The National Association of Realtors has released Existing Home Sales data for February 2010.

From the release:

Existing-home sales declined slightly in February, with modest gains in the Northeast and Midwest offset by softer sales in the South and West. A parallel NAR practitioner survey shows first-time buyers purchased 42 percent of homes in February, up from 40 percent in January. Investors accounted for 19 percent of transactions in February, compared with 17 percent in January; the remaining sales were to repeat buyers.

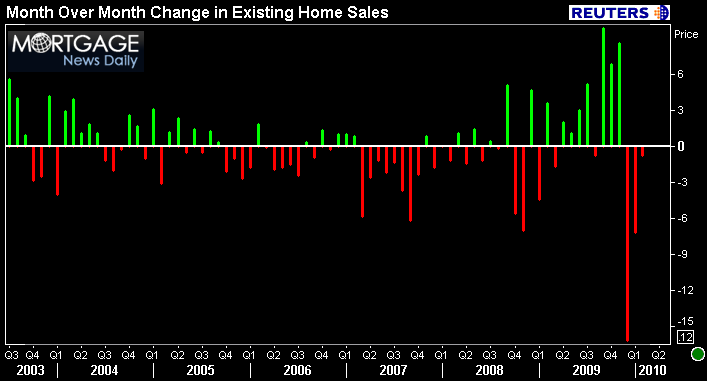

Existing-home sales, which are finalized transactions that include single-family, townhomes, condominiums and co-ops, slipped 0.6 percent nationally to a seasonally adjusted annual rate of 5.02 million units in February from 5.05 million in January, but are 7.0 percent higher than the 4.69 million-unit pace in February 2009. Single-family home sales declined 1.4 percent to a seasonally adjusted annual rate of 4.37 million in February from a pace of 4.43 million in January, but are 4.3 percent higher than the 4.19 million level a year ago. Existing condominium and co-op sales rose 4.8 percent to a seasonally adjusted annual rate of 650,000 in February from 620,000 in January

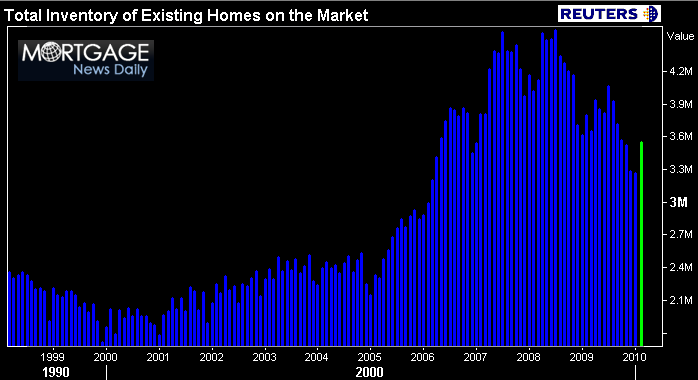

Total housing inventory at the end of February rose 9.5 percent to 3.59 million existing homes available for sale...

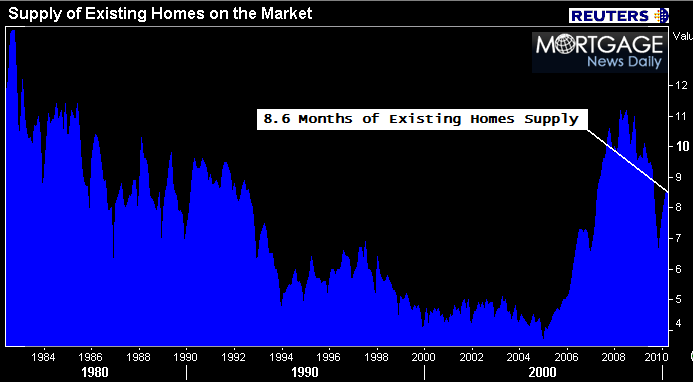

This represents an 8.6-month supply at the current sales pace, up from a 7.8-month supply in January. Raw unsold inventory is 5.5 percent below a year ago.

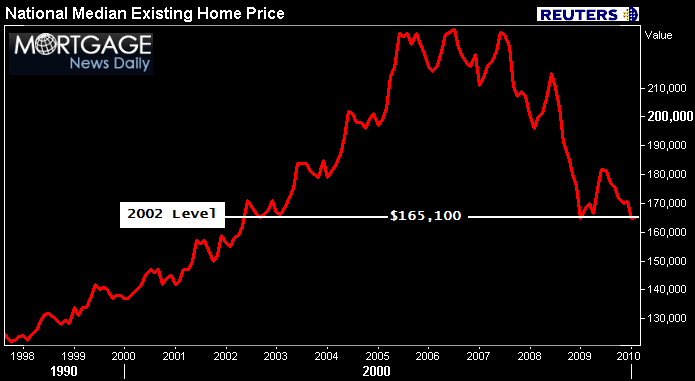

The national median existing-home price for all housing types was $165,100 in February, which is 1.8 percent below February 2009. Distressed homes, generally sold at discount, accounted for 35 percent of sales last month. The median existing single-family home price was $164,300 in February, down 2.1 percent from February 2009. The median existing condo price was $170,200 in February, down 0.2 percent from a year ago.

