In discussing mortgage rates near 23-year highs yesterday, we asked if there was any hope for relief and concluded that the only question was one of timing. In turn, timing would depend on economic data and inflation. Rates got a glimpse of friendly economic data today following the big jobs report from the Labor Department. It was still very strong in a historical context, but not quite as strong as economists had predicted.

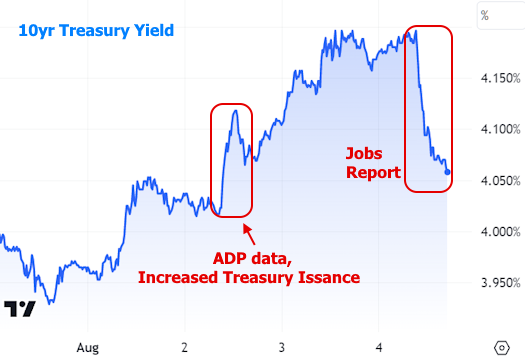

Up until then, rates were in a bit of a panic this week due to a confluence of other data and events. Wednesday was saw the biggest jump after the ADP employment data and an announcement regarding the government's anticipated borrowing needs (via Treasuries).

U.S. Treasuries are at the core of the rate market. When investors become less interested in buying them or when the government becomes more interested in selling them, rates rise. The ADP data hit the demand side of the equation and the Treasury announcement hit the supply side. We can see how things played out in the following chart of 10yr Treasury yields as well as the much-needed response to Friday's more important jobs report.

Despite Friday's recovery, current rate levels are still uncomfortably close to long-term highs. Mortgage rates only made it back to Monday's levels (30yr fixed index still over 7%). In order to get meaningfully into the 6's, we'll need more data that comes in cooler than the market expects.

So what's the next big economic report to watch? Easy! The Consumer Price Index (CPI) on Thursday, August 10th. CPI is the only other piece of scheduled monthly economic data that could compete with the jobs report over the past 2 years when it comes to impact on rates. The last CPI report was good for rates, but the market needs to see a pattern that's repeated for several consecutive months. If inflation is lower than expected this time around, it would be a solid step in that direction, one that likely allows rates to continue to moderate after this week's push toward long-term highs.