The Good, the Bad, and the Ugly

"....over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant."

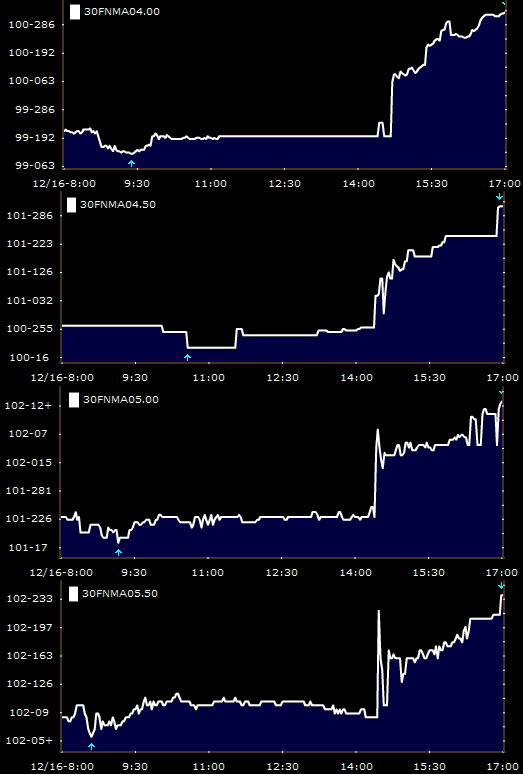

If we put the economy aside and focus purely on mortgage backed securities, this statement is exactly what we wanted/needed to hear to maintain a strong buy/float bias. Post policy release we observed a high volume down in coupon buying spree. I don't believe words do the instantaneous strengthening enough justice, pictures however are quite effective....

PRE-FOMC ANNOUNCEMENT 5PM/GOING OUT BIDS

FN 4.0: +5/32 at 99-19 FN 4.0: +49/32 to 100-31

FN 4.5: unchanged at 100-26 FN 4.5: +28/32 to 101-23

FN 5.0: +1/32 at 101-23 FN 5.0: +21/32 to 102-11

FN 5.5: unchanged at 102-08 FN 5.5: +13/32 to 102-21

FN 6.0: -2 at 102-20 FN 6.0: +4/32 to 102-26

FN 6.5: -2 at 103-00 FN 6.5: +2/32 to 103-05

Quick Educational Pause: Today was a prime example of a down in coupon day. The 4.0 (which is still irrelevant to rate sheets), the 4.5, and the 5.0 were all bid more aggressively than the 5.5. 6.0, and 6.5 coupons.

After the Fed fired off its last round of traditional policy ammo and the euphoric tingle wore off we bogged down and started sifting through lender re-prices. We took note of a couple of aggressive moves but the general feeling is that street level mortgage pricing has some room for improvement. This is not new though, we have noticed this occurring more and more as rates have continued to drop. The reaction we usually hear is an angry accusation of gluttonous pricing strategies. Although that may be the case at some coupon levels, the lender's story needs to be heard. Here is why rate sheets are not as strong as you'd hope....

Extra Premium #1: Confidence

We have become accustomed to the feeling of uncertainty over the past year, its cliché to say but the only consistency over the past 12 months has been to "expect the unexpected". Compulsive "value" buying in this environment has left many investors with their pants down on the wrong side of a trade. So when good news is priced into the MBS market like it was today... lenders will be cautious to share the wealth until they are confident there has been a noticeable decrease in the default rate of government promises. So if the Fed keeps reiterating that "The focus of the Committee's policy going forward will be to support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve's balance sheet at a high level"....then MBS investors will continue to jump on the down in coupon float boat.

Extra Premium #2: MBS Credit/Default Risk

We're really sorry but we need to take a pause from the celebration and put things in perspective for just a moment. Again WE'RE SORRY BUT WE HAVE TO SHARE THE GOOD, THE BAD, AND THE UGLY!

We believe many real estate professionals may have gotten so energized about the potential for a bottom in housing that you allowed yourselves to overlook the fact that in order for our economy to operate the Fed will HAVE TO "employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability" because "the Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.

Translation: Fed Funds will be left at zero until....until it doesn't need to be zero for our $15/16 trillion economy to function. The last central bank to employ this "Quantitative Easing" strategy was Japan, a country that left rates at zero for years only to lose their war against deflation...a war they have and still continue to fight since the early 1990's.

