Audited financials are starting to come in, and they’re confirming what we saw all year.

Top performing mortgage bankers made 90-100 bps per loan. That means, for every $100 million you closed, you should have (and could have) earned $900,000 to $1 million. If you didn’t make this much, you need to look carefully at why you didn’t. Or call us for a FOCIS-plus diagnostic to see what you can do to boost earnings per loan.

The top quintile of companies we worked with over the year made over 100 bps per loan, with the top performer making 121 bps. For every $100 million they closed, they made $1.21 million.

What most mortgage company Boards are somewhat clueless about is their earnings broken down into bps per loan. We see companies that did, say, $1 billion last year and earned 35 bps per loan. Although that makes the company a big underperformer, Directors or outside investors go “Gee, how about that, we made $3.5 million. Hot damn!” The reality is that they could have made at least 90 bps, which translates into $9 million!

What do you think of mortgage companies that use the word Bancorp in their name? It’s illegal to use the word bank unless you’re a real bank, but using the word Bancorp is legal. We know some very decent people that have Bancorp in their name, but we think it’s deceptive. If you’re not a bank, you shouldn’t use language to imply that you are one.

California’s General Obligation bonds yield about the same as bonds from Greece, but anyway, 30-year California G.O.’s are paying 6%. Because they’re exempt from state and federal taxes, higher-income Californians in a 40% combined federal and state tax rate get the equivalent of a 10% yield. Not bad.

This is depressing: We just read Time magazine, the one with Tom Hanks on the cover, and it has only 60 pages. We still have the November 6, 1989 Time which featured the breaking apart of the Soviet Union, and that issue was 119 pages. The latest issue of People magazine is 164 pages. We don’t even want to know what this says about our culture.

If you worry that there will be no one left to refinance soon, you should know that about 37% of all people with a mortgage have loans at 6% or higher. That’s $1.2 trillion sitting out there, and yes, many can’t be refinanced, but many can.

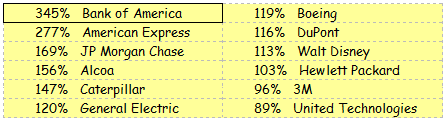

A year ago, everyone thought the world was coming to an end and that stocks were going to zero, but that was precisely when things bottomed out and started to turn around. Here are the top performs of the past 12 months.

A few others: Microsoft (88%), IBM (52%), Coca-Cola (38%), McDonalds (63%) and Wal-Mart (47%).

When you look at how Fannie Mae and Freddie Mac have changed things, one of the biggest changes is making refinancing much, much easier. Pre-1986, there was no premium pricing, and thus, there was no such thing as a no-points or no-cost loan. In about 1986, the two agencies started buying loans at prices above par, and the 1-2 point rebates allowed lenders to pay the loan officer’s commission and some of all of the closing costs. Prior to this, a refinance would cost the borrower points plus costs, and as a result, it didn’t make sense to refinance unless you could lower your rate by 2.0 points! Overnight, borrowers could refinance to save an eighth.

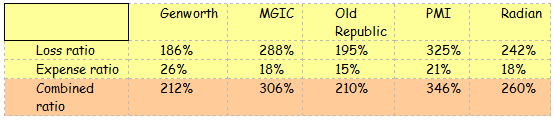

The Combined Ratio is a good way to measure insurance companies, and it seems to be just as meaningful for mortgage insurers. If the number is under 100, you’re making money. If you’re over 100, you’re losing money.

The M.I. companies are going through very difficult times, but the mortgage industry needs them more than ever, and they’ll come back strong.