The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending August 27, 2010.

The MBA's loan application survey covers over 50% of all U.S. residential mortgage loan applications taken by retail mortgage bankers, commercial banks, and thrifts. The data gives economists a snapshot view of consumer demand for mortgage loans.

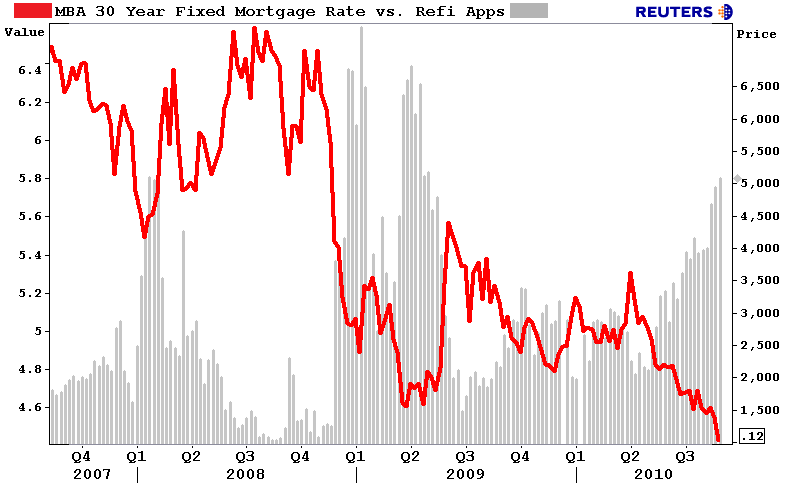

In a low mortgage rate environment, a trend of increasing refinance applications implies consumers are seeking out a lower monthly payment. If consumers are able to reduce their monthly mortgage payment and increase disposable income through refinancing, it can be a positive for the economy as a whole (creates more consumer spending or allows debtors to pay down personal liabilities like credit cards). A falling trend of purchase applications indicates a decline in home buying demand, a negative for the housing industry and the economy as a whole.

Excerpts from the Release...

The Market Composite Index, a measure of mortgage loan application volume, increased 2.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 2.3 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index is up 5.2 percent.

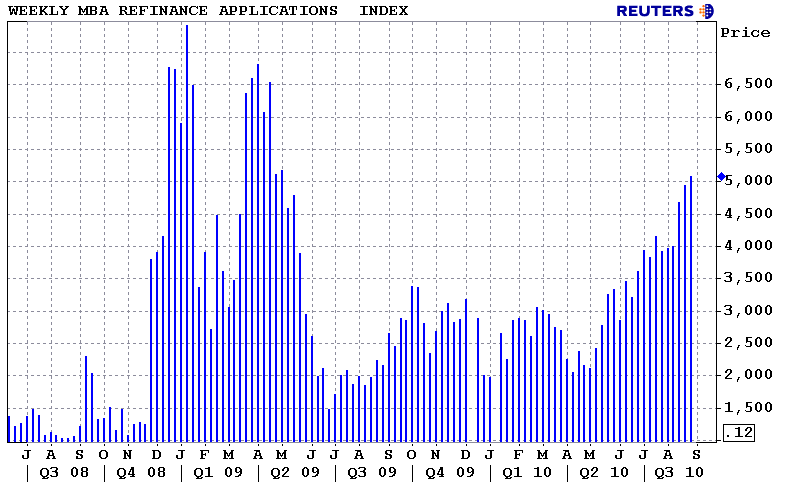

The Refinance Index increased 2.8 percent from the previous week and is at its highest level since May 1, 2009. The four week moving average is up 6.3 percent for the

Refinance Index. The refinance share of mortgage activity increased to 82.9 percent of

total applications from 82.4 percent the previous week and is the

highest refinance share observed since January 2009.

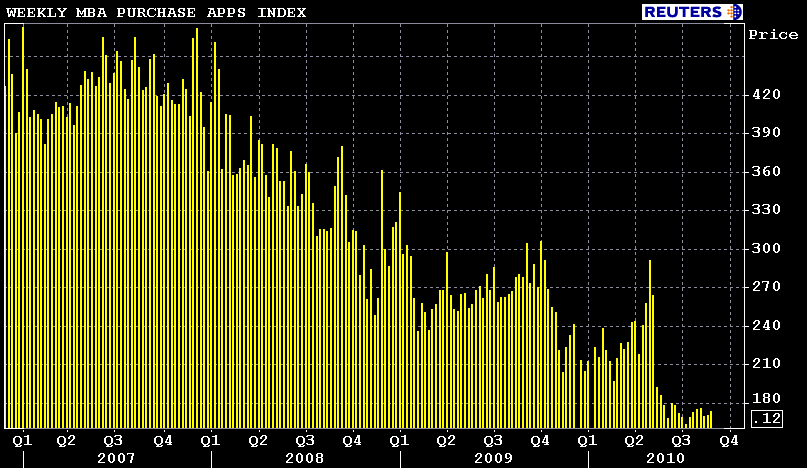

The seasonally adjusted Purchase Index increased 1.8 percent from one week earlier. The unadjusted Purchase Index decreased 0.4 percent compared with the previous week and was 37.0 percent lower than the same week one year ago. The four week moving average is down 0.2 percent for the seasonally

adjusted Purchase Index.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.43 percent from 4.55 percent, with points increasing to 1.34 from 0.89 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The contract rate is a new low for this survey. The effective rate also decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.88 percent from 3.91 percent, with points decreasing to 1.45 from 1.64 (including the origination fee) for 80 percent LTV loans. The contract rate is a new low for this survey. The effective rate also decreased from last week.

The average contract interest rate for one-year ARMs increased to 6.95 percent from 6.84 percent, with points increasing to 0.23 from 0.22 (including the origination fee) for 80 percent LTV loans. The adjustable-rate mortgage (ARM) share of activity increased to 6.1

percent from 5.8 percent of total applications from the previous week.

Michael Fratantoni, MBA's Vice President of Research and Economics, offers his insight...

"Refinancing activity picked up again last week, reaching new 15-month highs, as borrowers took advantage of even lower mortgage rates. The drop in mortgage rates was in line with Treasury rates as the latest data continue to show weak economic growth and an exceptionally weak housing market...The sharp decline in MBA's Purchase Application index in May had provided a clear leading indicator of the drops in new and existing home sales that were reported for June and July. Despite the slight increase in purchase activity in the past week, the continued low level of purchase applications indicates we are unlikely to see an increase in new home sales reported for August or existing home sales reported for September."

Loan officers, lock desks, and production managers tell me the recent uptick in the refinance index is reflective of targeted marketing tactics. Shops are contacting borrowers who they've refinanced or closed a purchase for in the last 20 months. This implies prepayment speeds on 4.5 and 5.0 MBS coupons should pick up in the next prepayment report (September 7). What's interesting about that is a large percentage of these loans are owned by the Federal Reserve. This should benefit the bond market because the Fed is reinvesting prepays on their MBS portfolio back into Treasuries, which will help keep benchmark yields and mortgage rates low (indirectly).

Negative convexity is no longer an illusion...

READ MORE: Mining Existing Lead Sources Makes a Difference in a Competitive Environment