Written by Tom Hollander and Jason Pickart

It may be tempting to think that the mortgage crisis is behind us. However, our analysis shows that there are still a substantial number of mortgages at risk of distress or foreclosure. One particularly troubling area concerns a type of product known as the payment-option adjustable-rate mortgage (option ARM).

These loans are about to make a splash in mortgage delinquency numbers. They were issued en masse during the peak housing bubble years, approximately 2005 through 2007, and many of them are due to recast in the next several years, resulting in higher—often significantly higher—payments for borrowers. Given the widely held belief that these loans were largely issued to borrowers wanting to buy more house than they could have otherwise afforded, the higher payments will be out of reach for many. Because of recent home price trends and the negative amortization characteristics of these loans, the familiar result will likely be an increase in delinquencies, distressed sales and foreclosures.

In order to provide some context to this problem, we have analyzed mortgage data to highlight the regions most exposed to the option ARM phenomenon.

A brief history of the problem...

During the peak of the housing bubble, a combination of speculation, low interest rates, easily available loans, and aggressive financial institutions fueled demand that pushed home prices to unprecedented levels. Many areas experienced double-digit year-on-year price appreciation, with the predictable result that housing in these areas quickly became unaffordable for even relatively well-off buyers. Option ARM loans, originally designed for borrowers with fluctuating incomes who wanted flexibility in making payments, became attractive for their low initial monthly payments tied to an initial teaser interest rate, enabling people to take on larger mortgages in the expectation that they could sell or refinance later. These loans were most popular in the hottest mortgage markets where prices were rising fastest.

Option ARMs typically give the borrower payment options for a specified period of time, typically including:

- A fully amortizing payment.

- An interest-only payment, covering one month’s interest but not the principal.

- A minimum payment, covering neither the principal nor the full amount of interest each month. The unpaid interest is added to the principal of the loan in a practice known as negative amortization.

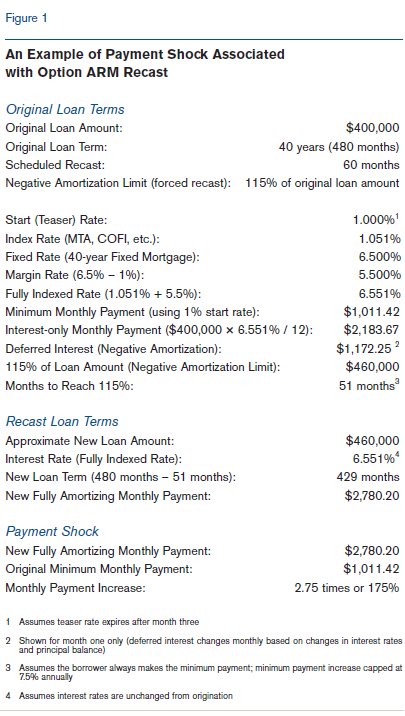

When the buyer makes the minimum payment, the total amount of the loan grows each month. Most option ARMs have a negative amortization limit ranging from 110% to 125% of the original loan balance; 115% is the most common setting. When the loan reaches the negative amortization limit, it is recast, forcing the borrower to begin making fully amortizing payments based on a shorter amortization schedule and a higher loan balance than when the loan was issued. An example of an option ARM recast and the resulting payment shock is shown in Figure 1.

Because the borrower has only been paying the minimum payment of $1,011.42, the loan will reach the 115% negative amortization mark in 51 months, nine months earlier than the scheduled recast. The new, fully amortizing payment is based on a higher loan balance and shorter amortization period than the original loan. The borrower will see their minimum monthly payment nearly triple to $2,780.20.

Given the falling values of most homes, option ARMs also create a situation of negative equity. If we assume that our sample borrower originally put 20% down, the original home value would have been $500,000. If we assume that property values declined by a mere 15% (many MSAs we examined declined significantly more), that would put the current value at $425,000. Since the borrower now owes $460,000, this takes the borrower from 20% or $100,000 equity at origination to $35,000 negative equity now. An unaffordable payment combined with negative equity is a situation in which a borrower may have an incentive to simply default on the loan.

Our analysis...

