Affordable housing isn't just a problem in high cost places like New York City and San Francisco according to a new study by the Urban Institute (UI) and the Federal Reserve Bank of Chicago. The creation of millions of new households every year will create more demand for housing than the nation is providing, and that will mean prices will rise even higher and faster.

The study, authored by UI analysts, Sarah Strochak, Bing Bai and Alanna McCargo and Taz George of the Federal Reserve says that the affordable housing crisis is usually associated with high rents and a limited inventory of housing, both new and existing, at the lower price end of the market. Since construction cannot be ramped up fast enough to fill the gap, existing homes must be made more available to potential homeowners. It is not only the shortage of low-cost homes but also the lack of traditional mortgage financing for small dollar purchases that is exacerbating the affordability crisis.

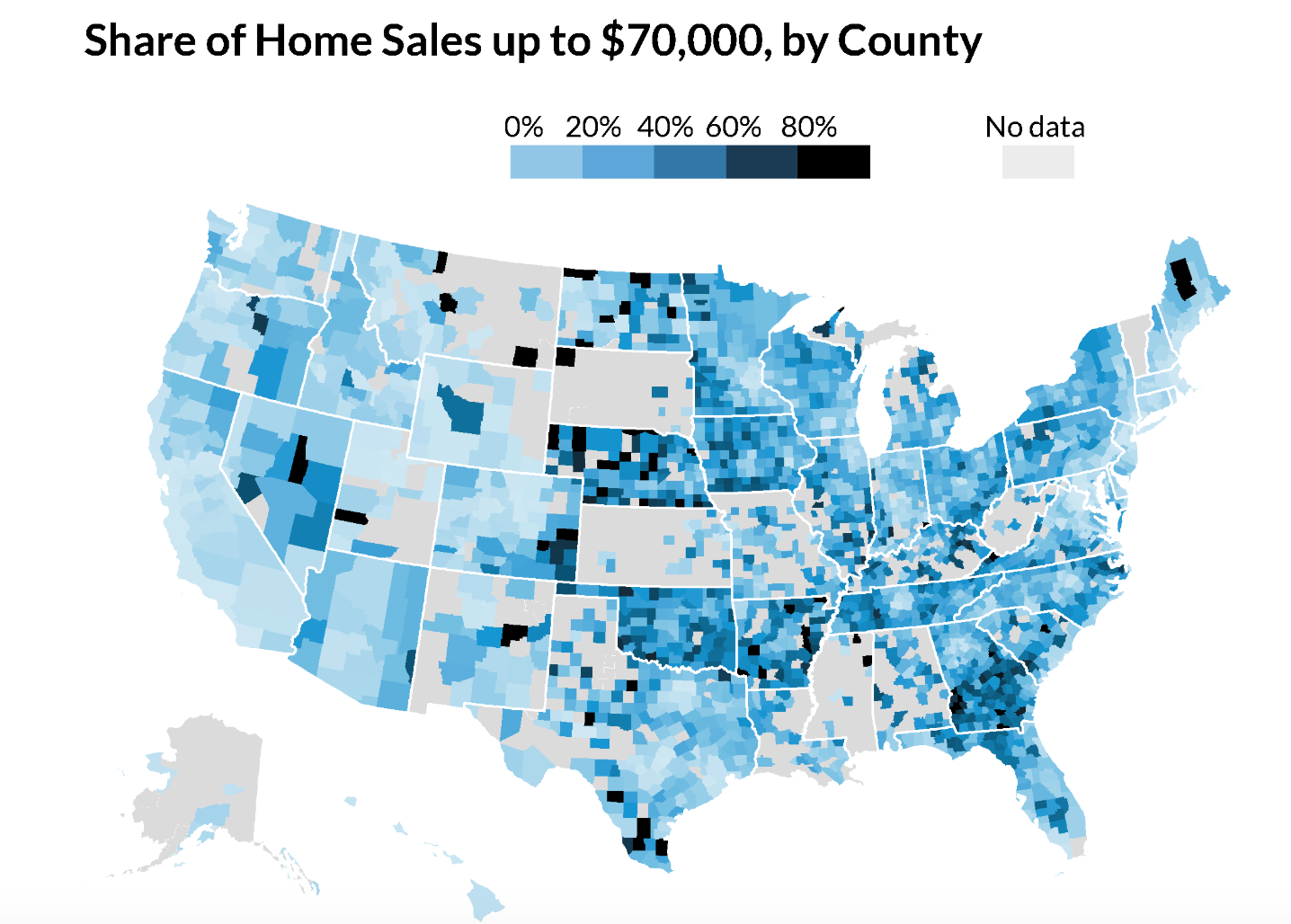

The analysts looked at every county with sufficient data to identify how much low-cost housing stock, which they defined as home sales under $70,000, was available. They found many counties, urban, rural, and suburban, with a large share of homes in this price range.

