Yesterday afternoon after a long day at the office preparing reports, responding to emails and answering my cell phone, I ventured out for a 2 hour bike ride on Mt. Tamalpais.

Mt. Tamalpais is located in Marin County, just a short drive over the Golden Gate Bridge. It rises 2,500 feet over the San Francisco Bay and the Pacific Ocean. It is fabulous place to hike, bike and hang out. Some say it is the birthplace of Mountain Bike riding.

My ride started at a trail near the south end of the mountain that traversed for 4-5 miles to the fire lookout seen above. From that vantage point, I got a 360 degree view of the bay and Pacific Ocean. The day was crystal clear and SF looked like the image above. If you’re in SF for a vacation, a trip to Mt Tam is a must.

Check out the view...

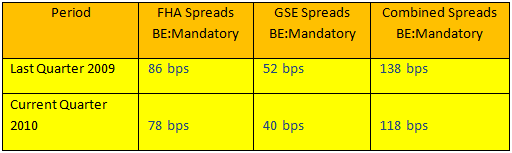

Enough of my travel logs. Let’s once again look at the most recent results of the difference between best efforts and mandatory delivery.

As we have discussed over the past several months, there is a quick pick up of profits that go right to the bottom line by actively managing a pipeline and delivery loans through mandatory commitments. We recently asked Brad Nease of Mortgage Capital Management to provide the most results and discuss what key procedures and disciplines are needed to migrate to mandatory commitments.

Mortgage Capital Management provides risk management tools and advisory services to mortgage bankers that are actively managing their pipeline.

The most recent pricing delta of best efforts and mandatory – provided by Mortgage Capital Management:

Brad believes there are four key areas a mortgage banker must develop and implement to ensure a successful transition to mandatory delivery and generate the spreads noted above.

Those areas are:

- A company must have a centralized lock desk and a strict lock policy. The lock policy should cover extensions, re-locks, and delivery times on forward locks.

- A company must have a system that tracks loans by stage from lock through loan settlement. The system should also have the capability to export loan level information to an accounting system. Mortgage banking systems such as Data Trac, Encompass 360 and PC Lender are good choices.

- A company should have an employee with secondary market expertise that can manage the secondary market activities, including pricing, locking and loan allocation.

- A company should engage a risk management advisory company like Mortgage Capital Management that provides the tools, reporting and advisory services to the secondary market manager and CEO. These firms have the analytical tools to successfully manage interest rate risk and ensure the company achieves best execution when loans are sold to investors.

It makes sense for many mortgage bankers to actively manage their mortgage pipeline and sell loans through mandatory commitments. The results are impressive. The caveat is that a company needs to develop and implement the items Brad noted above