Today kicks off with the Producer Price Index painting a similar picture to last week's CPI data. Specifically, monthly wholesale inflation dropped 0.3% at the core level (or 0.2% after last month's negative revision). This was enough for stocks and bonds to rally in early trading. The pattern is familiar by now: friendly inflation data or Fed comments lead both sides of the market to stronger levels, and vice versa. CPI, PPI, and the last Fed meeting combine to offer clear examples of the "mirror image effect" between stock prices and bond yields.

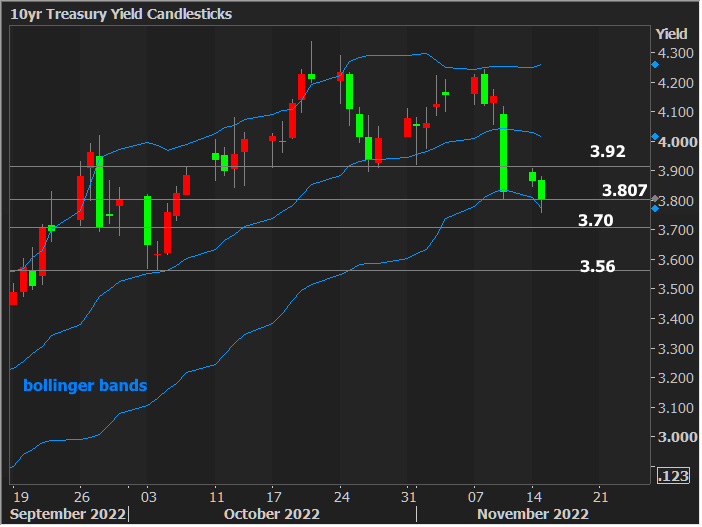

The rally brings yields deeper into the territory seen in late September and early October--a time when volumes and volatility were about as high as they've been since the start of the pandemic. There are all sorts of technical considerations in this range--limited only by how many different studies you want to consider.

In terms of simple pivot points ("key levels" i.e. places where yields have bounced in the past, especially in high volume), 3.807% was where the rally stopped after CPI last week and was also a pivot point in late September. It seems to be a central point of gravity so far this morning. 3.70% would be the next obvious option below that (closing levels from both Thursday and Friday after the September 21 Fed announcement, AND the floor for most of the following week).

3.70% feels like a big rally to pursue today (indeed, yields bounced at 3.76% after PPI and haven't been back in the vicinity since). It would also constitute a break below the lower Bollinger band and 50 day moving average. Given that Bollinger bands are already showing a classic "M-top" reversal, big breaks outside of the lower envelope would require quite a bit of justification from data.

Instead, there's and argument for patience from another hefty slate of corporate bond issuance (over 10 new deals announced already) as well as the general notion that we're still only looking at one stellar month of friendlier inflation data to drive this rally. That's actually a good thing. Slower and steadier = more sustainable.