We are past the point of no return, the FOMC had no choice to employ these DRASTIC measures. So while mortgage rates are at all time lows we must not forget that in the event of the worst case scenario .... a downward spiral of lower prices followed by lower production followed by lower wages followed by less demand for goods and services followed by more job losses followed by lower production followed by lower wages.....that people can't qualify for mortgages because they don't have a job and their credit is maxed out and those who do own a home will struggle to make their monthly payments because their employer cut their salary again. When placing a value on the expected future cash flows of mortgage payments....long term MBS investors should not lose sight of "Since the Committee's last meeting, labor market conditions have deteriorated, and the available data indicate that consumer spending, business investment, and industrial production have declined. Financial markets remain quite strained and credit conditions tight. Overall, the outlook for economic activity has weakened further"

Please don't overlook how unprecedented it is for the UNITED STATES OF AMERICA to have no choice but to GIVE MONEY AWAY just to sustain growth and preserve price stability.This default risk is not as big of a rate sheet influence as much as it is an MBS influence.

AGAIN. WE'RE SORRY, BUT WE HAD TO TEAR THE BAND AID OFF AT SOME POINT...

Lastly here is the big reason for "unfair/greedy" rate sheets

PREMIUM #3: HOW LOW WILL RATES GO?

One of the great features of mortgage debt is that you, the mortgage payer, have the ability to refinance your loan when the prevailing market interest rate is lower than your current rate. This feature is called an embedded call option. When rates decline, like they have over the past 30 days, you should be comforted to know that you can go to a bank or broker and try to lower your mortgage payment via a refinance. You could say the value of your call option is worth more to you now that market rates are lower than the rate on your mortgage. For example....if you hold a 6.0% mortgage note right now, your call option would be considered "in the money" because if you refinance you will most likely end up with a lower rate and payment.

This principle affects what interest rate a cash flow hungry MBS investor is willing to purchase. They will be looking for a minimum number of years that they can expect stable cash flows. Unfortunately a falling interest rate environment is not a positive for those who are counting on the cash flow that you contribute to the pool of MBS in which they are currently invested. When the interest rate bias is towards lower rates would it make sense to invest in a pool of higher coupon mortgages? No, it wouldn't....those loans have a higher probability of prepayment and therefore less expected future cash flows. This is why we say MBS are exposed to prepayment risk...because an MBS investor could lose cash flow if market interest rates go lower than the coupon they are holding and you decide to exercise your call option by refinancing.

This translates to rate sheets I promise.

In a falling interest rate environment, higher yielding MBS coupons actually begin to depreciate because their long term value erodes as the call option becomes more valuable. Because of this risk, when interest rates are expected to go lower, lenders will be hesitant to take a commitment to deliver a coupon that has a higher probability of prepayment. When the current coupon is close to 4.00 the market will demand 4.0s and 4.5s and 5.0s. Committing a supply of 5.5 gets riskier and riskier as rates go lower and lower because lenders will either not be able to fulfill their commitment to deliver 5.5s or the bid for their 5.5s will depreciate as rates go lower...and then they are caught with their"pants down" on the wrong side of the trade.

So while mortgage rates are continuing to fall, lenders will protect their commitments by passing though the additional "call option premium" to borrowers via a cushion in rate sheets. When the MBS settles in a stable range, lenders will be more willing to aggressively seek out their committed supply of loans, this is when the MBS to rate sheet spread tightens up. Until then lenders will continue to protect themselves from the risk of NEGATIVE CONVEXITY. This is the foundation for understanding negative convexity by the way!!! You didn't even know you were learning about it did you? We hope you feel smarter.

Of course there are a few more premiums. Some investors control their loan applications and commitments because of operational deficiencies...in plain English some lenders just can't handle too much loan volume. There is also the funding issue...although money is dirt cheap/free that doesn't mean it will flow to freely MBS purchasers. Until the perception of confidence is restored to the general market place, commercial banks will have no problem adding to their bank reserves to bolster balance sheets.

We have the float boat out to sea until the current MBS coupon finds a home in the 3.0-4.0 range. There will be profit taking and originator selling, but don't panic if that occurs, Ben and Hank got our back. The Treasury department has been an ever present real money bidder recently...until the Fed gives us reason to believe that the government will discontinue mortgage support...we will remain floaters. In the short term keep listening for profit taking/originator hedging lock recommendations.