The February edition of the Housing Scorecard was released by the Departments of Treasury and Housing and Urban Development (HUD) on Friday. In what has become a monthly litany, it said that "the housing market is strengthening although the recovery remains fragile."

The Scorecard is essentially a summary of data on housing and housing finance released by public and private sources over the previous month and/or quarter. Most of the data such as new and existing home sales, permits and starts, mortgage originations, and various house price evaluations have been previously covered by MND.

One piece of new information was data on the progress of the housing overhang. Inventories of existing homes for sale have continued to improve over the last two quarters, declining from 3.2 million in the second quarter to 2.4 million in the fourth quarter. Housing units held off the market have declined modestly, from 3.9 million in the first quarter of 2011 to 3.6 million in the fourth quarter.

The scorecard incorporates by reference the monthly report of the Making Home Affordable Program (MHA) through the end of December. This includes information on the universe of MHA programs including the Home Affordable Modification Program (HAMP), HOPE Now, and Second Lien Modifications and other initiatives. This month it also includes results of the most recent quarterly mortgage servicer assessments.

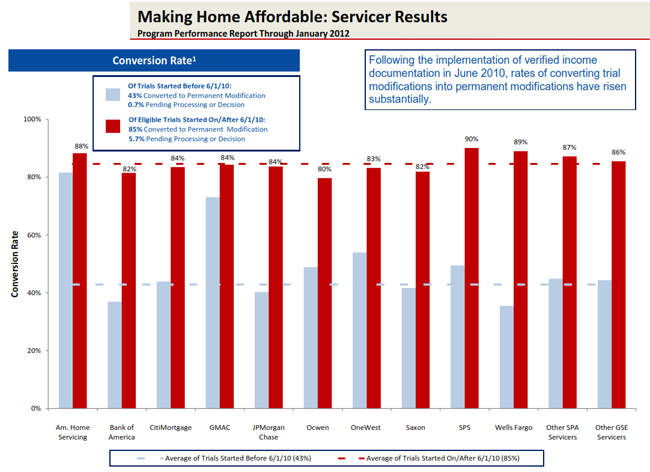

For the first time since the Federal Housing Finance Agency began the servicer assessments in an attempt to make HAMP more responsive and effective there were no servicers found to be in need of substantial improvement on any of a laundry list of metrics measuring their performance. These evaluation measures include the rate of conversions from trial to permanent modifications, missing paperwork, and data errors. In previous quarters JPMorgan Chase and Bank of America were found to have deficiencies serious enough for HAMP to withhold incentives for their performance. With the recent assessments, HAMP has released those withheld funds.

Of the nine major servicers now participating in HAMP (Litton's portfolio has been assumed by Ocwen Loan Servicing) seven were found to need moderate improvement* and the remaining two, OneWest Bank and Select Portfolio Service, to need minor improvement.

Assistant Treasury Secretary Tim Massad said about the servicer assessments, "The Making Home Affordable Program has established critical standards that have changed the mortgage industry for the better, and the assessments have been a principal tool for measuring that progress. By shining the spotlight on key practices, we have prompted servicers to improve their implementation of the Making Home Affordable Program. However, there is still more work to be done to ensure that the industry treats all borrowers properly. The implementation of the broader standards required by the settlement, [with servicers linked to 5 major lenders] together with our continued compliance efforts, will help bring this about."

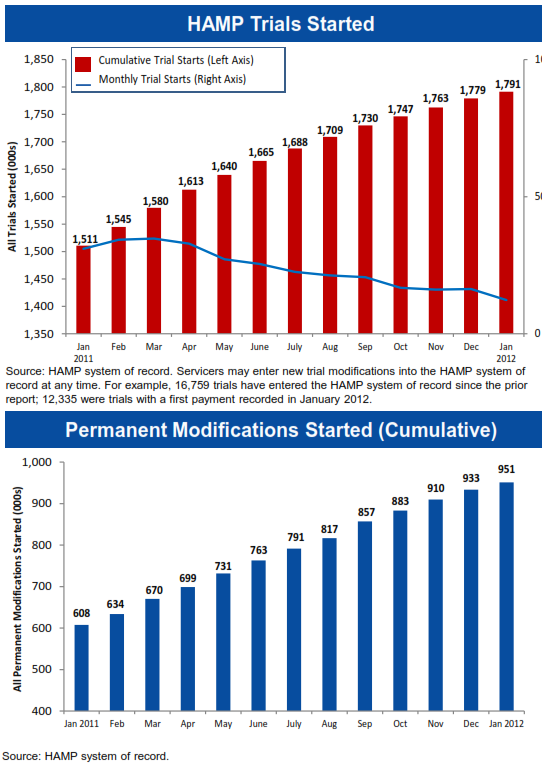

Since the December HAMP report 16,759 new trial modifications have started for a total of 1,791,354 since April 2009. On-going trials now number 76,343 and there are 768,773 active permanent modifications. Since the last report 17,992 trial modifications were converted to permanent status.

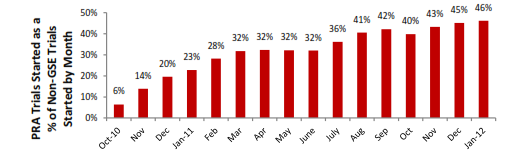

Treasury has been putting a lot of emphasis on principal reduction programs in the last few months. HUD maintains that the principal balances of Fannie Mae and Freddie Mac loans cannot be reduced, but extra incentives have been offered to servicers who reduce principal as part of the Principal Reduction Alternative (PRA) under HAMP. There have been 67,835 PRA trial modifications started and 47,114 that have become permanent to date, 44,058 of which are still active. The median principal reduction among those current active modifications is $68,063.

Loans modified with a PRA feature had a median loan-to-value (LTV) before modification of 159 percent and 115 percent post modification. All loans modified through HAMP had a median of 120 percent LTV before modification and 122 percent after.

Another HAMP program, Home Affordable Foreclosure Alternatives (HAFA) offers homeowners the option of exiting homeownership through a short sale or deed-in-lieu of foreclosure. To data almost 50,000 borrowers have requested this alternative and 31,426 have completed a HAFA transaction, all but 850 of them through short sales.

*In addition to Chase and Bank of America servicers needing moderate improvement are American Home Mortgage Servicing, CitiMortgage, GMAC, Ocwen, and Wells Fargo Bank