Regionally, existing-home sales in the Northeast rose 2.4 percent to an annual pace of 840,000 in February and are 12.0 percent above a year ago. The median price in the Northeast was $254,700, up 7.5 percent from February 2009.

Existing-home sales in the Midwest increased 2.8 percent in February to a level of 1.11 million and are 8.8 percent higher than February 2009. The median price in the Midwest was $128,000, which is 2.0 percent below a year ago.

In the South, existing-home sales slipped 1.1 percent to an annual pace of 1.85 million in February but are 6.9 percent above a year ago. The median price in the South was $139,600, down 4.2 percent from February 2009.

Existing-home sales in the West fell 4.7 percent to an annual rate of 1.22 million in February but are 3.4 percent higher than February 2009. The median price in the West was $207,900, down 9.8 percent from a year ago.

Plain and Simple: Existing Home Sales were 0.6 percent lower in February led by a 4.8 percent decline in condo sales. Median home price fell 1.8 percent. Total existing inventory rose 9.8 percent (yikes). While these stats are discouraging, they do not imply significant weakness as much as they imply continued STAGNATION after a busy summer buying season.

NAR President Vicki Cox Golder, says some buyers are just beginning to realize the urgency of acting before the contract deadline for the tax credit. “If home buyers want this tax credit there is literally no time to waste.”

Lawrence Yun, NAR chief economist, says “The key test for a durable recovery comes in the next few months as the tax credit deadline approaches....If we see a surge in home buying comparable to last fall in the months leading up to the original tax credit deadline, then enough inventory should be absorbed to ensure a broad home price stabilization.”

Yun notes that widespread winter storms in February may have masked underlying demand. “Some closings were simply postponed by winter storms, but buyers couldn’t get out to look at homes in some areas and that should negatively impact near-term contract activity,”

Economists, Politicians, Traders, Realtors, Loan Originators, Underwriters, Processors, Closers, Me, and definitely You are all wondering if housing is going to gain traction in the months to come.

While anecdotal evidence does imply there has been a significant pick up in housing and loan demand over the past month as buyers rush to take advantage of the tax credit, these reports are concentrated in geographic regions where employment levels have stabilized and home prices have shown clear signs of improvement.

Lawrence Yun makes a VERY pertinent point in saying that the key test of a durable recovery lies in the months ahead as the home buyer tax credit rapidly approaches.

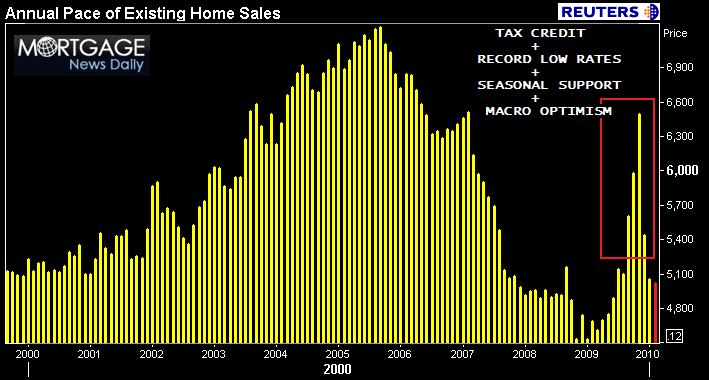

In the chart below, the effects of the original FTHB tax credit, record low mortgage rates, seasonal support, and a shift in macroeconomic sentiment are obvious. Stimulus played a pivotal role in a pick up in housing demand. If this level of buyer interest cannot be reached again heading into the summer months...WHAT WILL HOUSING DEMAND BE WITHOUT THE ARTIFICIAL STIMULUS? If buyers don't turn out before the tax credit expires, expect to see many economists downgrade their macroeconomic outlooks. Expect to see financial markets react to these downgrades.

The recovery in housing and the overall return to economic normalcy will be a long process. On the bright side, this sentiment should help keep retail investors anxious enough to maintain steady demand for US Treasuries. This will keep mortgage rates low from a historical perspective. The worst case scenario has likely been avoided, but the road ahead will be bumpy at best. READ MORE ON THE MORTGAGE RATES EQUATION

Plain and Simple: this is a key point in time for housing and the macroeconomic outlook. If housing is unable to gain recovery momentum before the tax credit expires, where will demand come from afterward?

My mom got 15 appraisal requests in a 48 hour period...14 of which were purchases. My dad, a loan originator, tells me there has been a noticeable pick up in purchase activity over the past three weeks. But their market, Washington DC metro, is filled with high credit quality, stable income earning borrowers.

WHAT IS GOING ON IN YOUR MARKET?