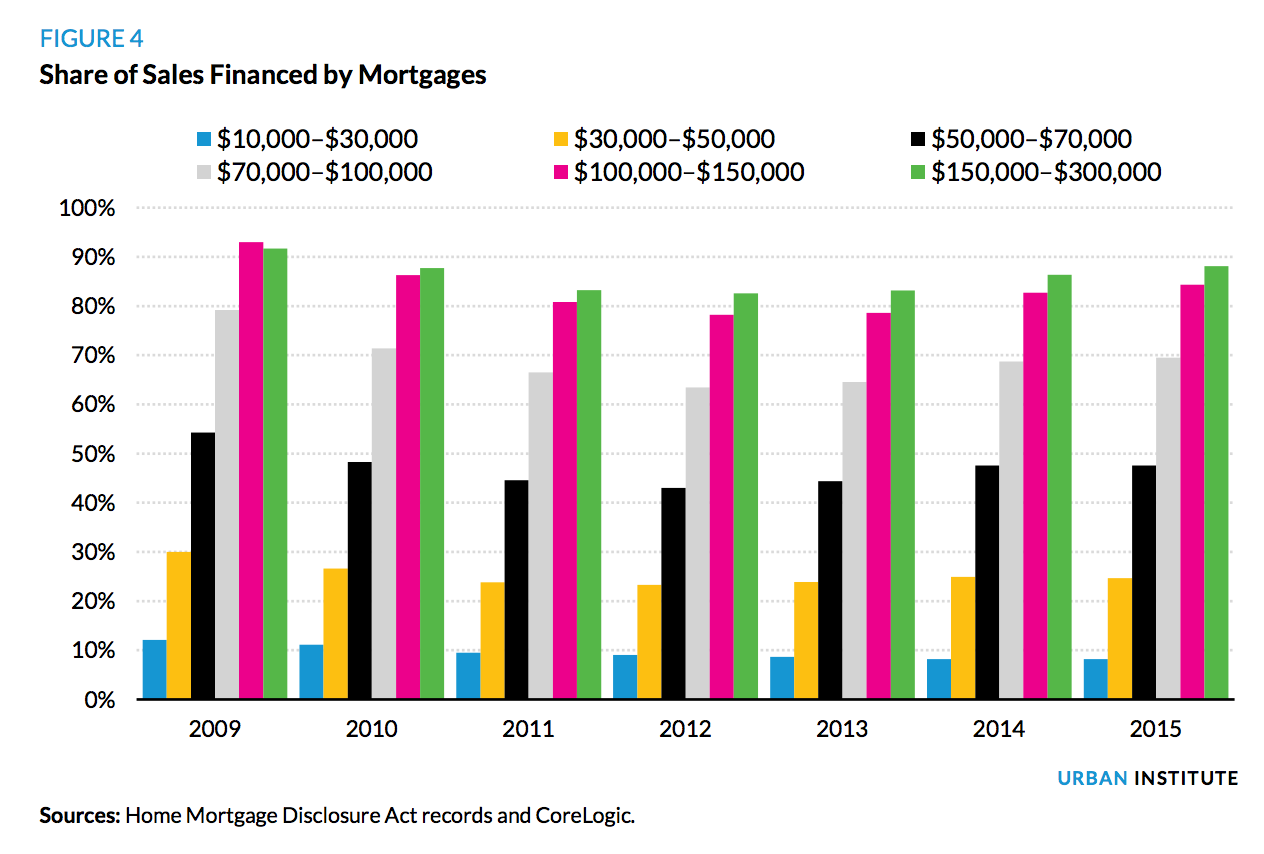

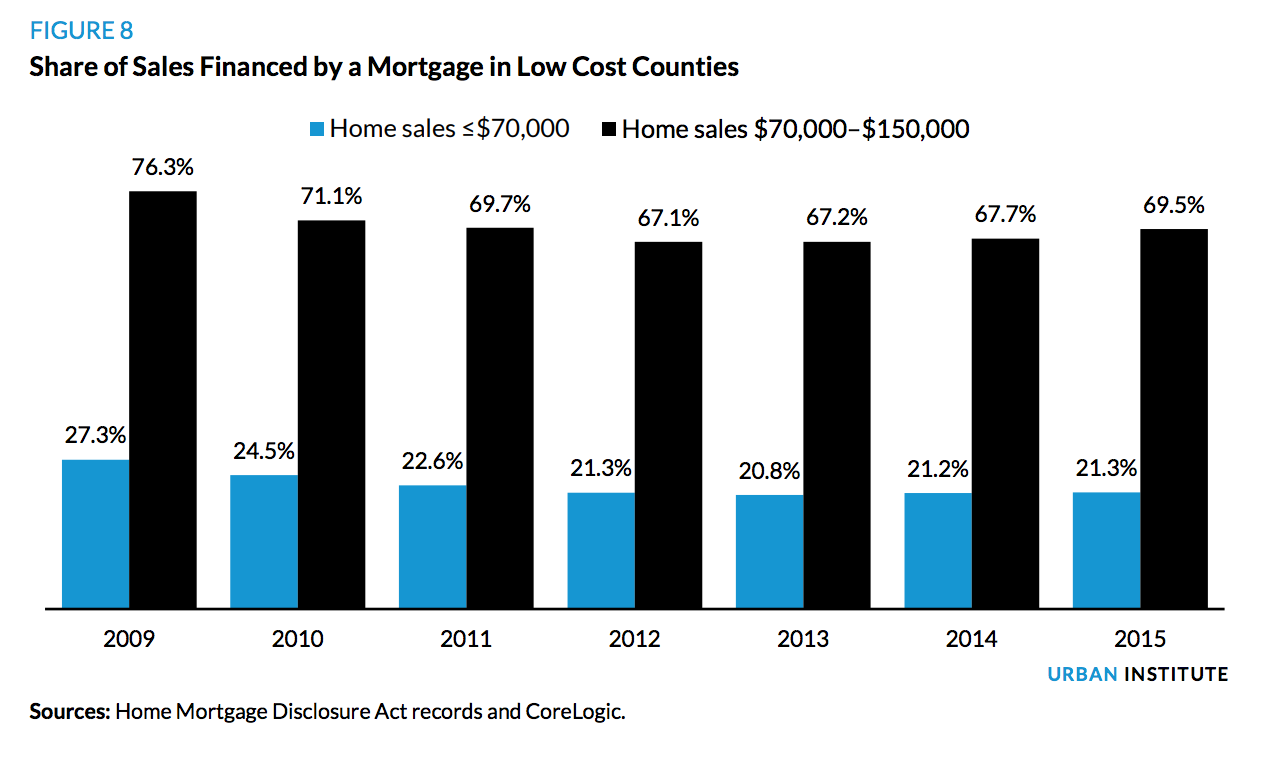

Of the single-family homes sold in 2015 in the US, 14 percent, or 643,000 homes, sold for $70,000 or less. That was the good news. But UI also found that these homes had primarily been purchased with cash. Slightly more than one-fourth were financed with traditional mortgages while among homes worth between $70,000 and $150,000, close to 80 percent of homes were purchased with a traditional mortgage product.

