Mortgage rates moved slightly lower yesterday as the interest rate market made modest improvements in the second half of the trading session. This allowed many lenders to reprice for the better at the end of the day. Both stocks and bonds rallied yesterday, this is not a normal occurrence. Typically when one market is rallying, the other suffers. For example if the stock market is moving higher, market participants sell less risky assets, such as benchmark Treasuries and agency mortgage-backed securities, to finance the purchase of higher yielding stocks. This generally results in higher Treasury yields, lower MBS prices, and an uptick in mortgage rates...that wasn’t the case yesterday as both the fixed income sector and the stock market rallied.

Lots of economic data hit news wires today.

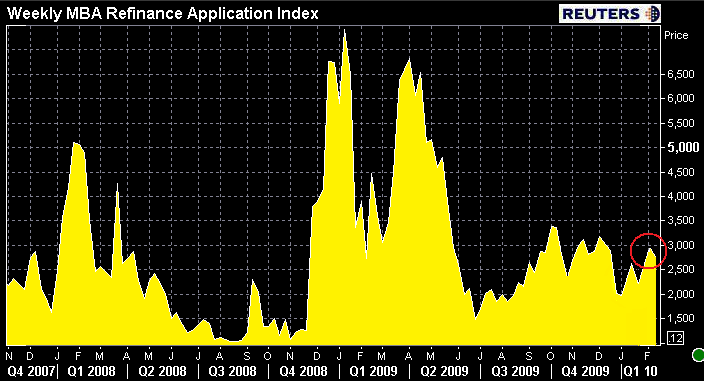

First out was the Mortgage Bankers Association Weekly Application Survey. The MBA survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. A rising trend of mortgage applications indicates an increase in home buying interest, a positive for the housing industry and economy as a whole. Furthermore, in a low mortgage rate environment, such a trend implies consumers are seeking out lower monthly payments which can result in increased disposable income and therefore more money to spend on discretionary items or to pay down other debt.

Last week’s survey indicated total mortgage applications declined 1.2%. Purchase applications fell 7.0% while refinance activity posted improved 1.3%.

According to today's release, which reported on loan demand in the week ending February 12, 2010, mortgage applications fell 2.1%. Below is a recap of the data using the text of the release:

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 0.5 percent compared with the previous week.

The Refinance Index decreased 1.2 percent from the previous week. The refinance share of mortgage activity decreased to 69.3 percent of total applications from 69.7 percent the previous week.

The seasonally adjusted Purchase Index decreased 4.0 percent from one week earlier.

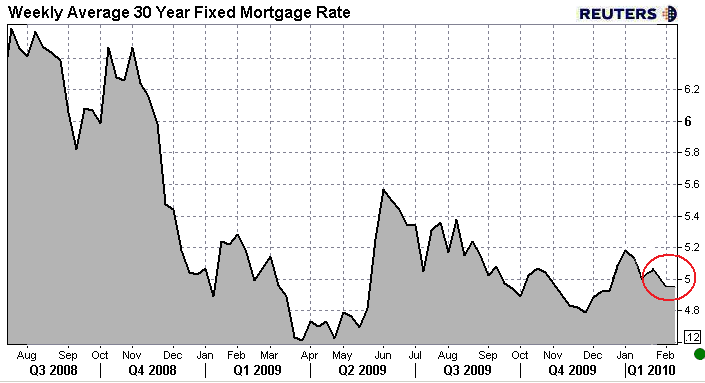

The average contract interest rate for 30-year fixed-rate mortgages remained unchanged at 4.94 percent, with points increasing to 1.09 from 1.06 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The average contract interest rate for 15-year fixed-rate mortgages remained unchanged at 4.33 percent, with points increasing to 1.02 from 0.95 (including the origination fee) for 80 percent LTV loans. The average contract interest rate for one-year ARMs decreased to 6.67 percent from 6.68 percent, with points decreasing to 0.32 from 0.35 (including the origination fee) for 80 percent LTV loans.

While it's disappointing that mortgage rates below 5.00% are not enough to stimulate activity in the housing market, this is nothing new to us as we believe the majority of borrowers, at least the borrowers who qualify, already refinanced in 2009. This leaves the mortgage market highly reliant on purchases in the year ahead.

Housing Starts and Building Permits were also released this morning.

Housing Starts data estimates how much new residential real estate construction occurred in the previous month. New construction means digging has begun. Adding rooms or renovating old ones does not count, the builder must be constructing a new home (can be on old foundation if re-building). Although the report offers up single family housing, 2-4 unit housing, and 5 unit and above housing data...single family housing is by far the most important as it accounts for the majority of total home building.

Building Permits data provides an estimate on the number of homes planned on being built. The number of permits issued gauges how much construction activity we can expect to take place in the future. This data is a part of Conference Board's Index of Leading Economic Indicators.

In the previous release, which reported on December data, Housing Starts declined 4.0% to an annualized pace of 557,000 while Building Permits posted an impressive 10.9% gain.

In the release published today, Housing Starts were better than expected at an annualized pace of 591,000. Economists expected a read of 580,000. Building permits declined 4.9% to an annualized pace of 621,000, this was in line with expectations. AQ wrote commentary on the release. READ MORE

We also got a reading on inflation with the release of Import/Export prices. This report is not as important as the next two reports on inflation which come tomorrow and Friday with the release of the Producer Price Index and the Consumer Price index, respectively. Today’s report showed the prices of items we export rose 0.8% last month while the prices of items we import posted a higher than expected 1.4% rise. The increase in import prices was fueled by a weak dollar and a surge in the price of petroleum. When excluding oil from the data, import prices posted only a 0.6% increase. Today’s report continues to show inflation in check, but the increase in import prices might be an indicator of future inflationary pressures.

Our final economic report out today was Industrial Production. This data gives economists a measure on the strength of the manufacturing sector. The release of the report indicated production increased 0.9%, which was slightly better than the anticipated 0.8% increase. This data supports the idea that an economic recovery in progress, which will continue to pressure interest rates higher.

At 2pm, the Fed released the minutes of the last Federal Open Market Committee meeting, which occurred 3 weeks ago. There were not many new things to report, if you are interested in reading more, HERE is some commentary.

After making marginal improvements yesterday, the interest rate market gave back all gains in the overnight session. This weakness was then supported by better than expected housing and industrial production data as well as a generally better outlook from the FOMC minutes. On top of that, stocks improved on the day. All of these factors combined to push mortgage rates higher at the open, and then even higher this afternoon as lenders repriced for the worse.

Reports from fellow mortgage professionals indicate lender rate sheets to be worse than yesterday. The par 30 year conventional rate mortgage remains in the 4.875% to 5.00% range for well qualified consumers. To secure a par interest rate you must have a FICO credit score of 740 or higher, a loan to value at 80% or less and pay all closing costs including an estimated one point loan origination/discount/broker fee. If you are seeking a 15 year term, you should expect a par rate in the 4.25% to 4.50% range with similar costs.

The Federal Reserve continues to support low mortgage rates via their daily purchases of agency mortgage backed securities. This has helped keep consumer borrowing costs low even as benchmark Treasury yields continue to rise. With the Fed's allocated funding almost exhausted, mortgage rates are expected to rise in the next month. That said, I still recommend locking all loans closing within the next 30 days. I think consumers 45 to 60 days from closing should be considering the same move. Although longer lock-in periods usually cost a few more basis points, removing the risk of rising rates is worth the cost. Typically a 45 day lock will cost you an additional fee of 0.125% while a 60 day lock will cost 0.250% to 0.375% points.