The Departments of Housing and Urban Development (HUD) and Treasury issued the administration's January Housing Scorecard on Monday. The report is essentially a summary of data on housing and housing finance released by public and private sources over the previous month and/or quarter. Most of the data such as new and existing home sales, permits and starts, mortgage originations, and various house price evaluations have been previously covered by MND.

The scorecard incorporates by reference the monthly report of the Making Home Affordable Program (MHA) through the end of December. This includes information on the universe of MHA programs including the Home Affordable Modification Program (HAMP), HOPE Now, and Second Lien Modifications and other initiatives.

Since the HAMP program began in April 2009 1,774,595 homeowners have entered into trial loan modifications, 20,074 since the November HAMP report. About half of these homeowners, 933,327, have completed the trials and converted to permanent modifications; 23,374 conversions took place during the current report period. Just over three-quarters of a million of the permanent modifications are still active.

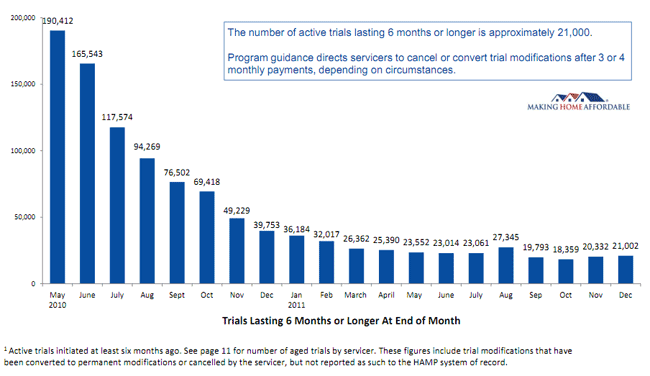

While the HAMP program dates to April 2009, it underwent substantial revisions to its policies and procedures in June 2010, and many of the measures of its performance are benchmarked at that time. Eight-four percent of homeowners who entered a trial modification after that date have received a permanent modification with an average trial period of 3.5 months compared to 43 percent who entered a trial prior to the changes. As of December, 21,002 of the active trials had been underway for six months or more; in May 2010, the month before the changes took place, 190,000 trials were six months old or more. In December every servicer except Ocwen was above an 80 percent conversion rate.

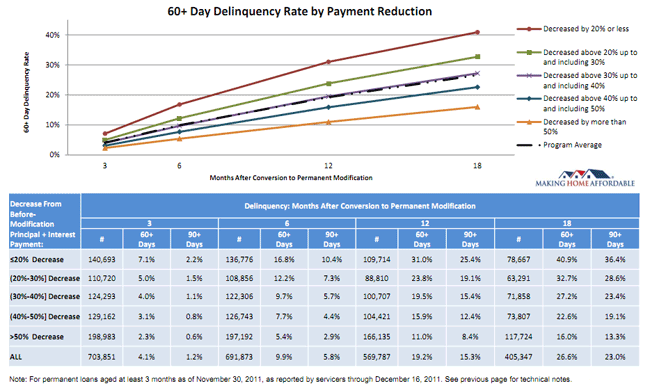

HAMP modifications with the largest reduction in mortgage payments continue to demonstrate the lowest redefault rates. At 18 months after modification all loans have a 90+ day default rate of 23 percent. However, loans with a 20 percent or smaller reduction in loan payment are defaulting at the rate of 36.4 percent while loans with a 50 percent payment decrease or greater have a default rate of 13.3 percent.

The Home Affordable Foreclosure Alternatives program offers incentives to homeowners who wish to exit home ownership through a short sale or deed-in-lieu of foreclosure. Thus far 43,368 homeowners have been accepted into the program and 27,665 transactions have been completed, the vast majority through a short sale. More than half of the completed transactions (18,350) were on loans owned by private investors; 7,711 were portfolio loans and 1,604 were GSE loans.

There has been an emphasis in some quarters on reducing the principal balance of distressed loans since the last HAMP report. Some members of Congress have asked for justification from the GSEs as to why they were not participating in principal reductions and the Treasury Department recently urged them to do so as well while tripling the incentives it is paying to other investors to reduce principal. The HAMP Principal Reduction Alternative (PRA) has started trial modifications for 63,203 home owners and permanent modifications for 42,753 of which 40,374 are still active. The median principal amount reduced in these modifications is $67,196, a median of 31.1 percent of the principal balance.

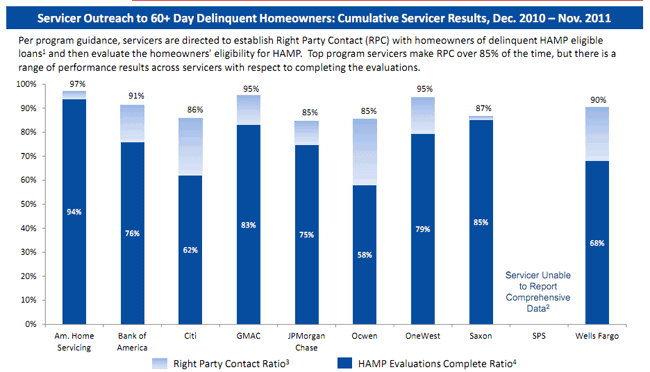

Each month HAMP reports on selected servicer performance metrics. Servicers are expected to make Right Party Contact (RPC) with eligible homeowners and then evaluate their eligibility for HAMP. HAMP evaluated servicer outreach to 60 days delinquent homeowners over the previous 12 months (November 2010-December 2011) and found most services have made RPC at least 85 percent of the time; however there is a wide range of performance results in terms of completed the evaluations.

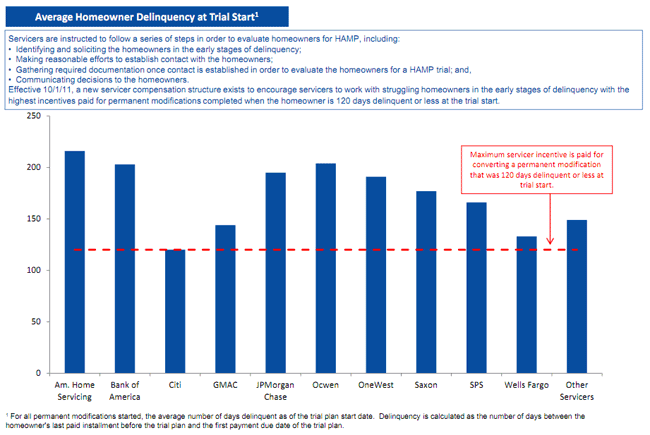

Servicers are also expected to identify and solicit homeowners in early stages of delinquency and, effective October 1, 2011, a higher compensation structure was put into effect to reward servicers who complete evaluations and place homeowners in a trial modification within 120 days of first delinquency. The table below shows the status of major servicers relative to their eligibility for maximum incentives.