First-time homebuyers and low- and middle-income (LMI) households often need low-cost properties to transition into homeownership, but most don't have the cash to purchase even a low-cost home outright. That there are lots of such properties available doesn't help because traditional financing of these properties is too difficult to obtain Instead, these properties are purchased by investors, who rent out rather than move into the properties.

And the share of those low balance mortgages is declining. According to Home Mortgage Disclosure Act (HMDA) data there were 205,797 new first mortgages with balances from $10,000 to $70,000, originated in 2009, 8 percent of the total. By 2016 that share had shrunk to 5 percent while loans between $150,000 and $300,000 increased 61 percent and those over $300000 were up 142 percent and nearly doubled their market share. Rising prices were only partially to blame for the shift.

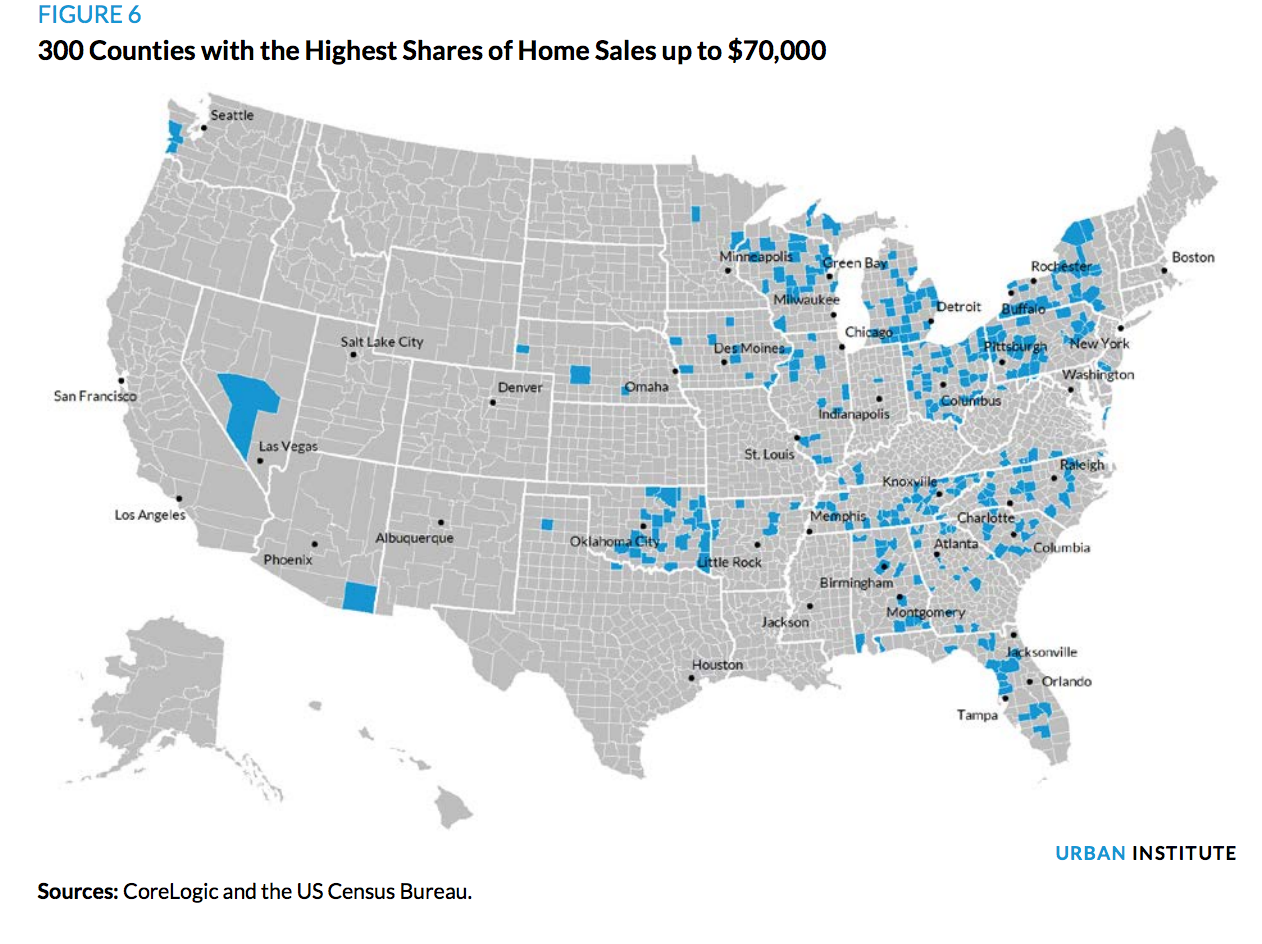

The study then focused on 300 counties that had the highest shares of low-cost sales among all counties with a minimum of 500 homes sold in 2015. The counties represented a mix of urban/rural and within/without metro locations. There were 449,000 homes sold in those counties, 10 percent of all U.S. sales and transactions under $70K accounted for 39 percent of the total compared to 14 percent nationally. Thus, the lack of credit access affected a larger share of their housing market.

Households in low-cost counties are more likely to be low income and live in older houses in need of repairs. While it may be more economical to own a home in low-cost areas, homeownership rates are only slightly higher than the US average, partly due to the lack of small-dollar mortgage financing. In 2015, only 21 percent of homes that sold for $70,000 or less in low-cost counties were financed by a traditional mortgage.

The study compared the household demographics of renters in low-cost areas and those who own low cost homes in the same areas. They found the median renter income is 20.5 percent below the median income of households who own a house worth $70,000 or less, but the median renter household could afford a $127,000 house with zero down payment. This suggests that many renters might be in the market for low-cost starter homes if they had adequate credit scores and could access reasonably priced small-dollar mortgages.

