Sometime things are just not worth the wait. The long-delayed December report on residential construction from the Census Bureau and the Department of Housing and Urban Development was finally released today, about five weeks later than scheduled, because of the partial government shutdown. Only one of the three indicators moved higher, and only marginally. Housing starts took an especially large hit and two of the three indicators are now badly lagging those of 12 months earlier.

Permits for privately-owned housing units moved higher by 0.3 percent in December to a seasonally adjusted annual rate of 1.326,000 units from a revised (from 1,328,000) 1,322,000 units. The December number is 0.5 percent higher than the permitting rate in December 2017. It was the second month that permitting moved higher; it had unexpectedly gained 5.0 percent in November.

Single family authorizations were at a rate of 829,000, down 2.2 percent from November's rate of 848,000 and 5.5 percent lower year-over-year. Permits for construction of units in buildings with five units or more increased 5.7 percent from November to 460,000 units and were 13.6 percent higher on an annual basis.

Analysts polled by Econoday had not expected any increase in permitting. Their consensus was for an annual rate of 1,290,000 in a range from 1,230,000 to 1,308,000

On a non-adjusted basis, permits were issued for 95,400 residential units, down from 101,000 in November. Single family permits dropped from 60,900 to 53,400.

For the year through the end of December there were 1,310,700 permits issued, an increase of 2.2 percent from the same period in 2017. Single family permits increased by 4.0 percent to 852,700 while multi-family authorizations dropped 1.0 percent to 420,400.

Housing starts gave back all of their 3.2 percent increase in November and then some. The November estimate was revised down from 1,256,000 to 1,214,000 and then fell drastically in December to an annual rate of 1,078,000. This put starts 11.2 percent lower than the revised November estimate and 10.9 percent behind the December 2017 rate.

Single-family starts lost 6.7 percent from the revised (from 824,000,) November rate of 812,000 to 758,000. Multifamily starts were down 22.0 percent for the month and 15.9 percent annually to 302,000 units.

Analysts badly overshot the mark with even their lowest estimates for housing starts. They were looking for 1,260,000 units with a range of 1,200,000 to 1,296,000.

On an unadjusted basis there were 71,700 housing starts in December, 49,000 of which were single family. In November the respective numbers were 92,200 and 59,100.

For the year through December there were 1,246,600 total housing starts, a 3.6 percent increase from the same period in 2017. Single-family starts totaled 872,800 compared to 848,900, a 2.8 percent gain. Multi-family starts were 5.0 percent higher at 359,700 units.

The third indicator, completions, also declined on both a monthly and an annual basis. The 1,097,000 units completed were 2.7 percent and 8.4 percent behind the two earlier periods respectively. Single-family completions rose 0.1 percent to 790,000 but remained lower by 5.6 percent year-over-year. There were 296,000 multifamily units completed (annualized), representing 9.5 percent and 14.7 percent fewer than in November and a year earlier.

On an unadjusted basis, builders brought 103,700 units on line during the month, 77,200 of which were single-family residences. This was up from November's 94,700 unit total and 68,700 single-family units.

For the year through December 1,191,700 housing units were completed compared to 1,152,900 for the same period in 2017, a 3.4 percent increase. Single-family completions were up 6.2 percent to 844,300, while multifamily completions fell 2.5 percent to 338,300.

At the end of the reporting period there were an estimated 1,144,000 units under construction, 534,000 of which were single-family units. There were an additional 187,000 permits issued, 101,000 single-family, for which construction had not yet begun.

Because of the delayed reporting, the Census Bureau said the December numbers include late reports and corrections normally associated with the first revision to the estimates.

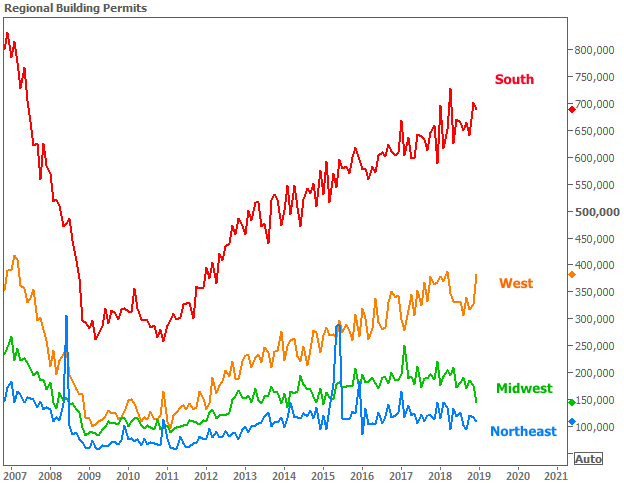

Permits in the Northeast were down 6.0 percent from November and 23.6 percent compared to a year earlier. Starts were unchanged from the previous month but were 21.6 percent higher year-over-year. Completions dropped by 39.1 percent and 29.6 percent from the earlier periods.

Permitting was down 17.6 percent in the Midwest for the month and was 34.1 percent lower than in December of 2017. Starts also fell, down 13.2 percent compared to November and 26.5 percent for the year. There were 5.1 percent fewer completions than in November and 25.1 percent less than 12 months earlier.

The South saw 2.0 percent slowdown in permits, but they were up 16.8 percent for the year. Starts fell by 6.0 percent but were running 6.1 percent higher than in December 2017. Finished units ticked up 1.8 percent from November but still lagged by 9.6 percent on an annual basis.

The volume of permits jumped 17.1 percent from November in the West and were 4.4 percent higher than the previous December. Starts plunged by 26.3 percent and 39.7 percent from the two earlier periods while finished units increased 5.8 percent and 12.6 percent respectively.