The National Association of Realtors released the Pending Home Sales Index today.

NAR's Pending Home Sales Index measures home sales contract activity. A sale is listed as "pending" when a contract to purchase an existing home (single-family, condos, and co-ops) has been signed but the transaction has not closed. A signed contract is not counted as an actual existing home sale until the transaction closes. The index is based on a large national sample, typically representing about 20 percent of transactions for existing-home sales. It is designed to be a leading indicator of housing activity. In developing the model for the index, it was demonstrated that the level of monthly pending home sales parallels the level of closed existing-home sales in the following two months

Excerpts Taken From The Release...

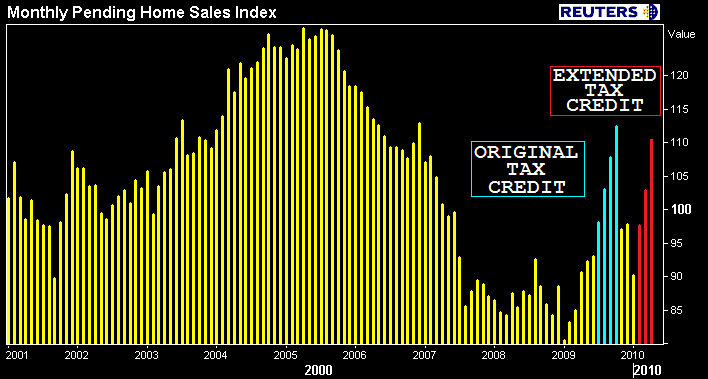

Pending home sales have risen for three consecutive months, reflecting the broad impact of the home buyer tax credit and favorable housing affordability conditions, according to the National Association of Realtors®.

The Pending Home Sales Index,* a forward-looking indicator, rose 6.0 percent to 110.9 based on contracts signed in April, from an upwardly revised 104.6 in March, and is 22.4 percent higher than April 2009 when it was 90.6. That follows gains of 7.1 percent in March and 8.3 percent in February.

Pending home sales are at the highest level since last October when the index reached 112.4 and first-time buyers were rushing to beat the initial deadline for the tax credit.

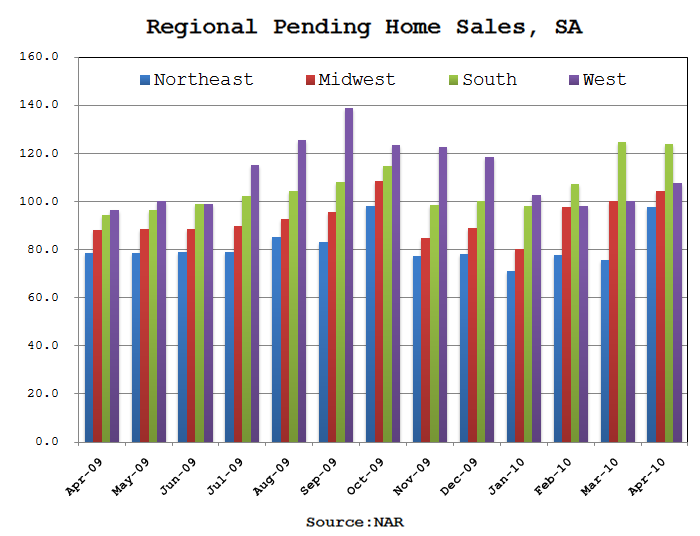

Regionally...

- Northeast: +29.5 percent to 97.9 in April and is 24.5 percent above a year ago.

- Midwest: +4.1 percent to 104.2 and is 17.9 percent above April 2009.

- South: -0.6 percent to an index of 123.9, but is 31.3 percent higher than a year ago.

- West: +7.5 percent to 107.9 and is 12.0 percent higher than April 2009.

Lawrence Yun, NAR chief economist, said this second round of surging sales from the tax credit extension looks as strong as the original tax credit.

“There were concerns that only a small pool of buyers were left to take advantage of the tax credit extension. But evidently the tax stimulus, combined with improved consumer confidence and low mortgage interest rates, are contributing to surging sales....The housing market has to get back on its own feet and now appears to be in a good position to return to sustainable levels even without government stimulus, provided the economy continues to add jobs.”

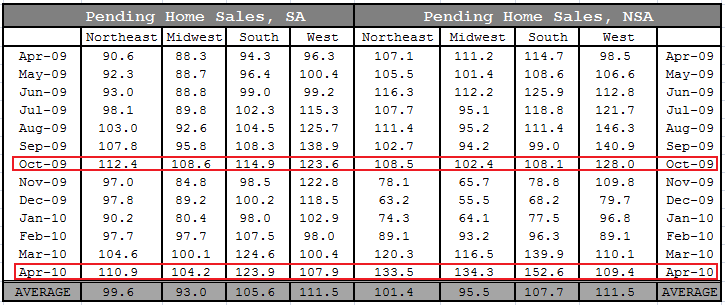

The table below matches up seasonally adjusted data and non-seasonally adjusted data. Let's compare the PHS index when the first tax credit expired to the PHS index when the extended tax credit expired.

On a seasonally unadjusted basis, the Pending Home Sales Index is lower in April 2010 vs. October 2009 (FTHB tax credit expired on Nov.7) in all regions but the South. However when looking at the data on a non-seasonally adjusted basis, all regions except the West are actually at higher index levels vs. October 2009.

While Yun is relatively optimistic about housing in the next year, he did point out some problems with the closing process...

“A big concern surfacing recently is insufficient time to close the deal at the settlement table. Under normal circumstances, two months would be enough time from contract signing to settlement date...However, the recent housing cycle has brought long delays related to the short sales approval process by banks, and from ongoing appraisal issues. There could be a sizable number of homebuyers who responded to tax credit incentives, but may encounter problems meeting the settlement deadline by June 30.”

Because of these market challenges, NAR has asked Congress to provide flexibility on the deadline for closing. We have discussed similiar issues HERE and HERE

April data is "fine and dandy" but it was expected that housing demand would improve as homebuyers rushed to take advantage of the tax credit before it expired on April 30.The data that comes in the months ahead is what matters most for housing. May data will be our first opportunity to see how housing is doing without government incentives. On June 16th we get May Housing Starts and Building Permits. On June 22nd, May Existing Home Sales will be released. New Home Sales on June 23. Mark your calendars....