Metrics for the Making Home Affordable Program (HAMP) improved substantially during March according to data released late Wednesday by the Treasury Department. The foreclosure prevention program, a joint effort by Treasury and the Department of Housing and Urban Development, has been widely criticized for its effectiveness in moving distressed borrowers into permanent loan modifications.

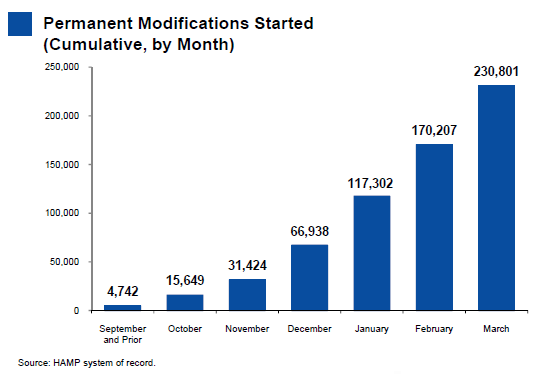

During the March, however, over 60,000 homeowners enrolled in the three month trial period required by the program were converted into permanent modifications. This brings the cumulative total of permanent loan modifcations to 230,801. The March conversions represent a 15 percent increase over the 53,000 accomplished in February and a 3.5-fold rise in permanent modifications since the first of the year. An additional 108,000 permanent modifications are pending; most are awaiting approval from the borrower.

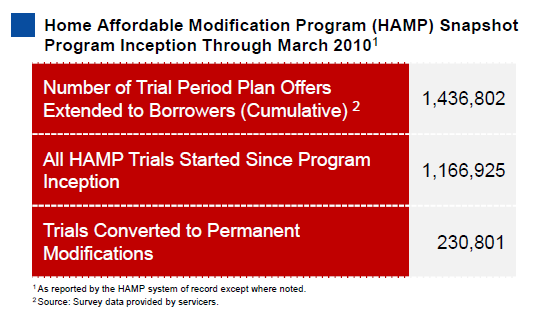

In terms of the overall conversion rate, 16.1 percent of all offers extended have been converted to permanent loan modifications. Much improved from last month's rate of 12.6 percent. When measuring performance against the number of HAMP trial offers that have actually been accepted, 19.8 percent of homeowners who have completed the 3-month period have been converted to a permanent modification. Again, much better than the 15.6 percent conversion rate reported in February.

The number of homeowners entering the program, however, is declining as might reasonably be expected after the initial flood of applicants. There were 57,000 new entrants into the program in March compared to 72,000 in February. A total of 1.44 offers for modifications have been extended to borrowers and 1.17 million homeowners have started the trial modification program.

There was a large number of trial modifications cancelled during the month. Since the program started in the spring of 2009, there have been a total of 155,000 cancellations, 66,500 of which were recorded in March. The report provided no explanation for this number. A total of 2,879 permanent modifications have been cancelled compared to 1,400 reported last month.

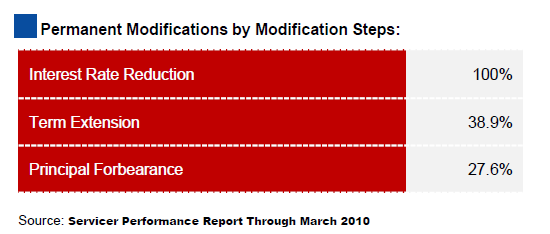

Under HAMP, borrowers are offered a five year modification of their existing mortgage based on a debt to income ratio that cannot exceed 31 percent. The servicers who administer the program can offer an extension of the loan term, a reduced interest rate, and/or a reduction of the principal balance. 100 percent of the modifications to date have included an interest rate reduction, 39 percent have involved an extension of the term of the loan and 28 percent have had some type of principal reduction or forbearance. Servicers have been reluctant to offer forbearance to borrowers and HAMP has recently announced a new component of the program to encourage this method of modification.

The HAMP report estimates that approximately 6 million residential mortgages are currently 60 days or more in arrears and that approximately 1.7 million of these are eligible for the HAMP program. Servicers are encouraged to contact borrowers to request information regardless of their apparent eligibility. To date servicers have sent out over four million solicitation letters.

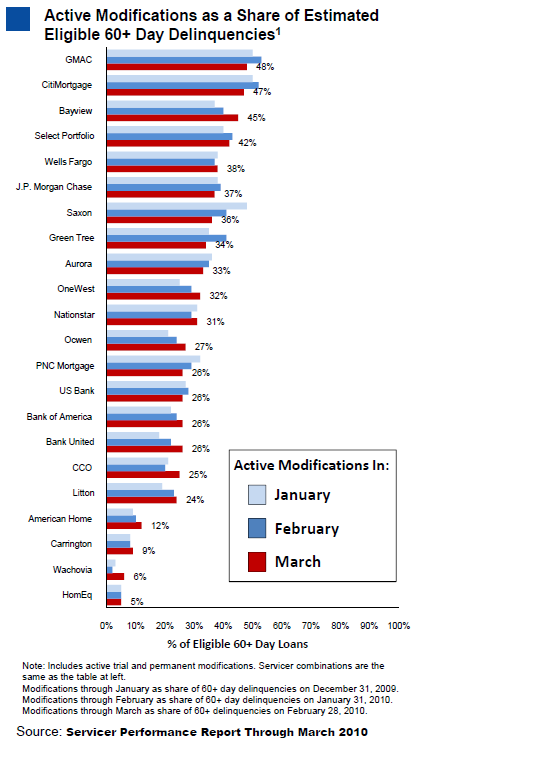

CitiMortgage and GMAC continue to be the most active participants in the program; both have nearly 50 percent of their estimated eligible borrowers enrolled in trial or permanent modifications.

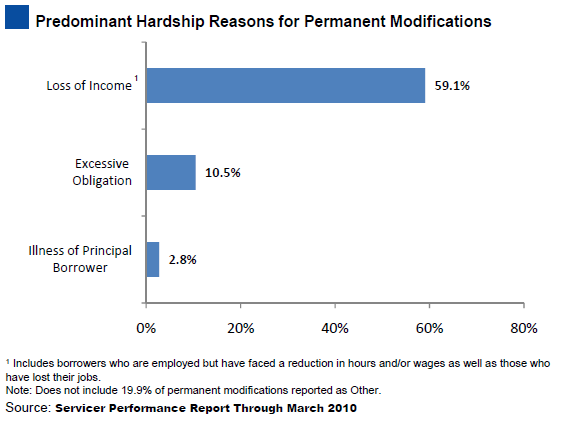

The reasons for delinquency as reported by the borrowers have remained relatively consistent over the life of the program; 59.1 percent report that their hardship was caused by a loss of income (a slight increase from 57.4 percent in February), 10.5 say it is excessive obligations and 2.8 percent report their delinquency was principally caused by the illness of the principal borrower. Combined with the fact that 44.1 percent of the 6.5 million unemployed Americans have been out of work for longer than six months, this statistic implies the true test of HAMP's success will be whether or not permanent loan modifications are able to avoid re-default.