For the first time in at least 21 months, the delinquency rates for all categories of mortgages - prime, Alt-A, and subprime - decreased, according to the June Mortgage Metrics Reports for the first quarter of 2010 released today by the Offices of Thrift Supervision (OTS) and Comptroller of the Currency (OCC.)

At the same time, the number of foreclosures, including new foreclosures, foreclosures in process, and completed foreclosures increased substantially. Loan modifications also increased and there were indications that servicers are picking up the pace of converting HAMP trial modifications to permanent status. READ MORE

The overall delinquency rate for the portfolio stood at 6.5 percent for the quarter compared to 7.1 percent in the fourth quarter of 2009. This is a decline of 7.7 percent from the previous quarter but an increase of 36.8 percent year-over-year.

A breakdown by delinquency "bucket" shows the same pattern as has been evident in other recent studies - a decrease in delinquencies that is most pronounced in the early stages while the most severely delinquent numbers are much less fluid.

Mortgages that were 30 to 59 days delinquent represented 2.8 percent of the total portfolio compared to 3.4 percent in the last quarter of 2009. This is a drop of 17.7 percent in the quarter and a -3.6 percent change from figures in the first quarter of 2009.

Loans that were 60 to 89 days in arrears dropped 19.3 percent from the previous quarter, to a 1.3 percent delinquency rate, a year-over-year decrease of 7.3 percent.

The most severely delinquent (over 90 days) bucket did decline by 7.7 percent from the previous quarter, but was still up nearly 37 percent from a year earlier. When borrowers in bankruptcy, a number that has remained relatively stable, are removed from the most seriously delinquent group, the year over year increase rises to 60.3 percent.

Compared to the previous quarter, new foreclosures increased 18.6 percent, while foreclosures in process were up 8.5 percent, and completed foreclosures rose 18.5 percent. Over 1.2 million mortgages were involved in some type of foreclosure during the quarter, an increase of 37 percent over one year earlier.

While the Metric Report did not explain the declining delinquency rate as an indication that the worst is over as others have done with their own data, they did, as others have, account for the increased foreclosure rates as a result of servicers exhausting other options and beginning to move the large inventory of potential foreclosures through the system. READ MORE

Short sales are an increasing option to foreclosure, more than doubling from one year ago to 41,033 sales. This is an increase of 9.2 percent from the fourth quarter.

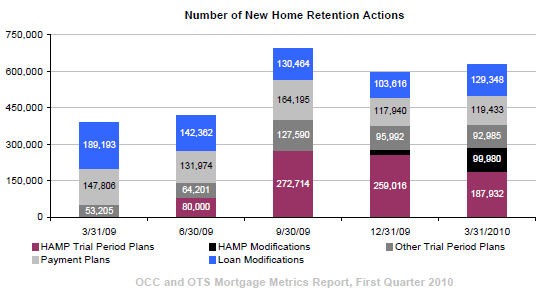

The number of modifications and other home retention actions increased to 629,678, an increase of 5.4 percent from the previous quarter and 61.4 percent from Q1 2009. The Home Affordable Modification Program (HAMP) accounted for 288,000 of the modifications with 188,000 borrowers entering the trial modification period. Just short of 100,000 borrowers converted from trial to permanent modifications, a whopping 385 percent increase over the fourth quarter, perhaps as a result of actions by HAMP administrators to more carefully monitor servicers, streamline documentation requirements, and recalibrate servicer incentives. 87 percent of all loan modifications reduced borrower payments and 55 percent of borrowers saw their payments reduced by at least 20 percent.

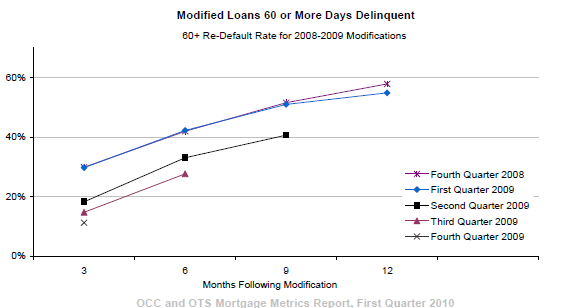

Modified loans still, however, have a poor prognosis. One year following modification more than half of the modified mortgages are 60 or more days delinquent. This, however, appears to be improving. Over half a million mortgages were modified in 2009 and nearly 52 percent of those were current at the end of the first quarter of 2010 compared to 27 percent of those that were modified during 2008. READ MORE