The best way to do this: Mortgage rates had a terrible week! (like ripping off a band-aid). The par 30 year fixed mortgage rate rose anywhere from .125 to .375% over the last five days. Maybe even more over the last two weeks. Not a whole lot went right for us during this time.

The Federal Reserve's $1.25 trillion Mortgage-Backed Securities Buying Program came to an end. We learned the labor market had its best payrolls month in two years. Stocks celebrated a 5 week rally by taking today off. And the most recent round of Treasury auctions were not met with adequate demand from the right funding sources. Some called the auctions "sloppy".

None of these events had a positive influence on mortgage rates. Before going on I think we should stop to show some gratitude though...

The goal of the Federal Reserve's agency MBS program was to provide support to mortgage and housing markets and to foster improved conditions in financial markets more generally. Let me be the first to say, if no one has already: GREAT SUCCESS!

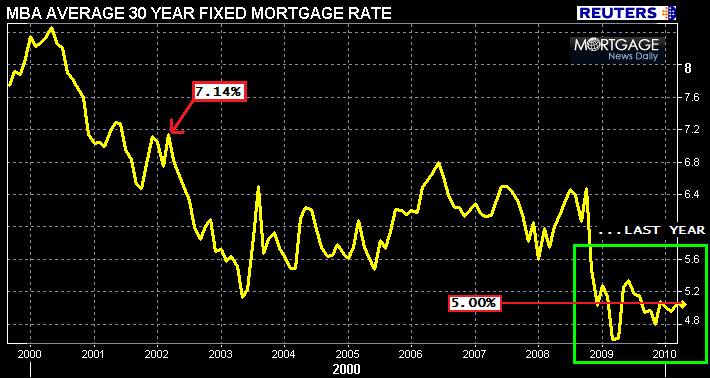

This success is more apparent in the chart below. The Federal Reserve's MBS Purchase Program served to stabilize volatility in the bond market which allowed lenders to keep the par 30 year fixed mortgage rate below 5.00% for most of 2009 and the first three months of 2010. Thank You Federal Reserve!

But that source of stability--that "backstop bid"--- is gone.

I

am willing to bet that most folks who were qualified to refinance in

the last 16 months, have already closed and funded though. Those who haven't (and could have) are probably enjoying index+ARM margin mortgage

payments or maybe an interest-only monthly cost. These folks are oblivious to

the fact that the interest rate environment is now much less stable than it

was over the course of 2009 into 2010. Unfortunately, others are not sleeping as well....

The group of prospective home buyers looking to take advantage of this tax credit, who are expected to be the main source of real estate and mortgage loan business in the next three months (no pressure)--- should be nervous. They should also be concerned, confused, jumpy, anxious, and uneasy about the road ahead for interest rates and mortgage borrowing costs.

Life without the Fed will be a new world for mortgage rate watchers. Before the Federal Reserve decided to buy MBS to keep mortgage rates low, the secondary mortgage market was essentially on life support. 16 months and $1.25 trillion later, we are coming out of a government induced coma. Now we must learn to walk again. The secondary mortgage market must learn to function on its own again. To make matters worse, the mortgage market must do so in an economic environment that is far from clear.

"BIG PICTURE" economic uncertainty is abundant. Stocks have rallied relentlessly for an entire year. Economic data headlines continually benefit from some sort of statistical variation, weather event, or methodology adjustment. Budgetary troubles have yet to play out in Europe. China isn't exactly feeling "peachy keen" about us at the moment. Our so called political "leadership" on Capitol Hill can't get anything done without bickering at each other first. Etc. Etc.. Etc...

This will be a feeling out process. There will be plenty of ups and downs. There will be less certainty about short term forecasts and overnight lock/float decisions will be highly sensitive to the next day's economic calendar.

If you're stuck in the float boat and starting to feel sea sick, now would be a good time to call your loan originator and lock, especially if you're happy with your monthly payment. This is the right decision for anyone who doesn't have room to spare under their bottom line...because the next few days (or maybe weeks) could get even more rough. The last thing we want is for you to wait it out a few more days only to panic and lock at a higher rate. No reason to play with fire or your emotions.

I doubt there are too many folks left in the "I could have locked and decided not to" category though. I think its safe to say that most "fence sitters" heard the warning bells ringing months ago. I bet the majority of float boaters don't even know they're floating yet. Or maybe they know it, but can't lock their loan because they haven't found the right property yet.

Tough spot to be in. My advice to you would be:

Get pre-qualified at the highest rate possible. Ask your loan officer to provide you with a range of home prices that keep your payment within agency guidelines and also meet your budget. Request that your loan officer calculate these home prices at multiple interest rate levels. That way, if mortgage rates do move significantly higher, you are prepared to adjust your home buying strategy and have already been pre-qualified at higher rates. I am not trying to scare you, just trying to prepare you for the "worst case scenario".

Don't panic though. This is "just in case" advice. While I do think we've seen the lowest mortgage rates of our era, I don't believe rates will rise past 5.50% in the next two months. The uptick in mortgage rates should be manageable for most potential homebuyers. At worst, maybe it knocks a few borrower's qualifying range down a couple thousand dollars in home price, but it shouldn't offset the expected increase in home buyer demand (which I think will be lower than forecast regardless of rates).

If you're having a tough time deciding whether or not to lock and it's keeping you up at night. Lock! If you have some time to work with and feel strongly that we will undergo a prolonged, frustratingly slow economic recovery--- I think its safe to float on a day by day basis. Evaluate your situation frequently and ask questions if you don't understand something though. Ask your loan officer to keep you updated on mortgage rate movements. Be proactive and communicate on what you are comfortable paying every month.

As for now, we are floating into Monday. One day at a time....