Interest rates are modestly higher this morning after equities closed nearly 3% higher Wednesday.

Ninety minutes before the opening bell, S&P 500 futures are just below yesterday's high at 1081.25 and the benchmark 10-year Treasury note is -0-04 at 100-09 yielding 2.593% (+1.3%). The October delivery FNCL 4.0 is -0-02 at 102-27.

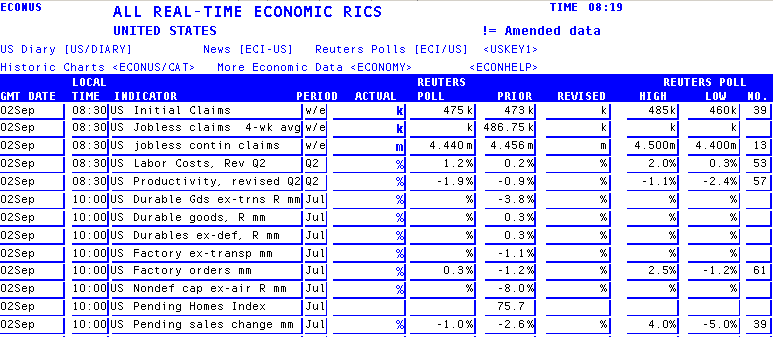

A busy economics calendar carries the potential to shift market sentiment in the day ahead.

At 8:30, initial jobless claims are anticipated to rise 2k to show that 475,000 Americans filed for first-time unemployment benefits in the final week of August.

The labor news comes one day before the official monthly numbers are released. The report should give further context to yesterday’s mixed data ― the ADP report showed 10k private jobs disappeared in the month, but the jobs component in the influential ISM manufacturing report posted its highest level on record.

“The ADP report has underestimated private-sector job growth in the BLS survey in 10 of the past 12 months, and we’re expecting about 30,000 private-sector jobs to be added in tomorrow’s report,” said economists at BMO Capital Markets.

Taking into account government sector lay-offs resulting from temporary census jobs, the economists said to look for total jobs to fall by 115,000 in the month.

Also at 8:30 is revisions to second-quarter productivity and costs. The consensus looks for productivity to decline by 1.9%, compared with 0.9% in the original estimate. Labor costs, by contrast, are thought to have risen 1.2% versus a first estimate of just 0.2%.

“An increase in unit labour costs would follow sharp declines in 4 of the past 5 quarters, which has helped juice corporate profit margins,” the BMO economists said. “Unit labour costs were down 3.5% y/y in 2009Q4, the steepest decline since 1950, and were still down a hefty 2.8% y/y in the preliminary Q2 release.”

At 10:00, July’s pending home sales index is anticipated to to fall 1.5% market, following a 2.6% decline in June.

Economists at Nomura point out that pending sales, which lead actual home sales by 1-2 months, “declined precipitously earlier this year on the expiration of the federal homebuyer tax credit” and has since “languished at low levels.”

They expect the trend to continue in July as mortgage purchase applications and homebuilder sentiment remain weak.

Other Events

09:00 -Fed Chair Bernanke and FDIC Chair Bair at Financial Crisis Inquiry Commission

09:05- Cleveland Fed President Pianalto (voter) and FRB Boston's Rosengren (voter) give perspectives at the REO and Vacant Property Strategies for Neighborhood Stabilization Summit; No Q&A

11:00 - Treasury announces the terms of the 3 year, 10 year, and 30 year bond auctions to be held next week.

Here are Reuters consensus estimates: