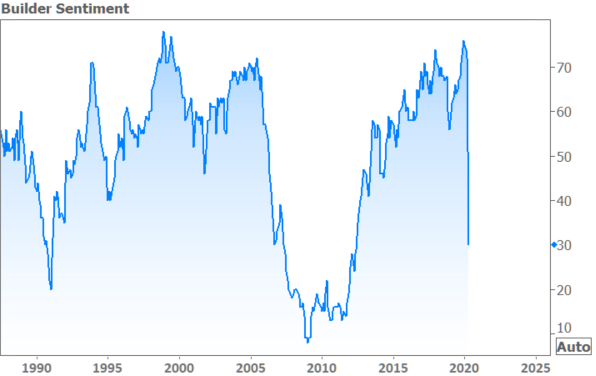

The National Association of Home Builders (NAHB) said its Housing Market Index (HMI), which it sponsors jointly with Wells Fargo, suffered the largest monthly change in its more than 30-year history this month, plunging 42 points from March to a 30 reading. It was the lowest the index, which measures its member's perceptions of the new home market, has been since June 2012 and the first time the index has fallen into negative territory (below 50) since June 2014.

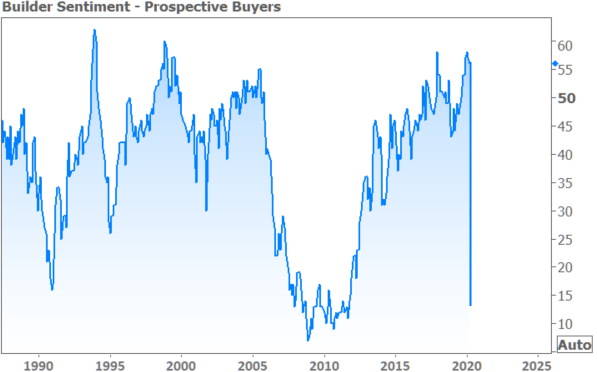

To construct its index, NAHB surveys its new home builder members, asking them for their perceptions of current single-family home sales and their expectations for those sales over the next six months as "good," "fair" or "poor." It also asks builders to grade current buyer traffic as "high to very high," "average" or "low to very low." Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three components of the survey, which was conducted during the first 13 days of the month, posted similar losses. The index gauging current sales conditions dropped 43 points to 36, the one measuring future expectations fell 39 points to 36 and the gauge charting traffic of prospective buyers also decreased 43 points to 13.

NAHB chairman Dean Mon said, "This unprecedented drop in builder confidence is due exclusively to the coronavirus outbreak across the nation, as unemployment has skyrocketed and gaps in the supply chain have hampered construction activities.

"Meanwhile, there continues to be some confusion over builder eligibility for the Paycheck Protection Program, as some builders have successfully submitted loan applications while others have not been able to. Home building remains an essential business throughout most of the nation, and as the pandemic shows signs of easing in the weeks ahead, buyers should return to the marketplace," He said that NAHB is working with the White House, Treasury and Congress to get the broadest builder participation possible.

"Before the pandemic hit, the housing market was showing signs of strength with January and February new home sales at their highest pace since the Great Recession," said NAHB Chief Economist Robert Dietz. "To show how hard and fast this outbreak has hit the housing sector, a recent poll of our members reveals that 96 percent reported that virus mitigation efforts were hurting buyer traffic. While the virus is severely disrupting residential construction and the overall economy, the need and demand for housing remains acute. As social distancing and other mitigation efforts show signs of easing this health crisis, we expect that housing will play its traditional role of helping to lead the economy out of a recession later in 2020."

Looking at the monthly averages of regional HMI scores, the Northeast fell 45 points in April to 19, the Midwest dropped 42 points to 25, the South fell 42 points to 34 and the West dropped 47 points to 32.