We almost never see mortgage bankers doing formal, ongoing due diligence on their counter-party risk, and it always concerns us.

A quick definition: “A review of how problems at a firm you do business with could negatively impact your own business."

For example...

A headline in American Banker caught our eye last week when we read that regulators issued a Prompt Corrective Action (PCA) letter to TierOne Bank. A PCA letter the final warning after Memorandums of Understanding and C&D’s have failed to bring is about the needed changes at the bank. The OTS has rejected the TierOne recapitalization plan and gave the bank till April 30 to enter into a merger agreement with a stronger bank and until May 31 to close the deal or raise additional capital, an amount estimated to be around $130 million. As someone said, a Prompt Corrective Action letter is the final “or else.”

A TierOne press release said it might not meet the OTS deadlines. They also announced that their newly appointed Chairman has resigned along with four Board members. Look, we’re all hoping for the best for the bank,but the news is not good. If you have a warehouse line with TierOne, a formal Due Diligence Program would have alerted you months ago to their regulatory issues and you could have started thinking about alternatives.

Another example...

As you probably know, MGIC and BofA are in arbitration over whether mortgage insurance claims should be paid on bad loans, with MGIC arguing that

Countrywide knowingly made loans it knew had no way of paying. Barron’s

cites as an example “…a woman who bought a $600,000 house, claiming she

worked at a California investment firm, earned $13,494.03 a month (nice

touch, that three cents), had a $45,000 bank account at Wells Fargo and

made a $30,000 down payment.”

When MGIC investigated, it discovered that (1) the investment firm the

borrower worked for didn’t exist, (2) the bank account didn’t exist, (3)

there had been no down payment, and (4) she actually made $3,901 a

month as a janitor. Whatever happens on the insurance claim, why haven’t

charges been filed against the loan officer and underwriter who were

involved in that loan?

Another example...

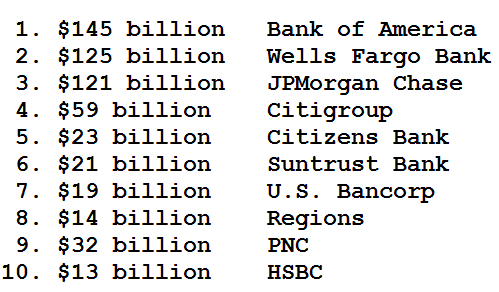

Home equity loans may not be worth par, but the banks still own tons of them. The top holders are:

Last thought...

We’ve now heard of two mortgage bankers whose applications to buy

banks were ultimately turned down by regulators for having "overly

aggressive growth outlooks". This makes us furious, not at the

mortgage bankers but at their advisers and attorneys for allowing a

business plan to be submitted that could be seen as unfeasible.

Owning a bank is a long-term investment, and trying to

grow too much the first several years is not looked upon favorably by

regulators – and is typically not a good idea in itself.

The point of looking at counterparty risk on an ongoing basis is to keep you from being caught off-guard when a key partner/vendor runs into trouble or is on course to not meet expectations.