The Commerce Department released March New Residential Construction: Building Permits and Housing Starts data this morning.

Housing Starts data estimates how much new residential real estate construction occurred in the previous month. New construction means digging has begun. Adding rooms or renovating old ones does not count, the builder must be constructing a new home (can be on old foundation if re-building). Although the report offers up single family housing, 2-4 unit housing, and 5 unit and above housing data...single family housing is by far the most important data as it accounts for the majority of total home building.

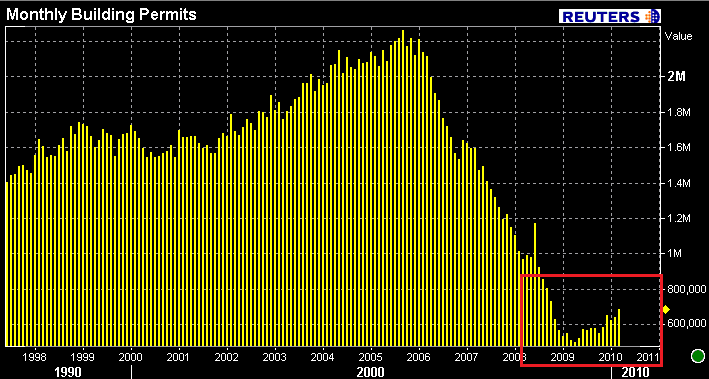

Building Permits data provides an estimate on the number of homes planned on being built. The number of permits issued gauges how much construction activity we can expect to take place in the future. This data is a part of Conference Board's Index of Leading Economic Indicators.

From the release...

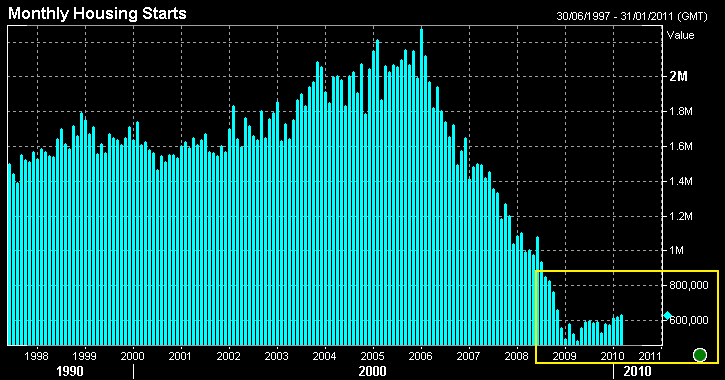

HOUSING STARTS

Privately-owned housing starts in March

were at a seasonally adjusted annual rate of 626,000. This is 1.6

percent above the revised February estimate of 616,000 and is 20.2

percent above the March 2009 rate of 521,000.

Single-family housing starts in March were at a rate of 531,000; this is 0.9 percent below the revised February figure of 536,000. The March rate for units in buildings with five units or more was 88,000.

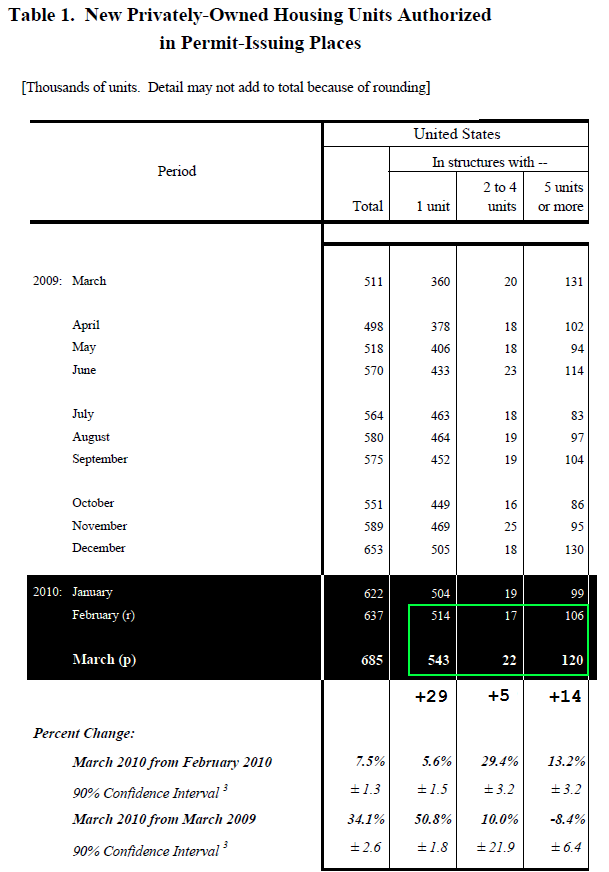

BUILDING PERMITS

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 685,000. This is 7.5 percent above the revised February rate of 637,000 and is 34.1 percent (±2.6%) above the March 2009 estimate of 511,000.

Single-family authorizations in March were at a rate of 543,000; this is 5.6 percent above the revised February figure of 514,000. Authorizations of units in buildings with five units or more were at a rate of 120,000 in March.

On a percentage basis, which is how this data is generally absorbed by Main Street, the improvement in building permits might be given credit to a 29.4 percent increase in 2-4 unit permits issued. The more important single-family home category gained what a modest 5.6 percent in March. However when you look at the data in absolute terms the story becomes a bit clearer. Single-family permits rose by 29,000. Permits for 2-4 unit structures saw a 5,000 unit uptick.

This is a good sign that builders are preparing themselves to start breaking ground. But that's about as far as our optimism can take us. While prospective builders must show a serious attitude and be well-prepared to obtain a permit, most homebuilders are not ready to allocate their cash (because they can't borrow money!) toward constructing an asset that might be lose value. No one wants to begin a project that has a high chance of not being profitable.

My point: Building permits are on the rise from record low levels, but builders are not using them, housing starts are essentially stagnant.

Isn't that a good thing though?

Focusing on Housing Starts, Building Permits, and Residential Construction Spending doesn't seem to make much sense in today's housing market. Not when existing homes inventory rose 9.5 percent last month and raw unsold inventory is up 5.5 percent from a year ago....and that doesn't even include shadow inventory!

Plain and Simple: We don't need anymore housing inventory on the market. It's OK that new home sales and housing starts are failing to gain traction. We need housing demand to eat away at current inventory before homebuilders start adding more supply. Once that occurs, relying on Housing Starts, Building Permits, and Residential Construction Spending will be a whole lot more relevant as forward looking indicators. In the mean time, don't let big month over month percentage gains fool you. Permits and Starts are coming off historic lows, so any gain is going to seem big from a percentage point of view. The charts above illustrate that point perfectly.