We often hear that there is no such thing as a perfect crime. Perhaps that is why there is always a fraudster trying to improve them.

CoreLogic says the newest wrinkle in mortgage fraud is a reverse approach to the old misrepresenting occupancy scam. Traditionally it has been prospective investors who have claimed they intend owner occupancy. By posing as a resident owner they might qualify for a better interest rate, lower fees, a smaller downpayment or higher loan amount than they would by applying for a mortgage as an investor.

CoreLogic analyst Willa Wei says there is a rising incidence of home buyers doing the exact opposite - claiming they will be renting out their purchase while actually intending to occupy. This allows them to claim "expected" rental income to satisfy the mortgage application debt/income requirement. That income, of course, will never materialize. This is referred to as a reverse occupancy scheme.

Wei says there are several typical characteristics that might alert lenders to this variation.

- Subject properties sold as investment properties

- Purchasers are first-time-home buyers with minimal or no established credit

- Purchasers have low income but significant liquid asserts authenticated by bank statement

- Purchasers make a large down payment

CoreLogic used these four characteristics to analyze investment purchase mortgage applications submitted over the last five years and identify those with higher risk of such fraud. The percentage of reverse occupancy scheme prevalence is calculated against the investment purchase application population for the top 50 Core Based Statistical Areas (CBSAs), based on U.S. Census population estimates.

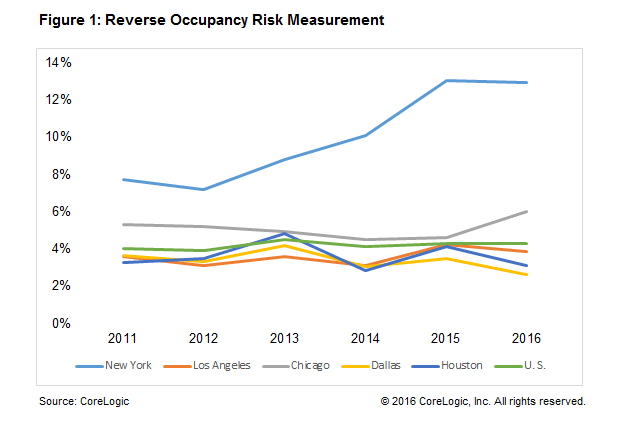

The company found New York had a higher reverse occupancy risk than any other metro area and it has increased in each of the last three years, reaching 13 percent in 2016. A few other CBSAs in the northeast region that have higher reverse occupancy rates but, "New York is a hot spot considering both percentage and volume."

Figure 1 compares New York's reverse occupancy risk rate with other large CBSAs, such as Los Angeles, Chicago, Dallas and Houston. It also shows the average reverse occupancy rate at the national level for benchmarking.

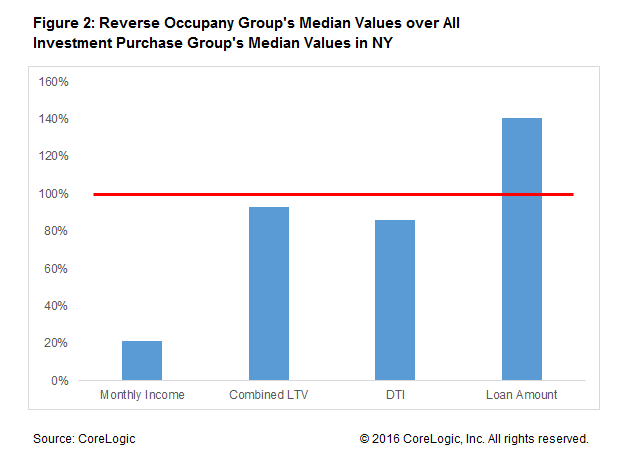

Using New York state as an example, the figure below shows key characteristics of reverse occupancy purchases compared with the total investment purchase population. The reverse occupancy group's median income is only 20 percent of that of the broader investment purchase groups median. The median loan amount, however is 40 percent more than that of the investment groups as a whole. The median loan to value (LTV) and debt-to-income (DTI) ratios of the risk group are also lower.

Wei says a key challenge of finding and combating mortgage fraud is the emergence of new schemes and their ever-shifting locations. Fraud "morphs from one scheme to another depending on changing local economic and real estate market conditions and government programs." With real estate recovering from the housing crisis, the share of purchase mortgage applications increasing and Freddie Mac and Fannie Mae expanding credit policies there is fertile ground for the resurrection of old types of fraud as well as twists on old ones. The heat map below shows that the places that stand out for their risk of reverse occupancy fraud are primarily areas where both home prices and rents have appreciated at the fastest rate.