Most option ARMs were originated in the years 2005, 2006, and 2007. Generally, these loans have a five-year scheduled recast (although some issued in late 2006 and 2007 have recast dates set at 10 years), which puts most of the scheduled recasts in 2010-2012, with roughly 50% of those happening in 2011. Beginning with the Loan Performance ABS database (which includes only non-agency securitized loans, rather than those held in the portfolios of financial institutions), we limited our search to loans with typical option ARM characteristics, including any or all of the following:

- Negative amortization permitted

- Negative amortization limit

- Current balance higher than original balance

This left us with over 500,000 loans, which we narrowed to loans least likely to be able to refinance at recast, including loans that are:

- Delinquent with negative equity now

- Current with negative equity now

- Current with forecasted negative equity by scheduled recast

- Current with unknown recast time frame but within 5% of negative amortization limit

For the current loans, we included book years 2004 through 2007, and, if known, a scheduled recast between fourth quarter of 2009 and the end of 2012. This left us with roughly 200,000 option ARMs we consider at-risk. For the purposes of this analysis, we consider at-risk to mean a disproportionately high likelihood of default between now and the end of 2012.

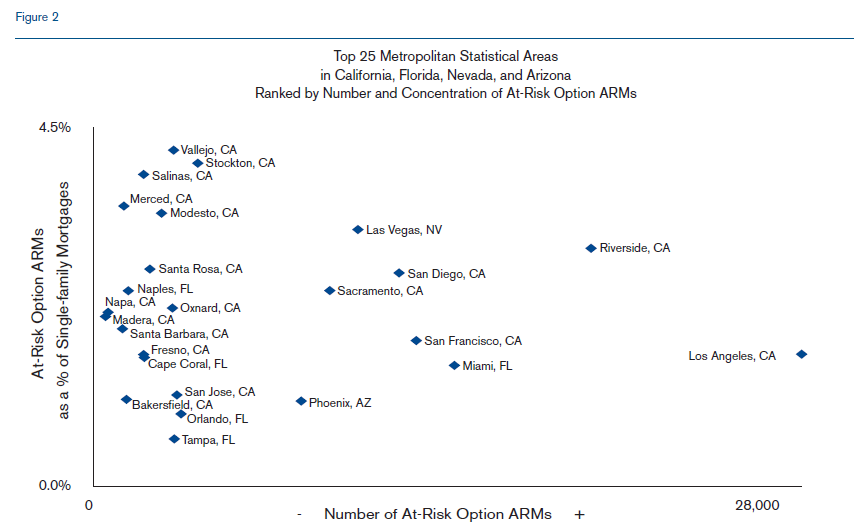

Next, we limited the data to states with the most at-risk option ARMs—California, Florida, Nevada, and Arizona. Loans in these four states encompass over 85% of the remaining at-risk option ARMs in our data set, with California having roughly 60%. Finally, we limited the data to the 25 metropolitan statistical areas (MSAs) we consider to be the most distressed housing markets in terms of the number and concentration of at-risk option ARMs. These 25 MSAs, shown in Figure 2, contain roughly 80% of the at-risk option ARMs in our data set.

As a note, there is an unknown number of option ARM loans currently held in portfolio by lending institutions. We have seen estimates that as much as 30% of all option ARMs originated from 2005 through 2007 are held in portfolio. Significantly less information is available about these loans; however, we believe they will only compound the overall problem of option ARM defaults.

Among the 25 MSAs we examined, we found there is dispersion in terms of the number and concentration of at-risk option ARMs. As illustrated in Figure 2, the Los Angeles MSA has by far the most at-risk option ARMs. However, in terms of concentration, as measured by at-risk option ARMs as a percent of all single family mortgages, the Los Angeles MSA is much less alarming than the Vallejo, CA MSA with a relatively high concentration of at-risk option ARMs. The worst case, as is the case with the Riverside, CA MSA, is to have both a relatively high number, as well as a relatively high concentration of at-risk option ARMs.

We believe a substantial number of these at-risk option ARMs will become delinquent, resulting in more houses on the market and putting further downward pressure on home prices. As we know from recent experience, foreclosures have ripple effects, making it more difficult for others to sell or refinance their homes. This could lead to increased volatility in the value of both collateral behind mortgage-backed securities as well as loans held in portfolio by lending institutions, creating the potential for further write-downs by lending institutions and increasing uncertainty related to the prices of mortgage-backed securities. We may see intervention or action on the part of the federal government or lenders to postpone or prevent the at-risk option ARMs from going to foreclosure; however, if recent experience is any guide, these may not be sufficient to fully address the problem. Of the loan modifications completed in 2008, approximately 52% were 60 or more days delinquent or in the process of foreclosure 12 months following modification[1].

Regardless, more housing sector pain may be on the horizon as a result of the coming option ARM recasts. And, unfortunately, this phenomenon is likely to hit hardest in the housing markets that are already in the most distress.

[1] OCC and OTS Mortgage Metrics Report, First Quarter 2009