Touting its record of on-target estimate, CoreLogic has again anticipated the official conclusions about 2015 mortgage originations in advance of the annual release of HMDA data. The Home Mortgage Disclosure Act (as amended by the Dodd Frank Wall Street Reform and Consumer Protection Act) mandates lenders to maintain and report data on mortgage denial rates, borrower and applicant information, mortgage pricing, and the level of originations.

The Consumer Finance Protection Bureau is the recipient of lender reports and will release 2015 data in September. Principal Economists Molly Boesel, writing in the company's Insights blog says last year when CoreLogic did an advanced estimate on mortgage originations using public records deed information it missed the actual CFPB numbers by 4 percent, but its average in prior years has been even better.

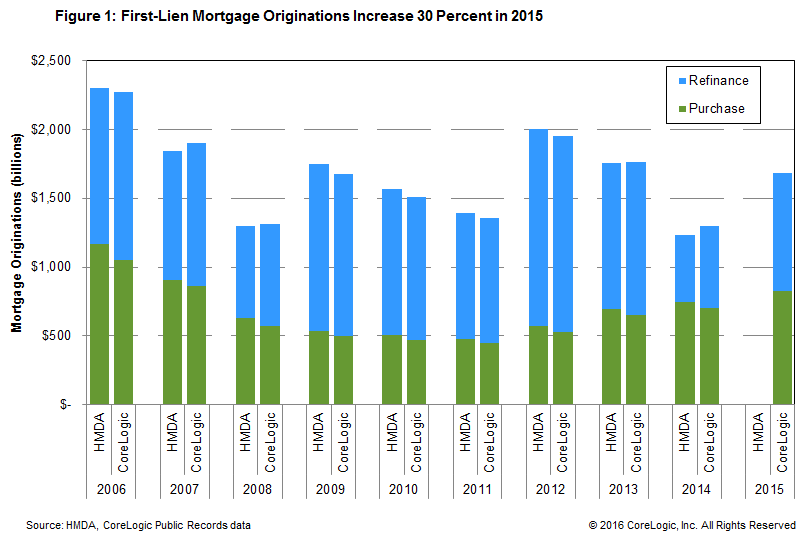

This year CoreLogic says its own data shows that mortgage originations in 2015 were up by 20 percent compared to 2014. After reached a post-crisis high of about $2 trillion in 2012, originations then slipped for two consecutive years. The anticipated 2015 rebound, the company said, resulted in seven million mortgage originations and a dollar volume that rose 30 percent to about $1.7 trillion.

Boesel says that CoreLogic's estimates have historically been on target. Between 2006 and 2014 the discrepancy between its figures and the HMDA estimate has averaged 1 percent on the low side. Therefore, she expects the actual number will be slightly higher than the $1.7 trillion CoreLogic number. "Some lenders are exempt from HMDA reporting, and many analysts estimate that lenders reporting under HMDA cover about 95 percent of the mortgage market; therefore, we estimate that total market originations-after accounting for under coverage-was probably closer to $1.8 trillion."

Both purchase money and refinancing loans contributed to the overall increase in 2015 originations. CoreLogic's data indicates that purchase money loans increased by 13 percent in number and 18 percent in dollar volume. The number rose due both to an increase in home sales, which were up 6 percent year-over-year, and a 3 percentage point dip in the cash sales share. Strong home price appreciation and increased leverage provided by lower FHA premiums and new low-downpayment products, resulted in a higher dollar volume. The number of refinance originations increased 29 percent and the refinance dollar volume increased 44 percent.