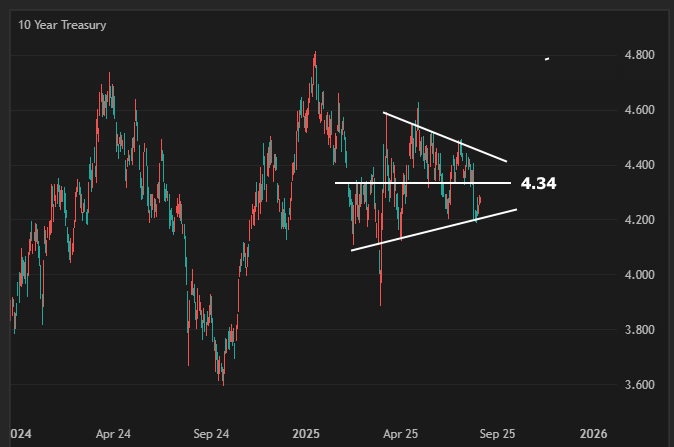

July represents the core of the summertime lull in financial markets. June and August are typically part of the lull unless econ data is suggesting an imminent shift in Fed policy. This is so well understood that back in May 2013, Kevin Brady famously asked Ben Bernanke if QE tapering could start before Labor Day. It was an odd question to anyone who didn't understand just how tuned out politicians and market participants can be during these months. Data-free Monday mornings during these months aren't necessarily forbidden from showing some volatility, but a flat trajectory is the least surprising thing to see at the start of the week. Yields have been orbiting 4.34% in an increasingly narrow range. This is good perspective considering the last 2 jobs reports seemed like "big deals" relatively, but actually fit inside this consolidation pattern.

Tomorrow could be a different story due to the CPI release--one of the only economic reports that can overcome the sideways summertime momentum.