Mortgage delinquencies continued to decline in October according to information released today by Lender Processing Services. At the same time foreclosure inventories reached a record high during the month, now representing 4.29 percent of all active mortgages.

The total delinquency rate in the country is now 7.93 percent down from 8.09 percent in September and 9.29 percent in October 2010. The delinquency rate is now 30 percent below the peak reached in January 2010. However, as the average days of delinquency have steadily increased, so has the foreclosure inventory, i.e. those properties that will in all probability become owned real estate (REO) at some point. The pre-foreclosure inventory now stands at a rate of 4.29 percent, up from 4.18 percent in September and 3.92 percent a year earlier.

The average delinquent loan in foreclosure has been delinquent for 631days. At the beginning of the foreclosure crisis an average foreclosure took 251 days from the first missed payment. The length of the process has increased by three months just since the beginning of this year. The average days that a loan is seriously delinquent (90+ days) before the foreclosure process is implemented, however, declined for the second straight month in October and is now 388 days.

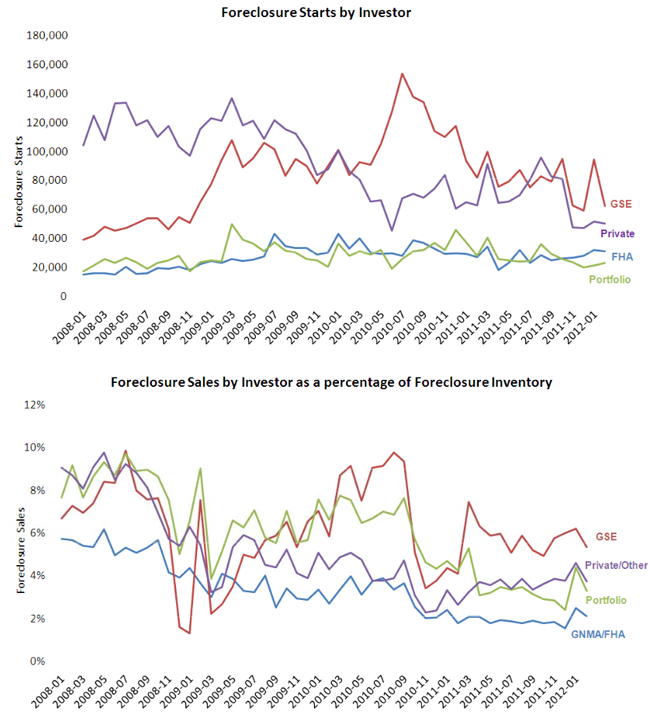

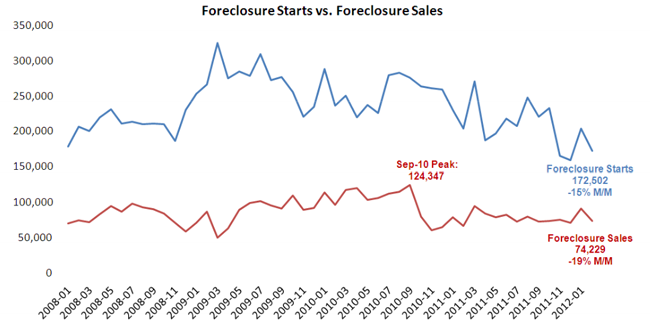

There were over 200,000 foreclosure starts in October with about 42 percent of them being repeat starts, as persons who were previously in foreclosure and cured or were able to modify their loans fell into trouble again. Repeat starts have increased about ten percentage points in the last three months.

Judicial vs. non-judicial foreclosure processes remain a significant factor in the reduction of foreclosure pipelines from state to state, with non-judicial foreclosure inventory percentages less than half that of judicial states. This is largely a result of the fact that foreclosure sale rates in non-judicial states have been proceeding at four to five times that of judicial. Non-judicial foreclosure states made up the entirety of the top 10 states with the largest year-over-year decline in non-current loans percentages.

The states with the highest percentage of non-current loans are Florida, Mississippi, Nevada, New Jersey, and Illinois.

FHA loans originated in the period 2008 to 2009 are defaulting at record rates. Nearly $25,000 million in loans from that vintage have missed more than 15 payments and another $18,000 million have missed 12.

The October data also showed that mortgage originations are on the rise,

reaching levels not seen since mid-2010. Mortgage prepayment rates have also

spiked, as much of the new origination is related to borrower refinancing;

loans originated in 2009 and later are the primary drivers of the increase. As

they have since the beginning of the housing crisis, the GSEs and FHA continue

to represent the majority of the market, now a total of 87 Percent as of the

end of Q2.