Is it finally over? With foreclosure filings throughout 2013 reported by RealtyTrac to be at the lowest annual level since 2007, one might begin to hope the housing crisis has ended. However the company also reports that overall foreclosure activity increased last year in 10 states and scheduled foreclosure auctions in judicial process states were the highest in three years.

RealtyTrac released its Year-End 2013 U.S. Foreclosure Market Report this morning showing that an aggregate of 1,361,795 default notices, scheduled auctions, and bank repossessions or completed foreclosures were filed during the year, a decrease of 26 percent from the level in 2012 and 53 percent below the peak number of filings in 2010. The last time filings were lower was in 2007 when 1.3 filings were recorded.

Looked at another way, in 2013 1.04 percent of U.S. housing units or one in every 96 received at least one foreclosure filing during the year. In 2012 filings affected 1.39 percent of housing units and in 2010 2.23 percent. RealtyTrac says that over the eight years ending in December 2013 10.9 million U.S. properties have started the foreclosure process and 5.6 million have been repossessed by lenders through foreclosure.

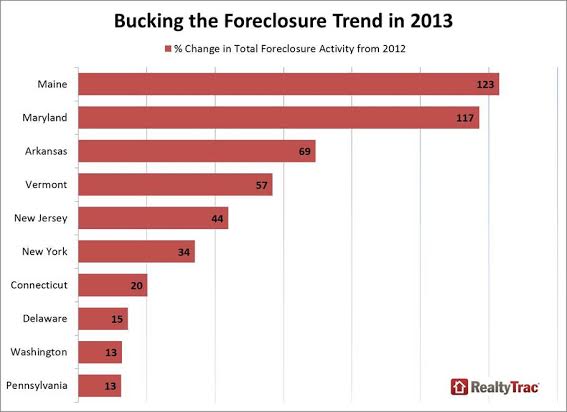

The ten states in which foreclosure activity increased in 2013 were Maryland which had 117 percent more filings than it had in 2012, New Jersey (up 44 percent), New York (+34 percent, Connecticut (+20 percent) and Washington and Pennsylvania which were each up 13 percent.

Scheduled foreclosure auctions (NFS) were the only foreclosure document type in which the frequency of filings nationwide rose in 2013. This was largely due to a 13 percent increase of these filings in judicial foreclosure states, the highest level in this subset since 2010. Some of the states in which NFS spiked were Maryland where scheduled auctions rose by 107 percent, New Jersey, up 64 percent, Connecticut (+55 percent) and Florida (+53 percent.)

Florida and Nevada continued their long tenure among the top two or three states for foreclosure filings, ranking first and second respectively in 2013. In Florida 3.01 percent of all housing units received a foreclosure filing during the year and in Nevada it was 2.16 percent. Other states making up the top five were Illinois (1.89 percent), Maryland (1.57 percent), and Ohio (1.53 percent).

The average estimated value of a property receiving a foreclosure filing in 2013 was $191,693 at the time of the foreclosure filing, up 1 percent from the average value in 2012, and the average estimated market value of properties that received foreclosure filings in 2013 has increased 10 percent since the foreclosure notice was filed.

The timeline for completing a foreclosure continued to increase to a current record high of 564 days. States where foreclosures took the longest in 2013 were New York (1,029 days), New Jersey (999 days) and Florida (944 days).

"Millions of homeowners are still living in the shadow of the massive foreclosure crisis that the country experienced over the past eight years since the housing price bubble burst - both in the form of homes lost to directly to foreclosure as well as home equity lost as a result of a flood of discounted distressed sales," said Daren Blomquist, vice president at RealtyTrac. "But the shadow cast by the foreclosure crisis is shrinking as fewer distressed properties enter foreclosure and properties already in foreclosure are poised to exit in greater numbers in 2014 given the greater numbers of scheduled foreclosure auctions in 2013 in judicial states - which account for the bulk of U.S. foreclosure inventory.

"The push to schedule these auctions is certainly coming at an opportune time for the foreclosing lenders," Blomquist added. "There is unprecedented demand from institutional investors willing to pay with cash to buy at the foreclosure auction, helping to raise the value of properties with a foreclosure filing in 2013 by an average of 10 percent nationwide."

Looking at individual filing types, a total of 747,728 U.S. properties started the foreclosure process in 2013, down 33 percent from 2012 to the lowest annual total since RealtyTrac began reporting on foreclosure starts in 2006. Thirteen states bucked the downward trend including Maryland (up 194 percent from 2012), Arkansas (+64 percent), New Jersey (+54), Connecticut (47 percent), and New York (+42 percent). States with the significant decreases in foreclosure starts included California (-60 percent), Arizona (-59 percent), Colorado (-58 percent), Georgia (-47 percent) and Michigan (-42 percent.) All five are non-judicial states.

Bank repossessions totaled 462,970 in 2013, down 31 percent from 2012 and the lowest number since 2007, but 12 states saw completed foreclosures increase including Maryland (+57 percent),l Arkansas (+43 percent), Washington (+30 percent) and New York and Oklahoma with respective increases of 28 and 26 percent. The more significant decreases were in California (-60 percent), Texas (-56 Percent), Arizona (-52 percent), Georgia (-50 percent), Michigan (-47 percent) and Illinois (-33 percent).

In December 2013, more than 1.2 million properties nationwide were in some stage of foreclosure or bank owned, down 19 percent from December 2012 and 44 percent below the peak of more than 2.2 million in December 2010. Florida, California, Illinois, New York, and Ohio had the largest numbers of properties in the foreclosure inventory, together accounting for 29 percent of the national total.

Lenders with the most inventory of bank-owned (REO) properties based on the name listed on the foreclosure documents were the government-backed entities of Fannie Mae, Freddie Mac and the U.S. Department of Housing and Urban Development (HUD), with a combined 41 percent of all REO inventory. Other top beneficiaries were Bank of America and Wells Fargo (each with 11 percent of all active REO inventory), Chase (8 percent), US BankCorp (7 percent), Deutsche Bank (5 percent), and CitiGroup (4 percent).

Miami had the highest foreclosure activity among metropolitan areas with a total of 96,710 filings during the year, a 6 percent annual increase. Other large cities with high levels of activity included seven in Florida (Jacksonville, Orlando, Palm Bay-Melbourne-Titusville, Port St. Lucie, Tampa, Ocala, and Sarasota.) Rounding out the top ten were Rockford, Illinois at 8th place and Las Vegas in 9th. Of the 209 metro areas tracked in the report, 51 bucked the national trend and posted increasing foreclosure activity in 2013 compared to 2012.