Mortgage rates took a beating yesterday as market participants sold their fixed income investments. This drove Treasury yields higher and MBS prices lower. The benchmark 10 year treasury note rose from a yield of 3.66 to 3.85 and the Fannie Mae 4.5 MBS coupon lost 100 basis points in price. Losses started early and continued throughout the day all the way into the close. All lenders repriced for the worse multiple times which increased the par 30 year fixed mortgage rate from the lows of the year all the way to the highs of the year, proving that rates rise much faster than they fall.

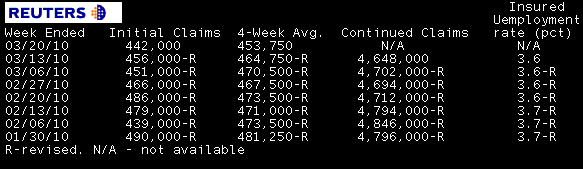

The only economic data released this morning was the weekly Jobless Claims report. This data provides three measures on the health of the labor market:

1. Initial Jobless Claims: totals the number of Americans who filed for first time unemployment benefits

2. Continued Claims: totals the number of Americans who continue to file for benefits due to an inability to find a new job

3. Extended Benefits: totals the number of Americans who have exhausted their traditional benefits and are now receiving emergency benefits

Since our economy is driven by consumer spending, economists track employment data to get a sense of future economic momentum. Higher jobless claims lead to less consumer spending, which is bad for the overall economy but generally helpful in keeping mortgage rates from rising. No trend of improvement has developed in jobless claims data. They have been very "up and down" lately.

Today’s release indicated, in the week ending March 20, 442,000 Americans filed for Initial Jobless Claims. This was slightly less than economist forecast for 450,000 new claims and a decline of 14,000 from the prior week. Continued claims decline 54,000 to 4.65 million, the lowest level since December 2008. The number of Americans receiving emergency Extended Benefits fell 345,000 to 5.7 million. There was no reaction in the bond market following the release of this report.

At 10am eastern, Federal Reserve Chairman Ben Bernanke testified before the House Financial Services Committee about the Federal Reserve's exit strategy from accommodative monetary policy. Bernanke reiterated the need for a low Fed Funds Rate and discussed his stance on Fannie Mae, Freddie Mac, and the MBS Purchase Program. We noticed one thing in particular, Bernanke called attention to an "unusually large" amount of money that the Fed earned from their MBS purchases. AQ wrote on this and provided some perspective on the rest of the hearing. READ MORE

At 1pm, the Department of Treasury announced the results of the last Treasury auction of the week: $32billion 7 year notes. Just as the prior two auctions of the week were met with weak demand, so too was today's 7 year note auction. This pressured mortgage rates higher. READ MORE

Many lenders were forced to reprice for the worse after the poorly subscribed Treasury auction. However, benchmark 10 year Treasury yields and mortgage-backed security prices did recover from their worst levels. This allowed many lenders to reprice for the better toward the end of the day.

Reports from fellow mortgage professionals indicate lender rate sheets to be similar to rate sheets yesterday afternoon. The par 30 year conventional rate mortgage has opened this morning in the 5.00% to 5.25% range for well qualified consumers. There are a few lenders offering 4.875% at par still. To secure a par interest rate you must have a FICO credit score of 740 or higher, a loan to value at 80% or less and pay all closing costs including an estimated one point loan origination/discount/broker fee. You can elect to pay less in fees but you will have to accept a higher interest rate.

Yesterday was either the beginning of rates moving higher or just a temporary correction. If your lender is still offering the same rate they were offering two days ago, lock! If the cost of borrowing has risen, which is the likely case, I think you should cautiously float at this point. The damage has been done and there is no need to panic just yet. We think the 10 year yield and MBS prices have some room to weaken before turning around. If a recovery rally does occur, I will continue to cautiously float until the rebound rally loses momentum. Lock at the price highs, float at the price lows has worked all year. Considering this spike in mortgage rates was not a function of the Fed's MBS Purchase Program coming to an end, I think it makes sense to give our long-standing strategy a chance to play out before locking.