There is also a need for small-dollar mortgage credit for home improvement loans. Low-cost homes are more likely to be older or purchased at a distressed property sale and could benefit from renovation to return them to safe, habitable, and affordable housing. Constrained home improvement lending to these owners exacerbates problems with upkeep in these communities.

While the government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, the FHA, and VA do originate small purchase loans, their market shares are lower than for larger lending. The Rural Housing Service has a slightly higher share of the small loan market, but 28 percent of small loans originated between 2013 and 2016 were retained in portfolio, more than three times the total market share. Many of these loans are originated and maintained by small community banks, credit unions, and large lenders who partner with local originators.

Borrower characteristics are not available from HMDA data, so the study used loan-level data from Ginnie Mae and the GSEs for loans originated in 2017. They found both small-dollar and large borrowers had high median FICO scores, although small borrowers were a few points lower. Small dollar mortgages had lower loan-to-value and debt-to-income ratios. In other words, the loan sizes appear equally credit-worthy.

Many factors contribute to the lack of small-dollar lending. Some are local market factors including the severity of the foreclosure crisis and resulting distressed properties, the composition and condition of the residential housing stock. A property appraisal gap can be a problem in markets that have experienced population decline and high vacancy rates. This is not confined to small-dollar loans, but some areas where it is a problem are those with the greatest concentrations of small-dollar sales.

Competition from investors may lock out potential owner occupants as the speed and certainty of an all-cash closing are appealing to sellers. This problem can't be solved by lenders but may require alternative strategies such as community land trusts to give first time and LIM buyers a fair shot at purchasing.

