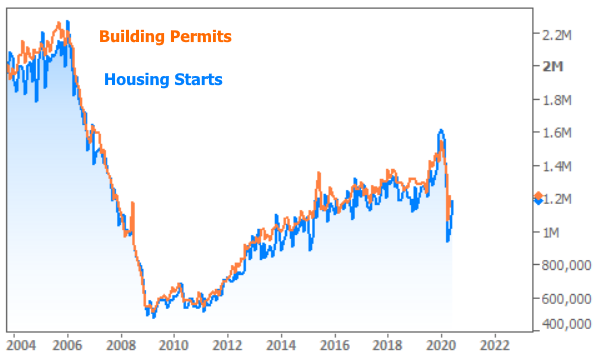

All three measures in the Census Bureaus June residential construction report moved higher, as the building industry continued to recover from its April collapse. However, of the three, only the rate of units completed was higher than its June 2019 level.

Permits increased by 2.1 percent to a seasonally adjusted annual rate of 1,241,000 units from 1,216,000 units (revised from 1,220,000 units) in May. This leaves the permitting rate down 2.5 percent from the 1,273,000 level of June 2019.

Analysts had been looking for a significantly higher number. Those polled by Econoday had a census of 1,298,000 units with a range of 1,150,000 to 1,340,000.

Single family permits jumped 11.8 percent to 834,000 units compared to 746,000 the prior month but those permits are also lower than a year earlier, by 1.1 percent. Multifamily permits were down 14.0 percent and 4.2 percent from the two earlier periods at a rate of 368,000 units.

The Mortgage Bankers Association's chief economist Mike Fratantoni said the construction permit numbers for June suggest building momentum in the months ahead. He added, "MBA's Builder Applications Survey for June showed that demand is running 54 percent ahead of last June, and the National Association of Home Builders latest Housing Market Index revealed rising builder confidence in future demand. This is positive, as the rebound in housing demand could be stymied if there is not more inventory on the market soon. Home prices have held up well thus far given the lack of supply, and we're forecasting for home-price growth of 4 percent this year."

On a non-adjusted basis there were 122,200 permits issued during the month compared to 104,400 in May. Single family permits accounted for 83,600 of those units in June and 66,100 in May. For the year-to-date (YTD) permits have totaled 655,300 compared to 657,800 at the same point in 2019, a decline of 0.4 percent. Single family permits are up 3.4 percent for the YTD to a total of 432,500 while multifamily permitting for the first six months is 7.6 percent lower at 202,800 units.

Permits rose 10 percent in the Northeast and but were 9.7 percent lower on an annual basis. In the Midwest there was a 10.9 percent increase from May and 6.4 percent growth year-over-year. Permits inched down 0.3 percent in the South but were 3.0 percent higher compared to June 2019. The West saw permitting decline for both periods, by 0.7 percent and 14.8 percent, respectively.

Housing starts jumped 17.3 percent from May and that month's original estimate was revised significantly higher than the 974,000 originally reported. The May start rate is now estimated at 1,011,000 units and June at 1,186,000. June starts are still 4.0 percent below the 1,235,000 rate in June of last year.

Analysts were also overly optimistic about housing starts as well, expecting them to range between 1,050,000 and 1,250,000. The consensus was 1,195,000.

Single and multifamily starts were similar in their improvement. Single family starts rose 17.2 percent to 831,000 units and the multifamily increase was 18.6 percent to 350,000 units. Both are still down from their June 2019 levels, single-family starts by 3.9 percent and multifamily by 2.5 percent.

On an unadjusted basis, construction was started on 112,200 residential units in June, 81,600 of them single-family houses. The May numbers were 92,800 and 65,900. YTD there have been 619,000 units started, a 0.7 percent year-over-year gain. Single family starts are down 1.3 percent to 425,000 while multi-family starts are 5.8 percent higher at 188,700.

Starts in the Northeast surged by 114.3 percent but remain 5.4 percent below their June 2019 level. The Midwest saw a monthly gain of 29.3 percent but lost 0.5 percent on an annual basis. Starts in the South rose 20.2 percent and were down 4.6 percent from a year earlier. The West is still struggling; starts were down 7.5 percent and 4.2 percent for the two time periods.

Residential units were completed at the rate of 1,225,000 units in June, up 4.3 percent from May's total of 1,174,000 and 5.1 percent higher year-over-year. Single family completions rose 9.6 percent and 4.0 percent, respectively. Multifamily completions were down 5.5 percent for the month but up 11.1 percent on an annual basis.

There was a total of 108,900 units brought online during the month, 80,100 of them single family houses, compared to 98,200 units and 68,900 units in May. There were 584,500 units of housing completed over the first half of the year, 424,000 single and 156,200 multifamily units. This was a decrease of 1.7 percent YTD in total units and 7.6 percent in multifamily completions. Single family completions are up 0.7 percent.

The Northeast saw 22.9 percent fewer completions than in May and 35.1 percent fewer than a year earlier while the Midwest saw gains of 5.3 percent and 34.9 percent. Houses were finished at a 5.5 percent higher rate than in May in the South and 7.3 percent higher for the year. Completions in the West rose by 10.5 percent and 1.3 percent from the two earlier periods.

At the end of the reporting period there were 1,162,000 units of housing under construction, 497,000 of them single family houses. There was a backlog of permits totaling 180,000, 98,000 of them for single units.