My headline yesterday was: Mortgage Rates Fully Recover from Recent Uptick. Energy Building in Benchmarks.

This is what I said:

Over the past two days benchmark Treasury yields and MBS prices have barely budged from a tight trading range. Trading has been very slow as market participants have been unmotivated by recent headline news developments and a generally slow economic calendar. AQ refers to this tight range as "coiling" or energy storage, this won't last much longer though. The coiled up energy will be released as soon as the market is presented with new data or information that justifies a broad based move. When that happens, prices/rates will probably jump considerably. This is a scary environment, especially with mortgage rates near their most aggressive levels of the year. With that in mind, I continue to believe that rates will not move lower than current levels.

Well. That "coiled up" energy was released today and rates jumped considerably...IN THE WRONG DIRECTION

Mortgage rates rose more today than they have all year, from their best levels of 2010, all the way to their worst. Several factors can be cited for the sell off in the bond markets. Lets look at the data.

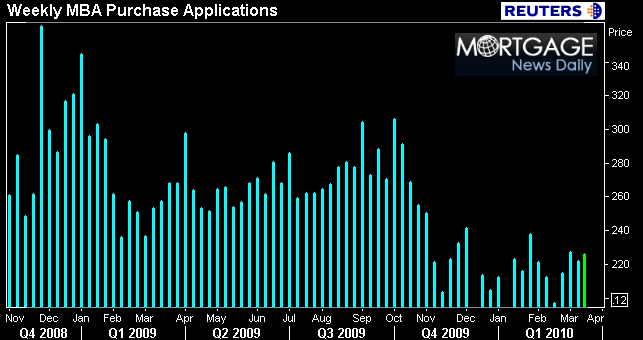

First up was the Mortgage Bankers Association Weekly Mortgage Applications Index. The MBA survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. A rising trend of mortgage applications indicates an increase in home buying interest, a positive for the housing industry and economy as a whole. Furthermore, in a low mortgage rate environment, such a trend implies consumers are seeking out lower monthly payments which can result in increased disposable income and therefore more money to spend on discretionary items or to pay down other debt.

Last week’s data showed both purchase and refinance applications declining modestly following big gains in the previous two weeks. In today’s release, which reported on loan applications in the week ending March 19, the purchase index rose 2.7% while the refinance index fell 7.1%. With government stimulus still only available for home buyers until the end of April, it isn’t surprising to see home purchase demand starting to pick up in recent weeks.

If you are looking to take advantage of the home buyer tax credit, you have until the end of April to be under contract and the end of June to close (to still qualify). AQ wrote a story on home sales and related it to the tax credit. READ MORE

Next up, released at 8:30am was Durable Goods Orders Data. This report measures new orders at U.S. factories for products that are expected to last at least three years such as computers, appliances, electronics, etc… Basically, this report tells economists how busy factories will be in the months ahead as they rush to meet the new orders. Increasing orders implies there is the potential for higher corporate profits and maybe the need to hire additional staff for a growing operation. This is good for the overall economy and stocks...but a negative for the fixed income sector/interest rates.

And the report indicated durable orders improved for the third consecutive month! New orders increased 0.5%--- less than the 0.7% economists expected. Last month’s orders were revised for the better from an initially reported increase of 3.0%.. to +3.9%. When excluding transportation orders, the report showed a larger than expected increase of 0.9% (vs 0.6% expected increase).

Before this release, benchmark Treasury yields were already on the rise. After the release they moved even higher.

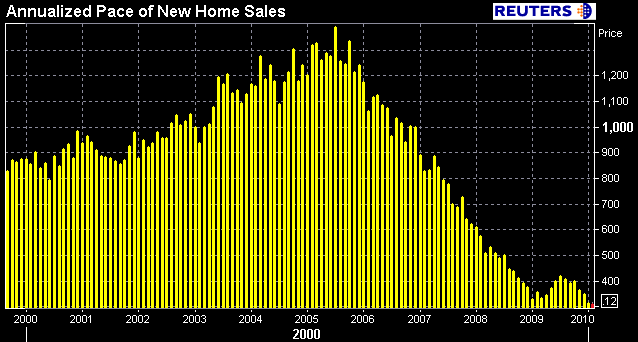

The final economic release of the day was New Home Sales. This report measures the number of new homes which have a committed sale during the month. A “sale” is defined as a deposit taken or sales agreement signed which can occur prior to a permit being issued.

Many believe that until housing recovers, it will be difficult for our economy to sustain any normal growth which makes tracking home sales data much more important in than in past years.

New Home Sales lost momentum in the winter months, the previous four reports have all indicated declining sales. Last month’s report actually fell to a record low level of annualized sales. Today’s release was no better as New Home Sales declined for the straight month to a new record low.

The notes of the release say:

"It takes 4 months to establish a trend for new houses sold. " (bottom of page 1)

New home sales have moved lower in 7 of the past 8 months---not that there is anything wrong with that. We do not need any more inventory of new homes. Existing Homes must go.

In February, New home sales fell 2.2% to an annualized pace of 308,000, less than the 315,000 that was expected. Once again the decline is being attributed to bad weather across the country instead of weak demand. Not much reaction in the markets following this report. READ MORE

At 1pm eastern, the department of Treasury auctioned $42 billion 5 year notes. When our government lacks the cash to pay for spending, they must borrow funds from investors. They do this by selling debt (Treasury bills, notes, and bonds).

Market participants gauge the success of auctions by tracking demand. Yesterday’s auction of 2 year notes saw below average demand which pressured treasury yields higher. The same thing occured again today. Demand was low and benchmark Treasury yields continued to rise after the auction results were released at 1pm. READ MORE about auction demand.

So to recap the day, benchmark interest rates started rising early in the trading session, before MBS trading officially opened at 8am. Positive Durable Goods Orders data pushed rates higher. Then poor demand at the five year Treasury note auction intensified bond market selling. After that, buyers basically gave up hopes. This pushed rates even higher. Over the course of the day, the 10 year Treasury note yield rose 16 basis points, MBS prices plummeted on more than one occasion and lenders were forced to reprice for the worse, more than one time!

Reports from fellow mortgage professionals indicate lender rate sheets to be much worse today. The par 30 year conventional rate mortgage has risen back to the 5.00% to 5.125% range for well qualified consumers. There are still a couple lenders offering 4.875%. To secure a par interest rate on a conventional mortgage you must have a FICO credit score of 740 or higher, a loan to value at 80% or less and pay all closing costs including an estimated one point loan origination/discount/broker fee.

At this point, if you have not already locked your loan, I think you should wait for rates to rebound. Lock in