Carol Galante, FHA's new acting commissioner presented highlights of the agency's FY2011 Report to Congress in a press briefing on Tuesday, telling reporters that FHA's Mutual Mortgage Insurance Fund (MMI) will return to mandated levels slightly ahead of schedule and that the agency is continuing to work its way through its legacy loan losses.

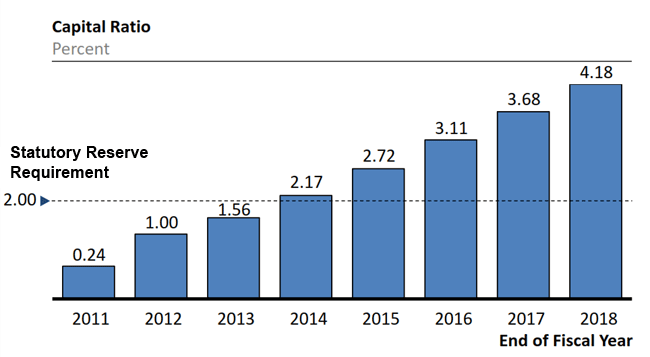

FHA's capital reserve ratio measures reserves in excess of those needed to cover projected losses over the next 30 years. The independent actuarial reviews of the MMI Fund estimate FHA's capital reserve ratio to be 0.24 percent of total insurance-in-force this year, falling from 0.50 percent in 2010. Congress has mandated a capital reserve ratio of 2.0 percent. FHA's total liquid assets (cash plus investments) grew by $800 million since last year, to $33.7 billion. That amount is $1.9 billion higher than at the end of FY 2009, and is also $7.7 billion higher than was predicted last year by the independent actuaries. At the same time, the economic net worth of the Fund fell by $2.1 billion this year, from $4.7 billion to $2.6 billion, as FHA continued to build loss reserves to prepare for greater claims in the coming years

A number of factors have negatively impacted the evaluation for the year, including:

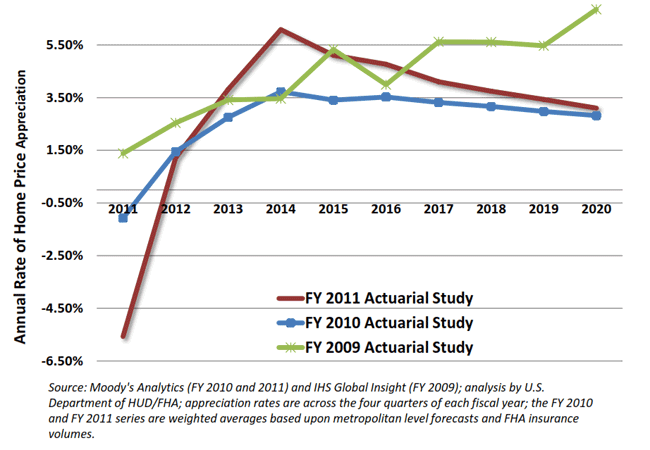

- An additional 5 percent decline in home prices in the base-cast forecast;

- Increasing numbers of active loans with previous defaults.

- The large number of loans caught in lengthy period of serious delinquency and foreclosure due to litigation and settlement discussions over servicing concerns;

- An actuarial assumption that the above concerns will lead to insurance claims rather than another form of resolution.

The actuaries find that FHA's current underwriting and premium structure have created a sound basis for growing capital at a rapid rate once the economy and housing markets stabilize and their base-case projections show capital ratios reaching the mandated 2 percent in 2014, earlier than was projected in last year's report. This three-year recapitalization projection matches FHA experience in the 1991-94 period.

The book of business generated from Q2

2009 is expected by the actuaries to be profitable, providing significant

revenues to offset losses from earlier business. Final losses on loans endorsed from 2000

through the first quarter of 2009 are expected to exceed $26 billion with 2008

alone costing close to $10 billion.

Claim rates on 2006-2008 loans could go over 20 percent.

Though they were prohibited in 2009, the ongoing effect of so-called "seller-funded downpayment assistance loans" is still significant. The net expected cost of those loans, as projected by the independent actuaries, grew by $1.8 billion over the past year to $14.1 billion.

