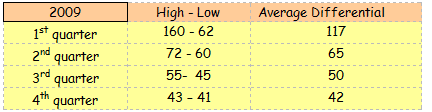

Corky and Joe were Compass Analytics users for years back when it was called Tuttle & Co. They were a great hedging advisor then, it may be even better today. One of the many things they track for clients is the spread between best efforts and mandatory pricing. Recently we looked at their numbers for all of 2009. The spread was as follows:

The first quarter of 2009 was crazy, and many of our clients made as much money selling on a mandatory basis in the first quarter as they did the rest of the year.

If you were a Compass user back in the early 90’s, you probably remember Art Yend, Ray Knapp, Lenny Auerbach, Rob Chrisman, and, of course, Paul Tuttle. Last week we stated that one way to measure a company’s greatness is to see how many industry leaders came from its ranks. By this measure, Tuttle/Compass was an amazing success, with the hedging and secondary world being populated with tons of ex-Tuttle employees.

We remember one Safety & Soundness Exam years ago where the Examiner-in-Charge was going through our hedging techniques. We were a Compass user, and their reports were detailed, comprehensive and easy to follow. We spent an hour with the EIC going over how we hedged, and after listening patiently, she started flipping through her notes and asked, “Um, yeah, like back at the beginning you used the term ‘being short” and then you said something about “being long.” I’m not familiar with those terms, so like, can you can explain them to me.” Uh oh.

Do you ever write to politicians? If you do, don’t use e-mail. Ask their staff members and they’ll tell you that most e-mails are no actually read. If you want your letter read by a decision-maker, do it via hard copy and send it by mail.

The San Francisco Bay Bridge was damaged in the 1989 earthquake, and they’re still rebuilding it 21 long years later. We were throwing out some old papers and came across an article with the headline “Red Tapes Holds up New Span of Bay Bridge.” Doesn’t that strike you as funny, as if it’s being held together by some sort of red-colored tape? If you care about good syntax, you can drive yourself batty with all the poor writing out there.

Remember last week our writing about Bank of Commerce that got a CAMEL 1 but with a 2 rating for management? Here’s an e-mail from their CEO Pete Davis:

“Hey,that was us!! Actually the regulators wanted to give the bank a CAMEL 2. This was after years as a 3 and even a 4 -- so they thought they were doing us a favor. When they finished going over the report with us, they asked if we had any questions and I said "What's the appeal process?" They were shocked as was Gary (the CFO). They said they’d get back to us, and when they did, the bank had an overall CAMEL #1, but management a #2. When Gary asked about this they said it was because Management was not receptive to regulatory counsel. The Bank sold for 5 times book less than a year later, so fighting this was moot. Besides we had gotten the Camel #1.” Is this a great story, or what?

There’s a company that helps lenders fight investor re-purchase demands. It’s Resolution Portfolio Management & Oversight in Boca Raton, Florida (866-661-4776). We don’t know anything about them, so if anyone out there has used them, please let us know what you think.

We’re endlessly fascinated by the role the bank Directors should play, and our latest thoughts are how Director Education can be such a tricky area. There are some areas that are so complex that there’s no way a Director can be expected to learn them. Think about all the financial engineering of the past few years, the derivatives, the derivates of derivatives, the swaps, the options, the swaps on options (they’re actually called swaptions) , the CDO’s and the CMO’s and on and on. If you have the President of a manufacturing company on your Board, or perhaps the head of a community based non-profit, can they really be expected to ever understand this? Of course not. Some of these instruments may be inappropriate for your bank, but some serve a legitimate purpose, so how can your Directors know which is which? The answer is multi-sided, but this is an example of things that Board members simply aren't going to ever really understand, no mater how good your Director Education might be.

So what should they be doing? We think they should look at the overall risk in the bank, and one such example is one of the basics of risk, this being leverage. Our recollection is that when Lehman fell, they had leveraged their capital 32-to-1, while most other Wall Street firms were leveraged around 15-to-1. Were Lehman’s Directors aware of this? Above all else, they should have been aware. This could be a perfect example of a broad policy where the Board sets the maximum leverage ratio and where this might take care of their not understanding many of the truly complex details of the banks operations. They may not understand Inverse Floating Collateralized Mortgage Obligations, but they can certainly under the maximum leverage that management is allowed. The key is to find the limited number of metrics that (a) are critical to directing the bank and (b) that can be understood easily by your Board members.

Banks and thrifts reported an aggregate profit of $914 million in the fourth quarter of 2009, a teeny, tiny amount but a huge improvement from the $37.8 billion loss the industry suffered in the fourth quarter of 2008.

More than half of all institutions (50.3%) reported year-over-year improvements in their quarterly net income. Almost one-third of all institutions (32.7%) reported net losses for the quarter, down from 34.6% a year earlier. All this data is from the FDIC Quarterly Banking profile HERE

The FDIC's liquid resources (cash and marketable securities) increased to $66 billion at year-end, up from $23 billion at the end of September. That might not be enough if some really big banks fail, but it should be enough if most bank failures continue to be the smaller institutors.

When people talk about the Third World, we know this means developing nations or emerging markets, (they used to be called under-developed nations but that was considered insulting). Anyway, the poor countries were the Third World, the West (The U.S., England etc.) was the First World and the Commies were considered the Second World. Foreign policy expert Leslie Gelb has come up with a new hierarchy he calls the Pyramid of Power with the U.S. alone on the top. The second tier contains Eight Principals: China, Japan, India Russia, the U.K. France, Germany and “just barely” Brazil. Below them are the Oil and Gas Pumpers. In the fourth tier are Regional Players like Mexico, South Africa, and South Korea. Next are the Harmless Responsibles (i.e. Switzerland, Singapore, and Norway) and finally, in the 6th tier are the Bottom Dwellers, like Zimbabwe, Sudan and the like. A good way for ordering the world.

For those of you haven’t gotten around to calculating your break-even, wasn’t January a sort of a proxy of a breakeven analysis? With volumes down 30-50%, many clients came face-to-face with what their earnings looked like when volume drops dramatically. It was a real wake up call for a lot of people we know.