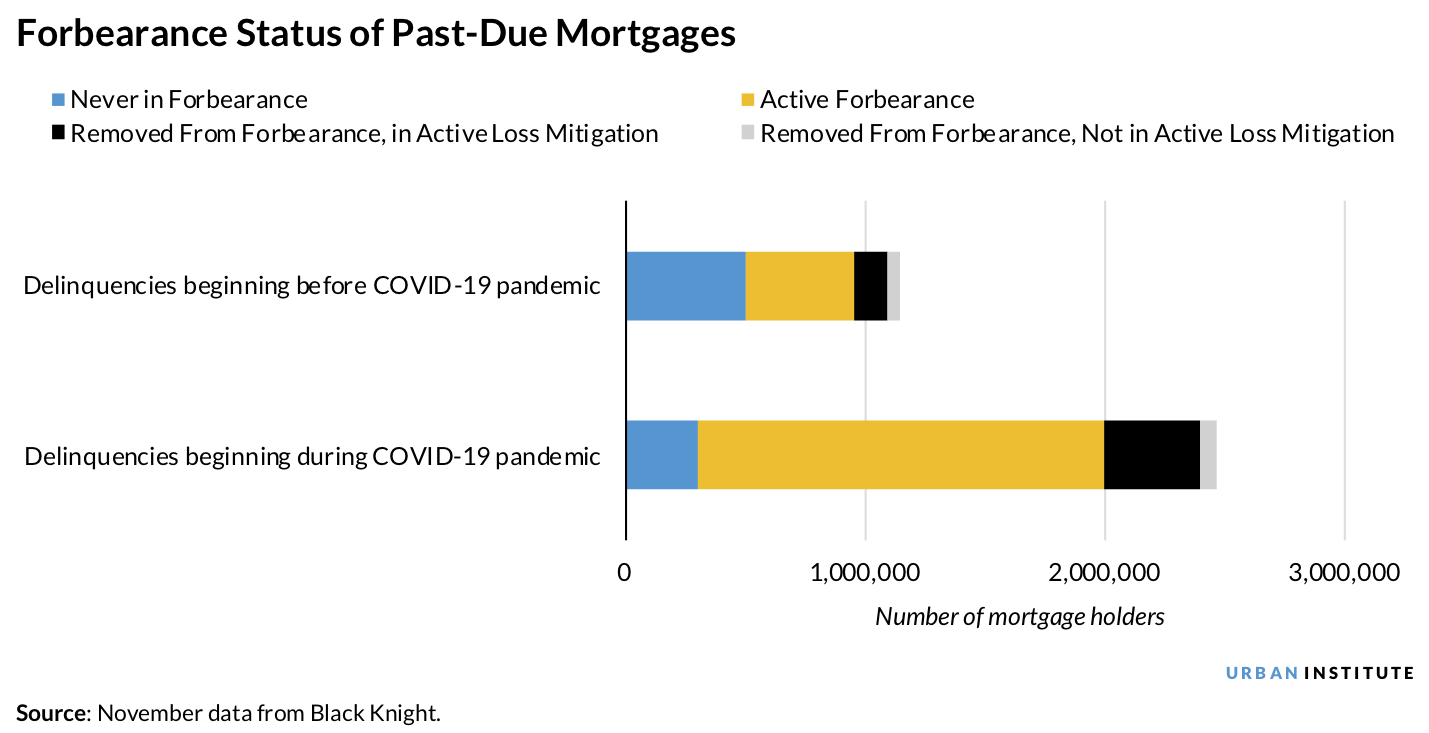

The Urban Institute (UI) recently held a webinar with housing experts to look at distress in the housing market. In a report on the findings, researchers Jung Hyun Choi and Daniel Pang say that, as of November, 3.7 million homeowners who had taken advantage of forbearance as the pandemic began have left the programs while 3.2 million others continue to struggle. About 2.8 million remain in active forbearance while another 369,000 are delinquent on payments but are not in plans. Many of those in active forbearance have reached their sixth month, requiring them to either leave their plans or request an extension.

UI reports there are many households which are delinquent but have not pursued any loss mitigation. There is a lack of homeowner awareness of payment options, and stark disparities in housing payment status by race, ethnicity, and income.

Webinar participants identified three priorities for policymakers, mortgage servicers, and financial institutions to help struggling homeowners.

The first is outreach to those borrowers who are delinquent but are not in forbearance. About 775,000 homeowners have fallen behind in their payments since the pandemic began and 299,000 of them were never in forbearance while 476,000 became delinquent after they exited it. Eighty-five percent of those are working with their servicers, but 40,000 have not entered loss mitigation. UI says, this number will likely grow when the maximum 12 months of forbearance expires in the spring.

Two webinar panelists, Dana Dillard of Housing Finance Strategies and Lisa Rice of the National Fair Housing Alliance pointed out that many households are facing multiple issues - health, struggling with their kids schooling, worried about employment. Even if servicers try to communicate and ease loss mitigation for clients, the process can still be complicated and repayment options challenging.

One solution could be housing counselors. Those approved by the Department of Housing and Urban Development were able to assist borrowers during the foreclosure crisis and Ellie Pepper of the National Housing Resource Center said, with adequate funding, they could do the same in this crisis.

A broader public awareness campaign could help homeowners who are in distress but not taking advantage of the help that is there. Efforts are being made, but the Housing Policy Council's Meg Burns said better data is needed about who these borrowers are and where they are located. Information is especially lacking in the private-label securities space.

A second need is to prepare for the wave of homeowners still in forbearance to exit this spring. They are likely to be in worse financial shape than those who exited earlier. They tended to be borrowers who continued to make payments during forbearance and those with Fannie Mae or Freddie Mac loans. The remaining 2.8 million will need additional support. About 23 percent of them say they don't know if they will have to make higher monthly payments or bring their loans current in one-lump sum. Fifty-four percent said they have little or no confidence that they will be able to resume monthly payments when forbearance ends.

Panelists said these numbers showed the need for a better communications plan from the industry. Various unique financial situations will affect how much borrowers can afford to pay each month. Diane Thompson of the National Consumer Law Center stressed that forbearance and repayment options should be clear and streamlined to avoid confusing servicers and consumers. She also emphasized the need for better government standards to bring clarity to the market.

The third need is to address the existing inequalities. Data show that households of color and those with lower incomes are more likely to fall behind on their housing payments. Inequalities that existed before COVID-19 could worsen as the pandemic continues.

Rice offered solutions to address these racial and economic disparities, such as halting negative credit reporting and strengthening antidiscrimination laws. Among other proposals were:

- Establish a "COVID-19" bond. These would be like the baby bonds suggested by Senator Cory Booker (D-NJ). A $1,000 initial endowment would be provided to every newborn. Family income would be the basis for additional contributions to the child's endowment. It would be held by the U.S. Treasury until the child is a young adult when it could be used to invest in an asset, such as education or a home. The COVID-19 bond would provide direct funding to those who have been hit hardest by the pandemic.

- Automatic forbearance for those who become 60 days non-current on their loans. Thompson early intervention is often more effective in helping households get back on track.

- Provision of more direct financial support to consumers during the crisis. Data shows that consumers have used unemployment benefits and stimulus checks to make both mortgage and rental payments.

All the panelists said it is important to tell the human stories behind the data. Linking the data and families through a compelling narrative is the best way to reach a wider audience and drive change.

They also said there will be other crises and it is not helpful for the housing industry to reinvent ad hoc responses each time. "Vulnerable homeowners deserve better policies and systems to enhance their financial resilience to weather COVID-19 and future crises," UI says.