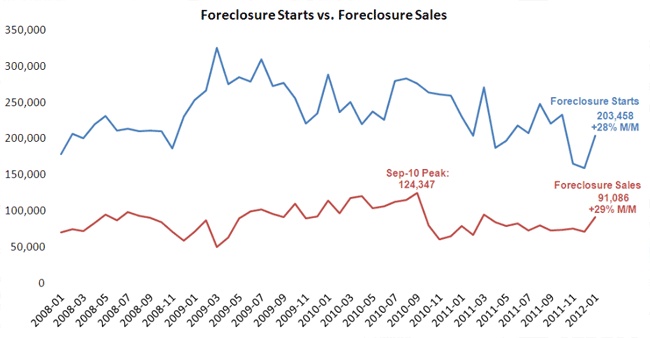

Both foreclosure starts and foreclosure sales jumped significantly in January according to data released today by Lender Processing Services (LPS), Inc. Starts were up 28 percent and sales 29 percent over the December figures. LPS commented that while one month's worth of data is not necessarily indicative of a trend, it might suggest that the backlog of foreclosures is beginning to move.

According to the LPS Mortgage Monitor, the

delinquency rate in January fell 2.2 percent from December and 10.5 percent

form one year earlier to a rate of 7.97 percent. Foreclosure starts numbered 203,453 during

the month compared to 159,092 in December and foreclosures were at a rate of

4.15 percent in January compared to 4.11 percent in December and 4.16 percent

in January 2011. Loans that were

seriously delinquency (90+ days) or in foreclosure were up 0.2 percent month-over-month

and down 6.8 percent year-over-year to 7.69 percent.

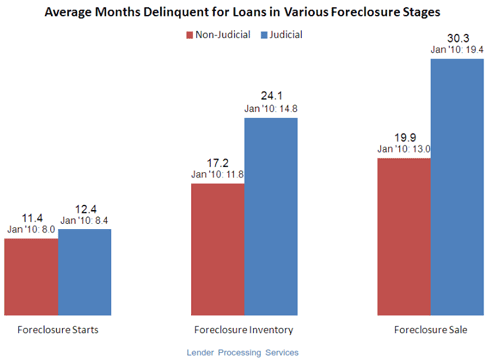

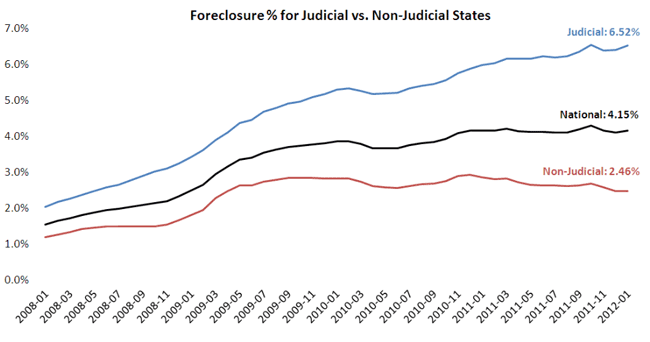

The foreclosure backlog continues to be skewed toward judicial foreclosure states because of the length of the process. While the national foreclosure rate is 4.16 percent, the rate in non-judicial states is 2.46 percent while the rate in judicial states is triple that number, 6.52 percent. By the time of sale the average loan in a judicial state has been delinquent for 30.3 months compared to 19.9 months in non-judicial states.

New delinquencies are low at 1.4 percent nationally, but there are pockets of problems must notably in Nevada, Florida, Mississippi, Arizona, and Georgia.

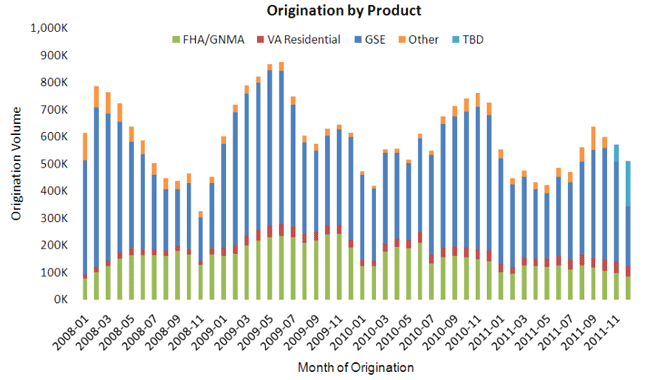

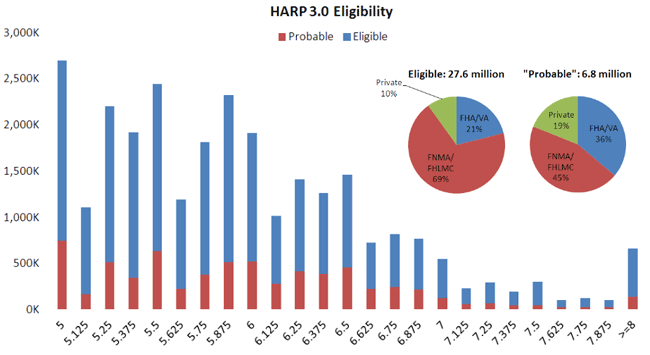

LPS reports that originations have continued to fall from their peak in September and that the new refinancing initiatives proposed by the Obama Administration are presenting new opportunities for originators.