Housing stock composition is also a factor. Manufactured homes, especially on leased land, can be difficult or impossible to finance with a traditional mortgage and low-cost condominium units can be more complicated to finance, especially via the FHA. Then too, many factors in todays' tight credit environment are exacerbated for low-cost property buyers. Since the recession lenders face higher origination costs, greater regulatory scrutiny on representations and warranties. Indemnification issues mean higher costs of delinquency, and higher servicing costs for non-performing loans.

Lenders try to compensate for increased costs with higher individual loan profits, but the structure of compensation and incentives works to the disadvantage of small dollar loans. Smaller loans generate lower sales prices, spreads, and servicing income, making them less economically attractive to lenders.

What then are the options for transacting on low-cost properties? The three possibilities are no sales, more all-cash purchases (which tend to be to investors, rather than owner-occupants), and greater use of seller financing vehicles, including land contracts, which often have fewer protections for borrowers than traditional mortgages. None of these is optimal for potential homeowners or communities who stand to benefit from their availability of low-cost properties.

The authors have several recommendations for creating new sources of capital and financing for rehabilitating or refinancing with small-dollar mortgages.

- Review regulations and business practices that might create barriers. A fresh look at lending guidelines for the FHA and VA and opportunities for conforming financing could bring needed liquidity to the small-loan market. Reviewing underwriting and lending practices could uncover areas where traditional lending rules and practices may be putting potential LMI borrowers at a huge disadvantage.

- Introducing new programs and leveraging the capacity of community-based nonprofit organizations, land banks, state housing finance agencies, credit unions, and community development financial institutions could expand the market for small-dollar lending. This includes testing new partnerships with public and private groups and leveraging the Federal Housing Finance Agency Duty to Serve rules to help foster and promote more active lending for rural and underserved markets.

- Create new consumer-friendly, fairly-priced small-dollar mortgage alternatives for home purchase, renovation, and refinance. The typical mortgage process might not be the best way to serve and lend to prospective borrowers who want to become homeowners. Mortgage products tend to be long term and subject to primary and secondary market requirements that may be overly burdensome for small loans. Among the suggestions: exploring waivers on appraisals, and standardizing loan officer compensation for smaller loans; streamlining other parts of the mortgage process that would speed up financing and make home buyers more competitive with investors. Providing incentives for sellers and investors of low-cost properties to consider owner-occupant buyers first could help with cash-buyer competition.

- Expand "first look" programs that allow first-time homebuyers, low-income borrowers, and minorities in affordable communities the ability to purchase over cash investors using a fund or pool. Establishing and testing programs with large single-family investors and with some home improvement retailers to promote mobility from renting to owning is another avenue to explore. More partnerships, collaboration, and cooperation among investor owners, community nonprofits, lenders, and potential borrowers to restore and revitalize low cost communities could change the trajectory of these properties and convert them from renter occupied to owner occupied.

- Explore opportunities to improve and expand secured, affordably priced manufactured housing finance, including safer, scalable, market-priced, secured products for chattel lending. Finding ways to include manufactured housing into mainstream lending would be especially important for resale of manufactured housing-a more common transaction as the quality of such housing has improved.

The authors conclude that the limited access to credit for low-cost properties had led to a growing imbalance in housing that affects both supply and demand. There is a growing affordability crisis for renters and homeowners; the housing infrastructure is aging, and economic forces continue to drive prices higher and put homeownership increasingly out of reach. Yet there are large swaths of housing stock that could ameliorate this if access to credit issues for small mortgages were improved.

In addition, small refinance and renovation loan options could help owners with low-mortgage balance properties improve their homes and assist with needed changes that will improve livability and neighborhood appeal.

Building robust tools to support small-dollar mortgage lending could expand the opportunity to turn renters into homeowners and provide much-needed investment in our naturally occurring affordable single-family housing stock.