The FOMC minutes have been released. Here are some bullet points from Reuters.

- SEVERAL FED POLICYMAKERS SAW NEED TO BEGIN PROGRAM OF ASSET SALES "IN NEAR FUTURE"

- FED OFFICIALS EXPECT U.S. RECOVERY TO CONTINUE, BUT SEE SLOW PICK UP IN EMPLOYMENT GROWTH

- FED MINUTES SHOW NO CLEAR SIGN THAT OTHER OFFICIALS INCLINED TO AGREE WITH HOENIG DISSENT

- FED OFFICIALS AGREED ON NEED TO EVENTUALLY RETURN BALANCE SHEET TO MORE NORMAL COMPOSITION, HOLD ONLY TREASURIES

- SOME FED OFFICIALS SAID RESERVE DRAINS MAY BE SEEN AS PRELUDE TO TIGHTENING, SHOULD ONLY BE DONE WHEN READY TO RAISE RATES

- WEAK LABOR MARKETS IMPORTANT CONCERN FOR FED, CREATES UNCERTAINTY FOR ECONOMIC OUTLOOK, CONSUMER SPENDING

- FED OFFICIALS SAW UPSIDE VS DOWNSIDE RISKS TO ECONOMY AS ROUGHLY BALANCED

- FED SEES UNDERLYING INFLATION AS SUBDUED, AND LIKELY TO REMAIN THAT WAY FOR SOME TIME

- FED OFFICIALS AGREED CONSIDERABLE SLACK PRESENT IN ECONOMY, BUT DIVERGED ON HOW MUCH

- MANY FED OFFICIALS THOUGHT USEFUL TO ADOPT "CORRIDOR SYSTEM" BETWEEN DISCOUNT RATE AND INTEREST ON RESERVES

- POLICYMAKERS THOUGHT A FUTURE PROGRAM OF "GRADUAL ASSET SALES" COULD HELP SHRINK BALANCE SHEET

- MANY FED OFFICIALS CONCERNED ASSET SALES COULD CAUSE MARKET DISRUPTIONS

- SOME FED OFFICIALS BELIEVE UNEMPLOYMENT RATE MAY BE OVERSTATING DEGREE OF SLACK RELATIVE TO PAST PERIODS OF HIGH UNEMPLOYMENT

- FED OFFICIALS DISCUSSED DROPPING REFERENCE TO ASSET "PURCHASES" IN FAVOR OF ASSET "HOLDINGS"

- HOENIG, IN DISSENT, SAID BETTER FOR FED TO EXPRESS EXPECTATION FED FUNDS RATE "WOULD BE LOW FOR SOME TIME"

- HOENIG BELIEVED HIGHER FED FUNDS RATE SOON WOULD LOWER RISK OF FINANCIAL "IMBALANCES," INCREASE IN INFLATION EXPECTATIONS

- PARTICIPANTS NOTED PICKUP IN GLOBAL GROWTH COULD PUSH UP ENERGY, COMMODITIES PRICES, PUT UPWARD PRESSURE ON INFLATION-FED

The main focus of MBS market watchers is policy maker discussions regarding the timing of asset sales. If the Fed starts to sell their MBS holdings "in the near future", it would increase implied volatility in the rates market and throw off supply/demand stability in the TBA MBS market. This would force other MBS holders to sell their coupons as they lost value relative to benchmark TSYs. Selling would snowball if the Fed offloaded a sizable amount of their MBS portfolio and mortgage rates would rise.

That said, I find it highly unlikely that the Fed does anything other than let their MBS holdings run off the balance sheet, especially with FN/FRE running out of room of their own balance sheet. The immediate reaction in relative value makes it clear that the market feels the same way I do about the possibility of the Fed selling MBS holdings. Yield spreads moved tighter!

In regards to hints of an MBS Program extension, I didn't see anything in my first review of the text.

After the release, 10 year TSY yields moved as high as 3.744% before falling back down to 3.729%. We are now outside the comfy confines of the 3.57 to 3.71 range.

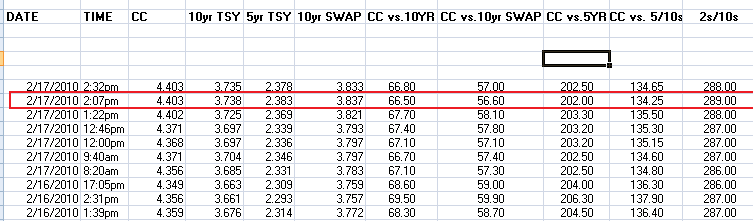

"Rate sheet influential" MBS prices are weaker as well. The FN 4.0 is now -0-15 at 97-22 yielding 4.221% and the FN 4.5 is -0-11 at 100-23 yielding 4.423%. The secondary market current coupon is 4.403%. The CC yield is 66.8bps over the 10 yr TSY note yield and 57bps over the 10 year swap rate.

THE REPRICE FOR THE WORSE ALERT IS STILL IN EFFECT