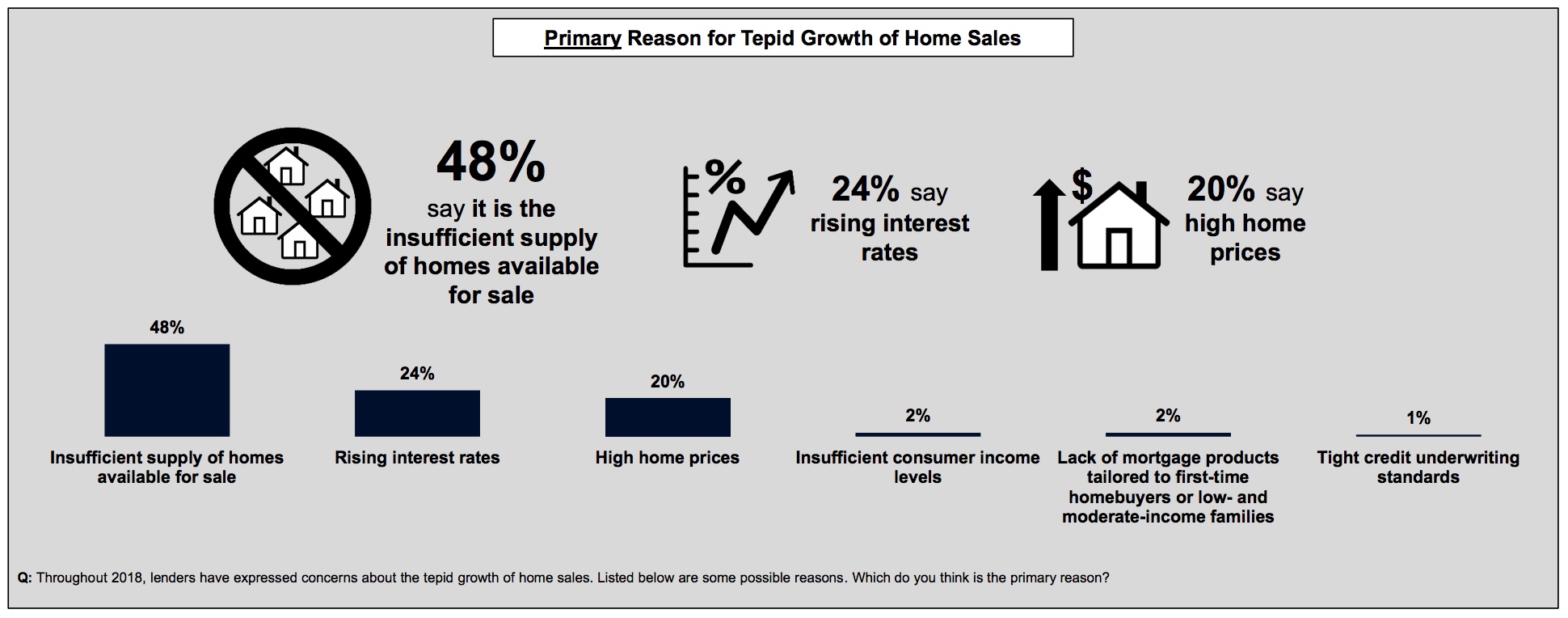

The chant throughout 2018 from housing industry sources was inventory, inventory, inventory - or lack of same. It was blamed first for rising home prices and then for the slow growth in home sales. Fannie Mae's fourth quarter Mortgage Lender Sentiment Survey found that most lenders agree that this was the case.

Mark Palim, Fannie Mae's Vice President and Deputy Chief Economist, writes in the company's Perspectives blog that nearly half of lenders responding to the survey named an insufficient supply of homes available for sale as the top reason behind the slow growth in sales last year. Twice as many cited inventory as mentioned the next most popular reason, rising interest rates. The third factor frequently mentioned was high home prices. Only small numbers of lenders attributed the weak sales in 2018 to tight credit and underwriting standards or to a lack of mortgage products tailored to first-time or low- and moderate-income homebuyers.

