All week we said "wait until Thursday to lock", "mortgage rates will improve after the bond auction on Thursday", "the end of the week will be the best time to lock in your loan".

The Treasury auction came and went. After the last round of debt was sold, $13 billion of 30 year bonds yesterday, everything that was supposed to happen in order for mortgage rates to improve...happened. Everything except mortgage rates moving lower that is!

Although prices of mortgage backed securities rallied immediately after the auction, prices soon lost progress and most lenders were not able to improve mortgage rates. To remind readers, as the prices of MBS move higher lenders can offer lower consumer borrowing costs.

This was a huge letdown for us. But we were still hopeful we might see improvements today. We had some hurdles to get through first: INFLATION DATA

The Bureau of Labor Statistics released the Consumer Price Index this morning. This report is a measure of the average price change of a fixed basket of goods and services purchased by consumers. In other words, it gives us a reading on inflation at the consumer level. If inflation is on the rise, interest rates will follow. Most economic data to date has indicated inflation to be of very little concern today which is also supported by recent Fed statements; however, we are starting to hear more and more about inflationary pressures. READ MORE

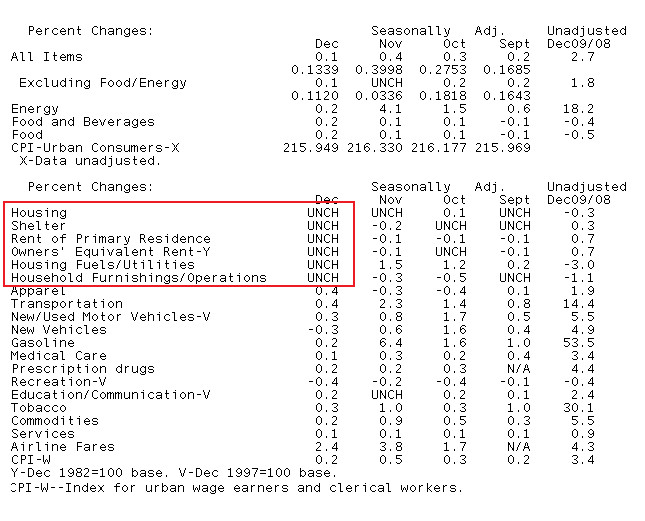

Both the headline and the core inflation reading, which strips out volatile food and energy prices, indicated consumer prices increasing 0.1% in December. This follows a 0.4% increase last month for the headline and 0.0% reading for the core.

Year over year, overall prices increased 2.7% while the core rate increased only 1.8% in 2009. This year over year gain is more a function of record low levels of inflation last year as opposed to rising inflation this year.

Overall the report was in line with economist expectations. Below is a table summarizing the data. I called attention to housing related price index. Notice all were UNCHANGED in December.

Once again we have economic data supporting inflationary pressures are in check despite the economic recovery which should allow the Fed to maintain the current accommodative stance with monetary policy.

Released at the same time as the CPI report was the Empire State Manufacturing Survey which is conducted by the New York Fed. This monthly survey of around 175 manufacturing executives gives market participants a gauge into the strength of manufacturing in the New York region. The bond market prefers slower growth which keeps inflationary pressures in check so they generally move higher when the report is less than expected. This survey plunged last month to a 2.55 reading after November’s 23.51 and October’s 34.57. Economists surveyed prior to the release expected a rebound to 12.0. The release of the survey indicated higher than expected optimism with manufactures posting a reading of 15.92. Since this is the lowest impacting report of the day, it had no affect on the markets.

The next report of the day was Industrial Production, which measures output at U.S. factories, utilities and mines. The report indicated Industrial Production increased 0.6% matching economists’ expectations.

The final report for the week lets us know how you, the consumer, is feeling: the Consumer Sentiment report. The University of Michigan’s Consumer Survey Center questions 500 households each month on their personal financial condition and attitudes about the overall economy. An optimistic consumer is much more likely to spend money while a pessimistic consumer is more likely to save. Since our economy is driven by consumer spending, stocks generally improve with optimistic consumers while bonds benefit with pessimism. The release indicates consumer sentiment holding steady but below expectations at 72.8 following last month’s 72.5. Market was looking for a 74.0 reading.

Ok so what happened to mortgage rates after this morning's economic data?

WE GOT THOSE MORTGAGE RATE IMPROVEMENTS WE WERE EXPECTING YESTERDAY!

Reports from fellow mortgage professionals indicate lender rate sheets to be at their best levels in a month. While the most aggressive lenders were offering 4.75% today, most lenders still have 30 year conventional par mortgage rates in the 4.875% to 5.125% range for well qualified consumers. To secure a par rate you must have a FICO credit score of 740 or higher, a loan to value at 80% or less and pay all closing costs including an estimated one point loan origination/discount/broker fee.

While I am comfortable with a float recommendation into next week, I must share with you that we are very defensive of these mortgage rate improvements. We don't see gains being a long lasting trend. With that in mind, if you are closing in the next month, you should be looking to lock in soon. If you are a "fence sitter" or have an Interest Only ARM that is about to adjust, you should be considering a refinance before interest rates start rising. I hope its obvious how defensive we are...floating one day at a time.

I hope everyone has a fantastic weekend. All markets will be closed on Monday in honor of Martin Luther King Jr. Day.