Think back to elementary school....on the day before Christmas vacation was scheduled to begin. The teacher's lesson plan was crammed with board games, Christmas carols, cookie eating, and card making.....plus extra long recess!!! Now fastforward to present day and look at the activity going on in markets today- Light/festive trading atmosphere, some cookies, and an early close! Funny...we grow up but our holiday activities dont seem to have changed too much!!!

I can only say festive because of the down in coupon rally taking place this morning...but again volume is light so don't get overly excited. By overly excited I mean the silly elation you may have received as child when you opened that ONE PRESENT that you had been longing for since early summer. You know... the giddy laughter and joyous celebratory shouting? Can you remember what that present? HAHA I am embarrassed to say but oh well here goes...the first one I really remember. MC HAMMER's CANT TOUCH THIS SINGLE...THE TAPE. I went bananas! I was a sweet kid what can I say? :-)

Anyway don't get overly elated...this is a nice little Santa rally but lenders are short staffed today so they wont be looking to provide much incentive to make themselves work harder today. Here is how the stack is bid currently...

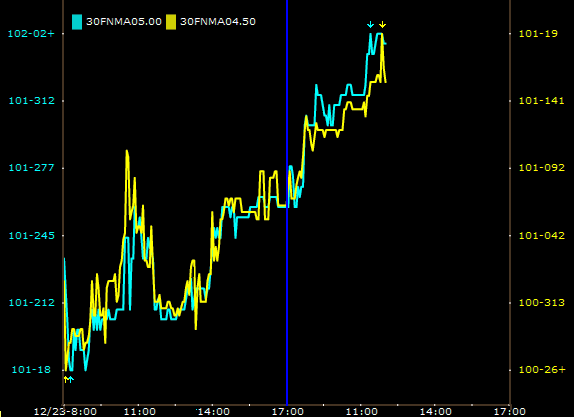

FN 4.0: +0-09 at 100-01

FN 4.5: +0-09 at 101-15

FN 5.0: +0-07 at 102-01+

FN 5.5: +0-04 at 102-10

FN 6.0: +0-02+ 102-20+

Pictures for spatial learners...nice little 2 day upward trend

Another prime example of DOWN IN COUPON!!! After the recent spread gapping we were due for some tightening, but as Matt pointed out yesterday this will be an uphill battle until at least the New Year. After more supply hit the market late Monday, spreads widened up on the lack of buying (no Ben/Hank buying= lack of confidence=wait it out). Today spreads are tighter to swaps and the yield curve by 5 to 8 ticks.

The Employment arena is expectedly gloomy (ugh).... unfortunately the actual data was unexpectedly worse than anticipated. Initial Jobless Claims registered a 30,000 increase to 586,000 vs. the consensus of 560,000. That is a 26 year high according to Reuters. Ugh again!!! FYI: 2008-26 years = 1982. If you do not recall, the early 80's recession was the last economic crisis to draw comparisons to the Great Depression. Not trying to be a downer on Christmas Eve...just want to keep everything in perspective.

HO HO HO