Net income generated by business generated since Q2 2009 is $18 billion and early payment default rates are a negligible .35 percent compared to 2.23 percent in January 2008. Under the base-case forecast used by the actuaries, the FY 2012 book will add an additional $9 billion in economic value to the Fund.

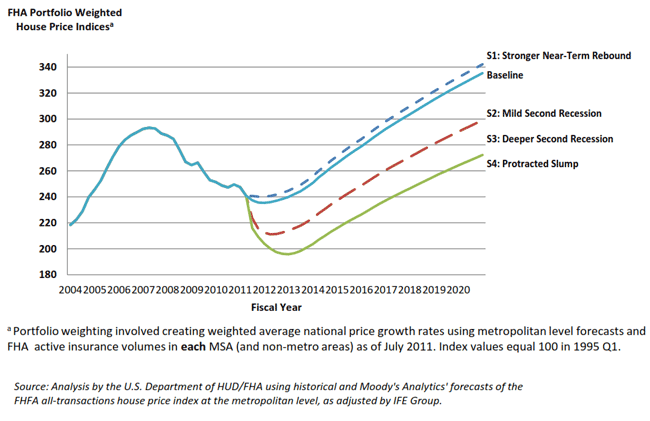

The base-case scenario from Moody's Analytics indicates price declines this year of 5.6 percent and a small increase of 1.3 percent in 2012 followed by steady growth. Galante cautioned that there are remaining risks including continuing significant declines in home prices which would require addition support for the current portfolio. The first support would come from the FY2012 book of business, estimated to be worth $9 billion. Actuarial estimates indicate that price declines in 2012 would have to rival those of 2011 before support beyond this would be needed. In that event, however, FHA would implement policy changes including additional premium increases. Only under the worst case would FHA look to the Treasury for support, but under current law it has permanent and indefinite budget authority to do so.

Galante said that the worst case home price scenarios are based on extreme declines in value occasioned by a second recession creating a 9 percent decline beyond the 5.6 percent decline in the base-case and there is no evidence this will happen. She said that the fund could withstand an additional 4 percent decline in prices beyond the base case without experiencing a negative capital situation.

FHA has taken steps to effectively manage future risk:

- Premiums have been increased for single-family and HECM (reverse mortgage) programs and both are at historic highs.

- Changes have been made to the HECM program including development of the HECM Saver and new guidance for lenders for treatment of tax and insurance defaults.

- A comprehensive overhaul of single family loan review policies has resulted in changes designed to strengthen lender monitoring.

- FHA will soon issue a final rule to strengthen the requirements for lenders participating in the Lender Insurance Program.

- FHA is obtaining 21st century information technology systems and continues to develop and implement a comprehensive and integrated risk management system.

During the past year FHA has insured its third highest dollar volume ever, $236 billion including $218 billion in single family and $18 billion in HECM loans on a total of 1.27 million loans. FHA provided financing for 770,000 homebuyers, 75 percent of them first time buyers and accounted for 56 percent of all first-time buyers. The agency also provided refinancing for 440,000 homeowners and hit the 40 million mark for the total number of single family loans guaranteed by the agency.

During the year FHA cured 362,000 defaults and was working on 155,000 open cases to develop loan reinstatement plans. There had also been 26,000 short sales. The re-default rate on these loans in the lowest in the last five years and is down 8 percent from last year.

Galante was asked at the press conference about the impact of new, lower loan limits that went into effect on October 1. While it is too early to be definitive, she said, there will probably be little impact as higher balance loans constitute only 5 to 6 percent of FHA's total portfolio. If Congress should mandate a return to the higher levels for FHA but not for Fannie Mae and Freddie Mac, a plan currently under discussion, Galante said the agency would be happy to implement it but, as it would be breaking new ground, she would not estimate how much new business it might generate.

Another question involved the possibility of reevaluating the fees for a Streamline refinancing to make it possible for more people to refinance. Galante said that FHA had not yet done an analysis to see how many people might benefit from reducing or eliminating fees but that these fees were factored into actuarial projections and to change them would change the trajectory of the actuarial projections.