There are several interrelated factors which have led to a recent increase in the number of bank-owned properties (REO) nationally. While most measures of distress in the mortgage market, delinquencies, negative equity, foreclosure filings, and foreclosure starts, have been improving monthly, the REO inventory has grown from a post crisis low of 375 properties in August of 2013 to 430,000 in March of this year, an increase of 15 percent.

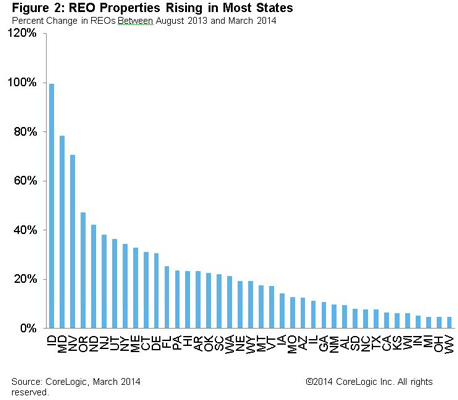

An analysis by CoreLogic, presented by Sam Khater on the company's Insights blog, found that the reversal has been broad based with REO up since last summer in 46 states. He points to Idaho where the number of properties in bank inventories nearly doubled in that time frame and Maryland which increased by 78 percent followed by Nevada (up 70 percent), Oregon (up 47 percent) and North Dakota (up 42 percent).

Khater says that there are several inter-related factors behind this increase. The robo-signing that servicers were engaged in was discovered in September of 2010 and many banks put an immediate foreclosure moratorium in place to investigate. By October the number of completed foreclosures which had been rising rapidly before the news broke dropped by one third. Even after the moratoria were lifted many servicers proceeded more cautiously in the process and the number of bank-owned properties did not begin to rise again until late 2011/early 2012 when the National Mortgage Settlement provided servicers with more clarity on foreclosure standards.

Coinciding with the widespread resumption of foreclosures was an increase in demand on the part of investors which more than offset the growing inflow of properties. That demand began to drop off in the fall of 2013 as rising home prices and mortgage rates made REO investment less attractive. Short sales, which had diverted many properties out of the foreclosure stream, peaked in early 2013 and began to decline, a drop that was accelerated at the beginning of this year when Congress failed to reauthorize the Mortgage Forgiveness Debt Relief Act of 2007.

Khater said that while the level of REO properties is below the peak it reached during the crisis we can assume that the rapid improvement that led to the trough in the inventory last summer is over and the market has entered a new phase as it continues to work through the legacy of the housing crisis.