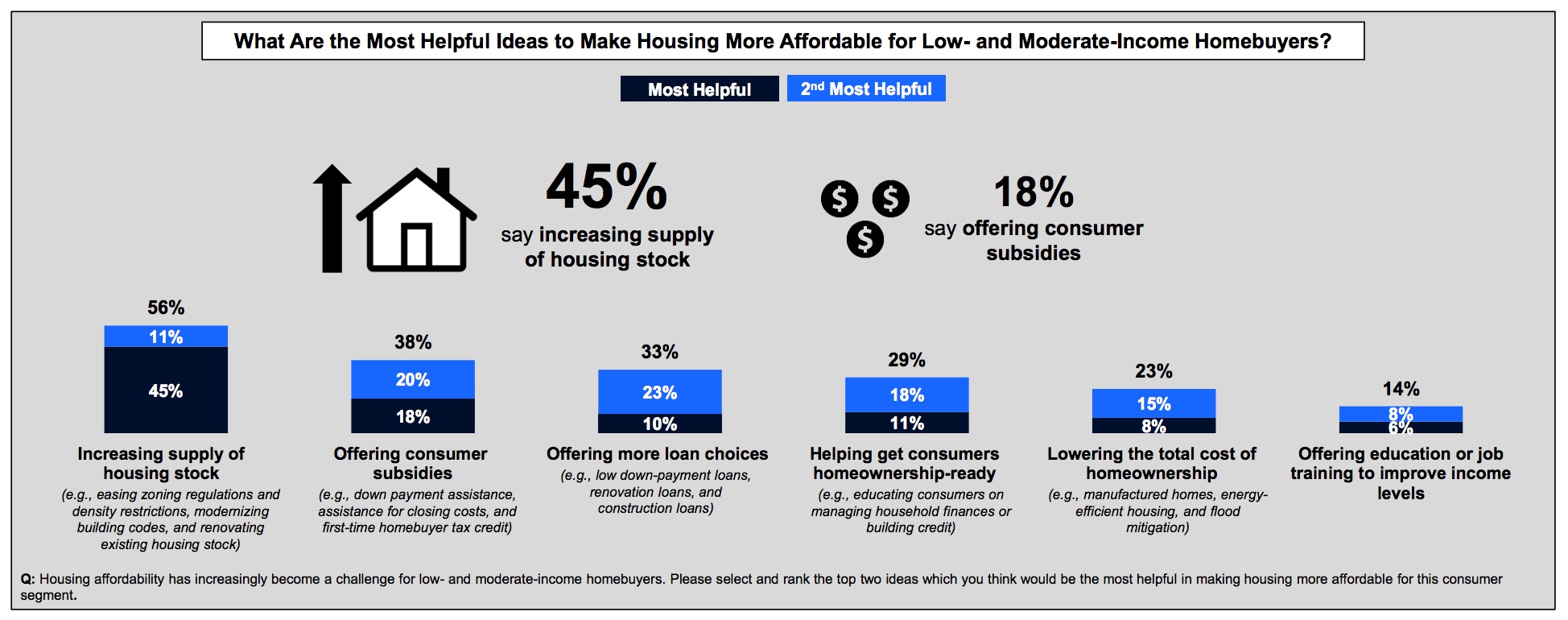

Lenders told Fannie Mae that they believe there are steps that could improve affordability for first time homebuyers and those with low and moderate incomes and 45 percent said growing the housing stock would be the most helpful. A much smaller number said offering consumer subsidies such as the first-time homebuyer tax credit that was available in 2008, assistance with closing costs, or a wider array of loan products would help ease the shortage of affordable housing. Other suggestions included improving consumer readiness through education or job training.

When asked to evaluate the helpfulness of various loan programs to enhance housing affordability for low- and moderate-income homebuyers, lenders gave high ratings to low down payment mortgages (44%). Mortgage loans covering renovation costs (18%), loans for condominiums (17%), and loans for manufactured homes (17%) were also considered helpful by lenders. In contrast, loans for home construction (11%) and loans including energy-efficiency installation costs (5%) are seen as less helpful.

Palim said that other organizations such as the National Association of Homebuilders (NAHB) have echoed the survey findings, suggesting that the inadequate supply of new homes is largely unrelated to primary or secondary mortgage market factors. Strategies of growing the housing stock include easing zoning and density regulations, modernizing building codes, and renovating existing housing.

Fannie Mae's own research indicates that an inadequate level of new housing construction relative to the pace of job growth and underlying demand has contributed to strong home price appreciation and ongoing affordability challenges for first-time and move-up homebuyers. Single-family (one-to-four units in the structure) housing starts remain well below levels typically seen during expansions and, by Fannie Mae's estimate, the annual pace should be about 200,000 units higher.

In the face of the perceived impacts of non-mortgage supply constraints, Palim says it appears that further easing of consumer credit standards would be more likely to contribute to stronger home price appreciation than it would to expanding sustainable homeownership.