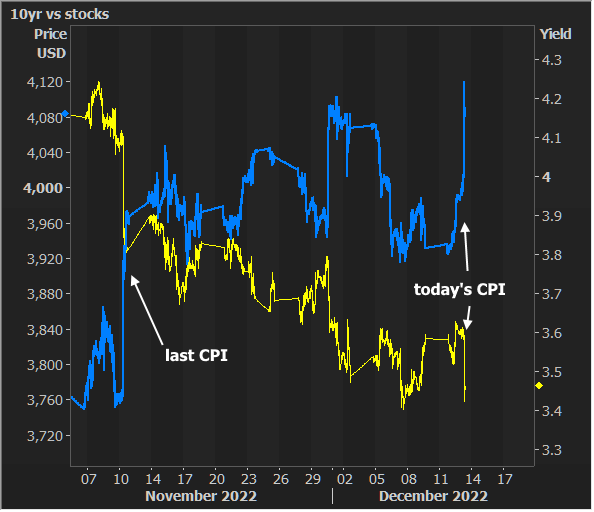

You can go back and research decades of Consumer Price Index reports to compare the size of the market movement relative to the size of the beat/miss vs forecasts and you will never find a day like today--at least as far as the first hour of the reaction is concerned. For a measly beat of 0.1% (core monthly CPI was 0.2 vs 0.3 f'cast and 0.3 prev) the market is partying hard--both stocks and bonds--even if not quite as hard as the last CPI.

MBS are doing even better than Treasuries relative to their December 7th levels. This is due to the shorter duration associated with MBS combined with the outperformance of the short end of the yield curve. In other words, 2-7yr yields are down more than 20bps while 10yr yields are "only" down around 16bps, and MBS tend to last 4-7 years on average, so their movement should align with that section of the yield curve, all other things being equal.

Why would shorter-duration Treasuries be doing better than the long end? First off, the long end has already anticipated the economic cooling likely to result from aggressive Fed rate hikes. A 10yr yield can price in movement over 10 years whereas a 2yr yield is heavily dependent on the Fed Funds Rate outlook (which is infinitely more predictable over a 2 year time frame than, a 10 year time frame). As such, the implications for the Fed's rate hike outlook have instantly benefited the shorter-dated Treasury yields more than the longest end of the curve.

As for our favorite 10yr benchmark, they're still well within the prevailing range of the past 2 weeks.

This could also be a factor of the "modicum of restraint" expected in advance of tomorrow's Fed events. A friendly enough Fed could easily break the range, but we have our doubts as to how much fuel the Fed will want to add to the fire. If anything, the Fed is more likely to try to temper the exuberance because the exuberance is counterproductive to the Fed's goals.