All I can say about yesterday is that it was an UGLY UUUGLY day for interest rate watchers. Mortgage rates were pressured higher right out of the gate following a warmer than expected read on producer level price inflation. And then, to make matters worse, as the day progressed, benchmark rates drifted even higher, this forced prices of mortgage-backed securities progressively lower. By the end of the day all lenders had repriced for the worse, some even did so more than once!

Following two action packed days of economic data, today was a little quieter, we only had one data release.

The Bureau of Labor Statistics this morning released the Consumer Price Index. This index measures the price change of a fixed basket of goods and services purchased by consumers, also known as inflation, the enemy of interest rates. While yesterday’s Producer Price Index report showed rising inflation on the wholesale level, it has been difficult for goods producers to pass along these higher costs to consumers because they are already strapped for cash and spending less. If producers raise prices, less people will buy their goods! So, when judging inflation, we tend to consider consumer prices to be much more important than producer price levels.

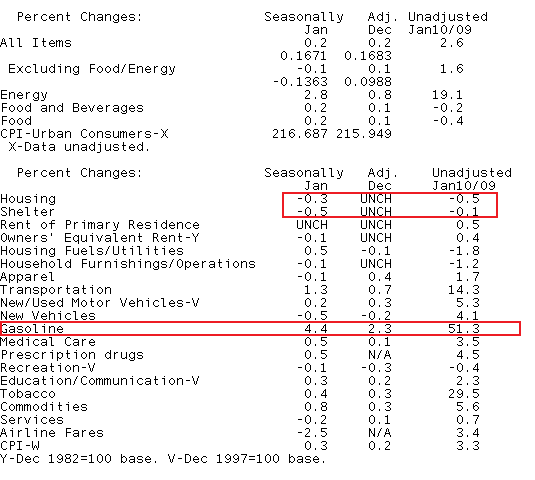

Economists surveyed expected overall consumer prices to post a monthly increase of 0.3% while the core rate, which strips out food and energy, was forecast to read +0.1%.

The actual results beat consensus estimates, indicating consumer level inflation is still in control. The Overall Consumer Price Index edged higher by only 0.2% while the core rate posted a 0.1% decline. The Federal Reserve generally watches the Core CPI number as monetary policy has more of a direct influence over the items in that index. However, we are well aware that food and energy are a necessity in life, so anytime those costs tick higher, it affects your wallet. In the table below you can that gasoline prices were the main culprit behind rising costs, so too was transportion, but that is a function of higher fuel costs too. Check out Housing, down 0.3%, Shelter was 0.5% lower. That is a bit concerning for home owners in desperate need of some equity in their house. More or less, that decline is a factor of the seasons as winter is not the best time of year for home prices.

There is another matter I should address. Late in the afternoon yesterday, the Federal Reserve announced it was raising the cost they charge to loan banks emergency funding. This is called the Discount Rate. This should not be confused with the more mainstream Fed Funds Rate, which is the interest rate banks charge each other for overnight loans. The Prime Rate is tied to the Fed Funds Rate, you may be familar with Prime as it is part of the rate many homeowners pay on their HELOCS. Prime Rate is the Fed Funds Rate plus 3%, which places it at 3.25% today. While this decision created a lot of commotion, it turned out to be a bigger deal in the media than in the financial markets. For the most part, the raising of the discount rate has not affected mortgage rates. READ MORE

Unfortunately, I still have bad news. Although benchmark interest rates and MBS prices staged a small comeback at the end of the day, which allowed a few lenders to reprice for the better, mortgage rates are still higher compared to yesterday (and last Friday). This marks the third consecutive day mortgage rates have risen. I know the timing of this rise coincides with the Fed's decision to increase the Discount Rate, but I assure you rising rates have been the preferred bias of many rates traders over the past week. This is partially due to $118 billion in Treasury auctions that will take place next week (plus an $8 billion 30 year TIPS auction.

Reports from fellow mortgage originators indicate the par 30 year conventional rate mortgage has moved into the 5.00% to 5.25% range, for well qualified consumers. To secure a par rate you must have a FICO credit score of 740 or higher, a loan to value at 80% or less and pay all closing costs including an estimated one point loan origination/discount/broker fee.

The last few days may have been the beginning of the end for record low mortgage rates. That said, if you followed our advice and locked your loan in the last month, well done! While I still favor locking over floating, if you haven’t locked yet, I think the risk of floating over the weekend might just be justified. If demand is strong at next week's Treasury auctions, it could help us reverse course and move lower for a short time. The odds of that happening are 50/50 at best though. Just remember, we do expect mortgage rates to continue to rise in the months ahead.

Have a great weekend