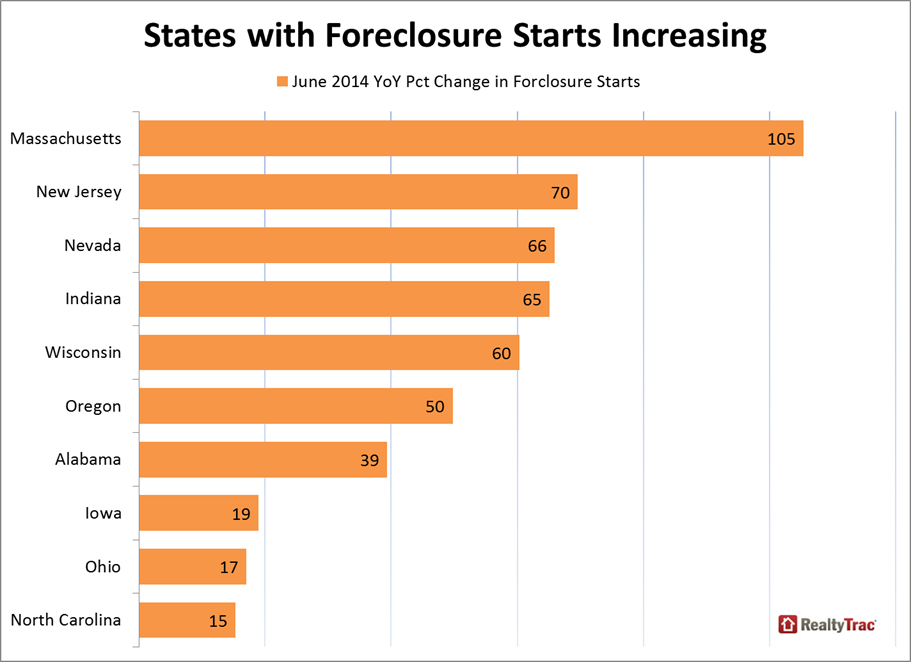

Foreclosure starts in June increased from the previous month in 15 states and were up from a year ago in 20 states. States will large annual increase include Massachusetts (+105 percent), New Jersey (+70 percent), Nevada and Indiana (+65 percent), and Oregon (+50 percent).

There were 26,889 completed foreclosures in June and 174,691 during the first six months of the year. June's foreclosures were down 5 percent from May and 24 percent from June 2013 and represented an 84 month low. Based on the midyear number RealtyTrac estimates there will be 350,000 foreclosures this year, down from 462,970 in all of 2013.

Completed foreclosures in June were higher than in May in 16 states and higher than a year ago in 12. Both Iowa and Maryland had 86 percent more foreclosures in June than a year earlier, New York was up 49 percent and Oregon 22 percent.

Foreclosure auctions were scheduled for the first time on 46,743 U.S. properties in June, 1 percent fewer than in May and down 13 percent from a year ago to the lowest level since July 2006 - a 95-month low. Scheduled auctions increased from May in 12 states and from a year ago in 17 with the largest increases of 68 percent and 62 percent respectively in Connecticut and Pennsylvania.

"There continue to be concerning trends in some states and local markets that clearly indicate those markets are not completely out of the woods when it comes to the lingering foreclosure problem left over from the housing bust," Blomquist said. "While it's important that any remaining foreclosure infection is addressed promptly to keep it from festering, foreclosures are no longer a widespread contagion threatening to derail the housing market's return to full health."

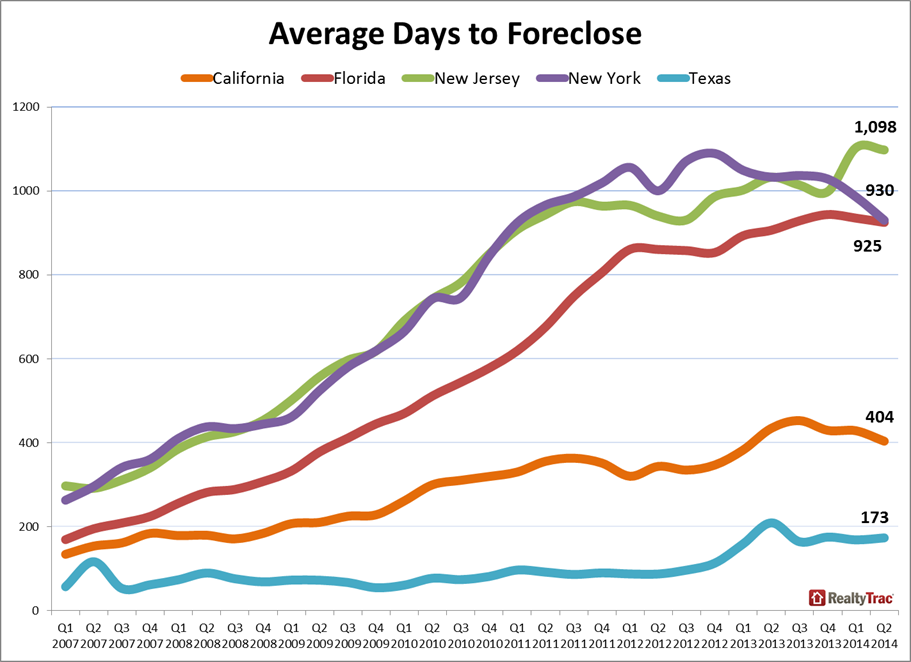

Despite dwindling numbers of foreclosure filings the timeline to complete a foreclosure continues to lengthen. The average time to complete a foreclosure in the second quarter of 2014 was 577 days, up from 572 days in the first quarter and 526 days in the second quarter of 2013 while in New Jersey it currently takes nearly twice as long, an average of 1,098 days. The process is also extremely lengthy in New York (930 days), Hawaii (915 days), Illinois (850 days) and Massachusetts (784 days.